Solana News Today: "Solana Surpasses Ethereum in Speed, Cost, and DeFi Momentum"

- Solana (SOL) surges 17% in 7 days, outperforming Ethereum’s 6% gain, with $199.36 price and $108.4B market cap. - Solana processes 101M daily transactions at $0.0003 fees, dwarfing Ethereum’s 1.68M transactions and $4.02 average cost. - Network upgrades like Block Assembly Marketplace and DoubleZero fiber push 100K TPS, while DeFi TVL hits $8.6B with 3M daily active addresses. - Ethereum maintains medium-term appeal via PoS transition, Layer 2 scalability, and $4.6B ETF inflows despite Solana’s speed and

Solana (SOL) continues to attract investor attention amid a surge in DeFi activity and performance enhancements. As of recent, the price of 1 Solana token stood at approximately $199.36, with a market capitalization of $108.4 billion, according to comparative analysis by Messari. Over the past week, Solana has outperformed Ethereum , with a 17% gain in the last seven days compared to a 6% increase for ETH. This momentum was further reinforced by reports of Solana processing over 101 million daily transactions, significantly outpacing Ethereum’s 1.68 million, and maintaining an average transaction fee of roughly $0.0003, far below Ethereum’s ~$4.02.

Recent developments on the Solana network include the implementation of performance upgrades, such as the Block Assembly Marketplace and the DoubleZero fiber network, designed to increase throughput and enhance finality. Load testing has already reached 100,000 transactions per second (TPS), with further optimizations expected from the Alpenglow consensus protocol. These improvements are helping to solidify Solana’s position as a high-throughput blockchain, catering to high-frequency applications and DeFi initiatives.

The DeFi ecosystem on Solana has also been expanding, with key integrations including PancakeSwap v3, 1inch cross-chain swaps, and the Across bridge, enhancing user accessibility and liquidity options. According to on-chain data, Solana’s DeFi total value locked (TVL) has reached $8.6 billion, with an increasing proportion of active staked supply translating to deeper protocol-level liquidity for yield strategies. This growth has been mirrored by active network participation, with over 3 million daily active addresses, compared to Ethereum’s 551,000.

While Solana’s short-term gains and rapid innovation capture trader interest, Ethereum’s robust ecosystem, deeper liquidity, and broader Layer 2 scalability options continue to provide a foundation for medium-term investment strategies. Ethereum’s transition to Proof of Stake (PoS) in 2022 and ongoing upgrades, such as Block-Level Access Lists and Rolling History Expiry, aim to enhance scalability and user experience. These developments, along with the recent record inflows into Ethereum-based ETFs, have kept ETH central to broader altseason rotations.

Despite the divergence in performance and ecosystem strategies, both blockchains are advancing through distinct but complementary innovations. Solana’s focus on high throughput and low-cost transactions is attracting a new wave of traders and developers, while Ethereum’s emphasis on composability, security, and Layer 2 integration continues to anchor the broader crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

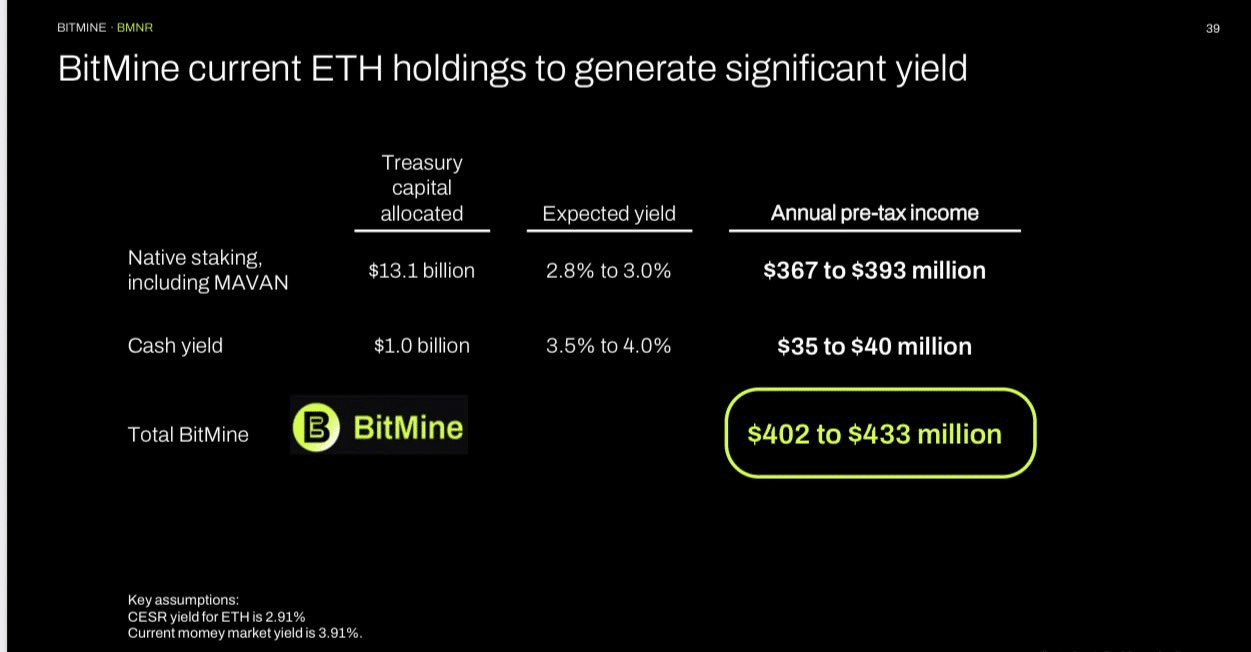

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense