Tether Pivots: Prioritizing Mainstream Chains Over Legacy Ones

- Tether reverses plan to freeze USDT on five blockchains, opting to halt new issuance while allowing existing token transfers. - Affected chains include Omni Layer ($82.9M USDT), EOS, and Algorand, reflecting a multi-year strategic shift toward high-traffic ecosystems like Tron and Ethereum. - The move prioritizes blockchains with strong developer activity and scalability, aligning with Tether’s focus on operational efficiency and user accessibility. - USDT and USDC dominate the $285.9B stablecoin market,

Tether has reversed its decision to freeze USDT smart contracts on five blockchains, following feedback from community stakeholders. The stablecoin issuer now plans to discontinue new issuance and redemption of USDT on Omni Layer, Bitcoin Cash SLP, Kusama, EOS, and Algorand , while allowing existing tokens to remain transferable between wallets. This revised strategy was announced on Friday and represents a shift from Tether’s original plan to fully freeze the tokens by September 1 [1]. The decision reflects a broader strategic focus on maintaining operations on blockchains with strong developer activity, scalability, and user adoption [1].

Omni Layer, once a foundational blockchain for Tether’s operations, will be most affected by the change. It currently holds $82.9 million in circulating USDT, significantly higher than the $4.2 million on EOS and under $1 million on the other affected chains. Tether had previously announced in August 2023 that it would stop issuing USDT on Omni Layer, Kusama, and Bitcoin Cash SLP, and in June 2024, it halted minting on EOS and Algorand. These moves indicate a multi-year transition rather than an abrupt withdrawal [1]. Despite the reduced support, users will still be able to transfer USDT on these chains, though they will no longer have access to direct issuance or redemption services.

The move aligns with Tether’s emphasis on high-traffic blockchain ecosystems. Tron and Ethereum remain the top platforms for USDT, with circulating supplies of $80.9 billion and $72.4 billion, respectively, according to DeFiLlama. BNB Chain ranks third with $6.78 billion in USDT. Tether has also expanded its footprint to other emerging ecosystems like Solana and Ethereum layer-2 chains Arbitrum and Base, although these chains predominantly use Circle’s USDC as the primary stablecoin [1].

The broader stablecoin market continues to grow, with a total market cap of $285.9 billion as of the latest data. USDT and USDC dominate this space with market caps of $167.4 billion and $71.5 billion, respectively [1]. Analysts expect the sector to expand further, with the U.S. Department of the Treasury projecting the stablecoin market to reach $2 trillion by 2028. Additionally, the recent passage of the GENIUS Act is seen as a step toward reinforcing the U.S. dollar’s dominance in global finance by promoting dollar-pegged stablecoins [1].

Tether’s revised strategy highlights its commitment to balancing innovation with user accessibility. By removing full freezes but ending new support, the company aims to reduce operational overhead while preserving limited functionality for users. The decision also underscores Tether’s focus on transparency and community engagement, as it adapts to evolving blockchain landscapes and user expectations [1].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Week Ahead: The US Dollar's Upward Adjustment Since Christmas Could Be Nearing Its End

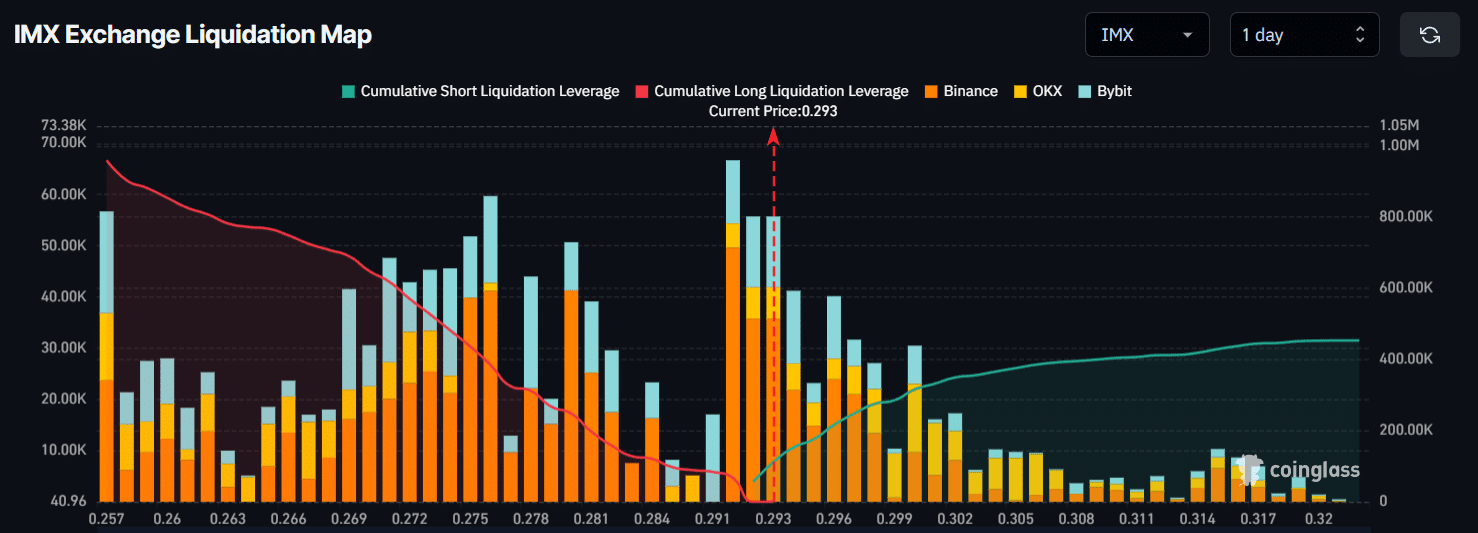

Why Immutable traders are betting long as IMX tests $0.30

The world's largest auto supplier warns profit margin may fall below 2%