Date: Wed, Sept 03, 2025 | 08:20 AM GMT

The cryptocurrency market remains slight volatile as Bitcoin (BTC) consolidates near $111,000, while Ethereum (ETH) hovers around $4,300 after retreating from its recent high of $4,953. Despite this broader choppiness, several altcoins are showing unique setups, with RWA token Ondo (ONDO) beginning to flash early signs of strength.

ONDO is trading back in the green today with a 4% jump, and more importantly, its latest chart structure suggests that more upside could be on the horizon.

Source: Coinmarketcap

Source: Coinmarketcap

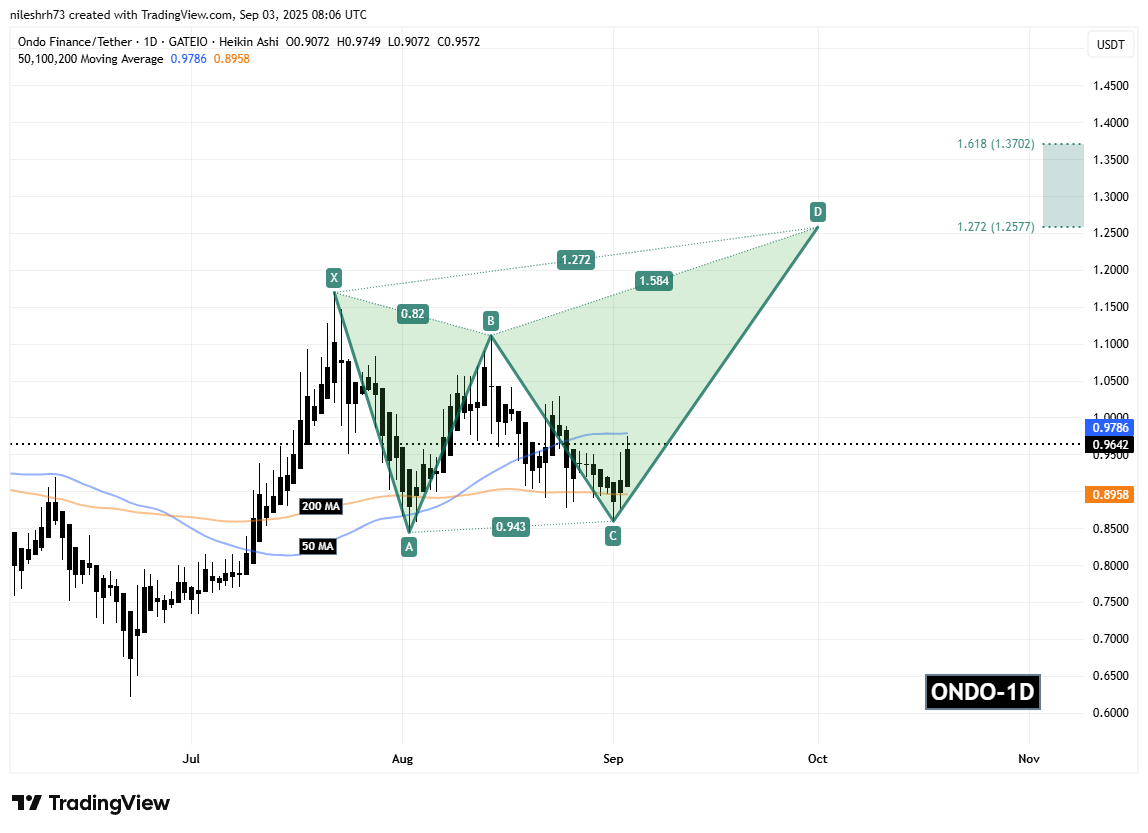

Harmonic Pattern Hints at Potential Upside

On the daily chart, ONDO is forming a Bearish Butterfly harmonic pattern. Despite its name, this setup often delivers a bullish continuation during the CD leg, especially as the price enters the Potential Reversal Zone (PRZ).

The structure began at point X ($1.1693), dropped to A, rallied to B, and then retraced lower to C near $0.8594. Since then, ONDO has started recovering, currently trading around $0.9642, though still in the early phase of confirming its bullish continuation.

Ondo (ONDO) Daily Chart/Coinsprobe (Source: Tradingview)

Ondo (ONDO) Daily Chart/Coinsprobe (Source: Tradingview)

A critical development is that ONDO is now testing its 50-day moving average ($0.9786). A successful breakout and close above this level could flip it into strong support, reinforcing bullish sentiment.

What’s Next for ONDO?

If bulls manage to defend the 100-day MA ($0.8958) or the C-point support at $0.8594 and push the token higher, ONDO could continue toward the PRZ between $1.2577 (1.272 Fibonacci extension) and $1.3702 (1.618 extension). These levels align with the Butterfly completion zone, making them crucial to watch in the short term.

On the downside, a failure to hold $0.8594 would weaken the bullish setup and may indicate that a new C-point is forming, forcing traders to reassess the structure.