Date: Wed, Sept 03, 2025 | 02:50 PM GMT

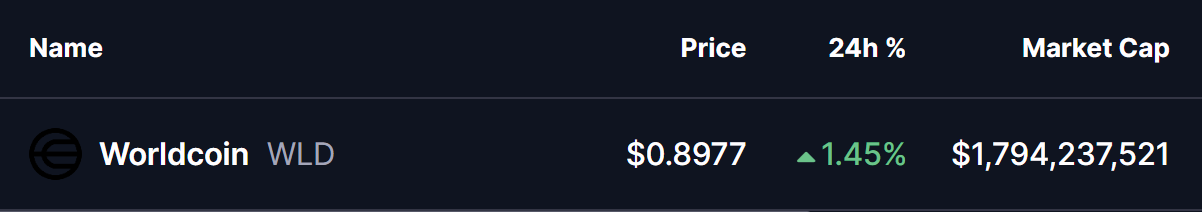

The cryptocurrency market is regaining its ground as Ethereum (ETH) climbs above $4,450 today from its recent low of $4,221. Following this recovery, several altcoins are showing early signs of strength—including Worldcoin (WLD).

WLD is trading back in the green today, and more importantly, its chart is now displaying a key bullish pattern that hints at a potential breakout in the sessions ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge in Play?

On the daily chart, WLD is shaping a Falling Wedge pattern, a setup often seen as a bullish reversal structure that signals the end of a downtrend and the start of upward momentum.

The latest rejection from the resistance trendline pushed the price down toward its support base near $0.832, where buyers stepped in strongly. This defense sparked a rebound, with WLD now bouncing back to $0.897, just below its wedge resistance.

Worldcoin (WLD) Daily Chart/Coinsprobe (Source: Tradingview)

Worldcoin (WLD) Daily Chart/Coinsprobe (Source: Tradingview)

This positioning suggests that a breakout attempt may be on the horizon.

What’s Next for WLD?

If WLD breaks decisively above its wedge resistance and reclaims the 200-day moving average ($0.99), it would serve as a strong bullish confirmation. From there, momentum could accelerate, with the next technical target around $1.40, based on the wedge’s measured move projection.

On the flip side, if WLD fails to sustain buying pressure and slips back, the $0.825 support level will be critical.