PARTI - 70.88% 24H Drop Amid 62,840% Annual Surge

- PARTI plummeted 70.88% in 24 hours to $0.1678 despite 62,840% annual gains, highlighting extreme short-term volatility. - Analysts attribute the drop to technical indicators/macroeconomic cues amid fragile market sentiment and shifting investor behavior. - Long-term holders remain bullish, with 12-month gains underscoring sustained interest despite sharp near-term sell-off. - Traders now monitor key support/resistance levels as event-based backtesting reveals mixed post-crash recovery patterns.

On AUG 31 2025, PARTI dropped by 70.88% within 24 hours to reach $0.1678, despite having risen by 49.67% in the previous seven days, 323.13% in one month, and 62840% over the past year. The sharp 24-hour decline contrasts with its longer-term gains, indicating significant volatility in the asset's valuation. Analysts project that short-term market sentiment remains fragile, with investors reacting to rapid price swings.

The sudden drop raises questions about the catalysts behind the sell-off, which occurred in the context of broader market uncertainty and shifting investor behavior. While no specific event was cited as the cause of the decline, the movement suggests that traders may have been reacting to signals from technical indicators or broader macroeconomic cues.

Despite the recent drop, PARTI's long-term trajectory remains strong. The 62,840% gain over the past year suggests that the asset has continued to capture investor interest, particularly from long-term holders. This stark divergence in performance—between short-term volatility and long-term appreciation—highlights the challenges and opportunities in managing exposure to such assets.

The recent price action has drawn attention to technical indicators that may influence future price movement. Traders and analysts are now closely monitoring key levels of support and resistance, as well as volume patterns that could signal further directional bias. The rapid 24-hour decline, while steep, has not yet triggered broader bearish signals, according to some market observers.

Backtest Hypothesis

In evaluating the behavior of assets like PARTI, event-based backtesting can provide valuable insights into how the market responds to specific price movements. For example, a backtest strategy could focus on days when the price drops by 10% or more and analyze the performance of the asset in the days that follow. This approach allows for the isolation of market reactions to sharp declines and can help identify whether such events are typically followed by rebounds or continued downward momentum.

To implement this strategy effectively, it is important to define both the asset and the criteria for identifying the event. A backtest could be run on a single asset (e.g., a specific token like PARTI) or on a broader market index to compare how different assets respond to similar price shocks. By identifying all instances of a ≥10% one-day drop within a defined time frame—such as from 2022-01-01 to the current date—analysts can assess whether the market tends to correct, consolidate, or continue the trend post-event.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

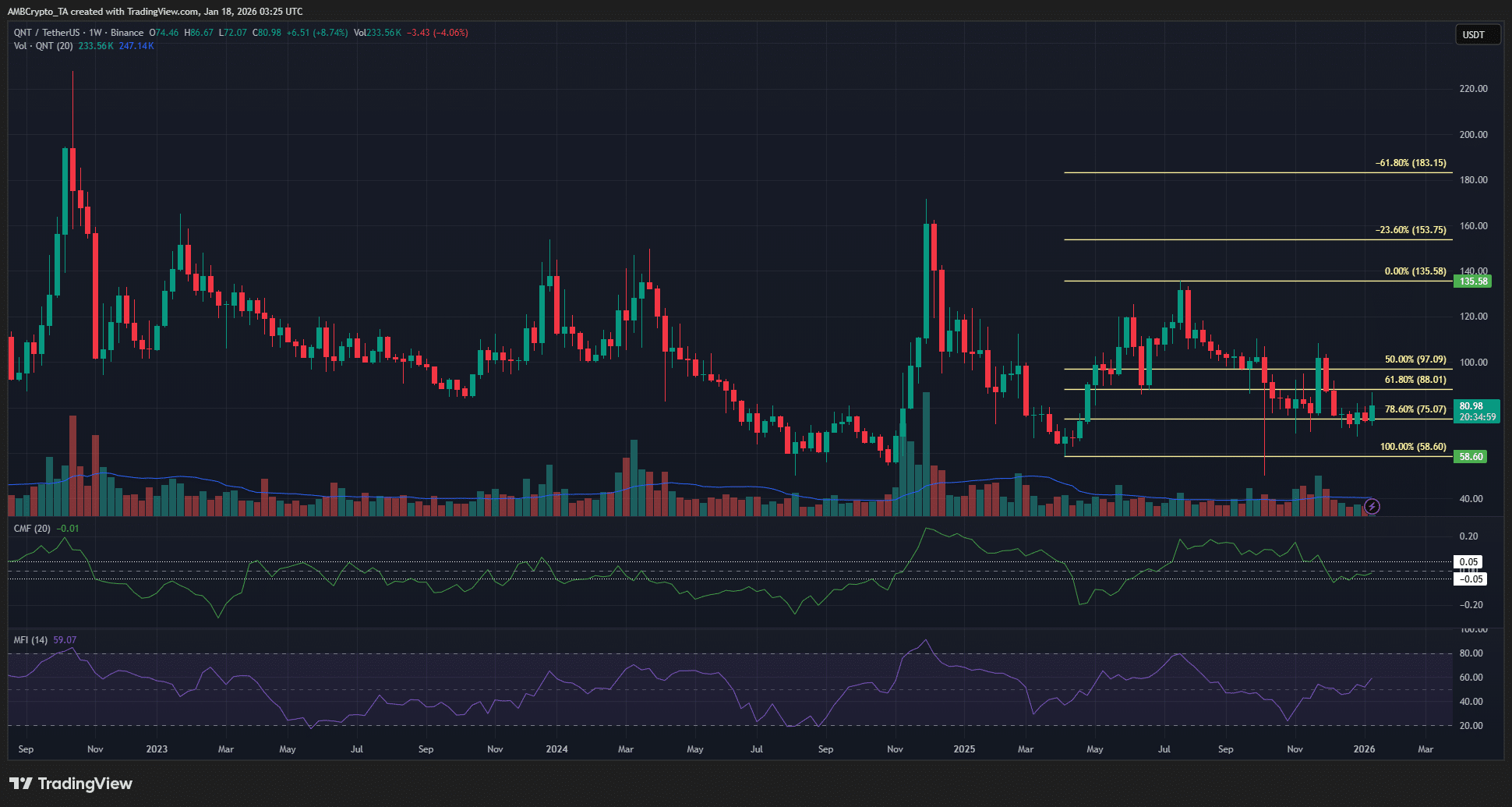

QNT jumps 12% as volume triples — Can Quant bulls defend THIS floor?

GRAM Ecosystem Joins EtherForge to Boost Web3 Gaming Across Chains

Everyone to get their own AI friend in five years, Microsoft executive says

Bitcoin’s Weekend Journey Sparks New Market Trends