Nonfarm payrolls disappoint! Rate cut expectations surge, gold and bitcoin soar

U.S. non-farm payroll data for August fell far short of expectations, with the unemployment rate hitting a new high. Market expectations for a Federal Reserve rate cut in September have risen significantly, causing sharp volatility in the cryptocurrency market. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Despite a hiccup before the release of the US Non-Farm Payrolls report (a malfunction in the Bureau of Labor Statistics data retrieval tool), the report was still published on schedule at 8:30 PM (UTC+8) on September 5th, Taiwan time. The data showed that the seasonally adjusted non-farm payrolls in the US for August increased by only 22,000, far below the expected 75,000; the unemployment rate for August was recorded at 4.3%, in line with expectations but marking a new high since October 2021.

At the same time, the number of new non-farm jobs added in June was revised down from 14,000 by 27,000 to -13,000; for July, the figure was revised up from 73,000 by 6,000 to 79,000. After these revisions, the combined new jobs added in June and July decreased by 21,000 compared to the previous figures.

Significant Increase in Probability of a Rate Cut in September

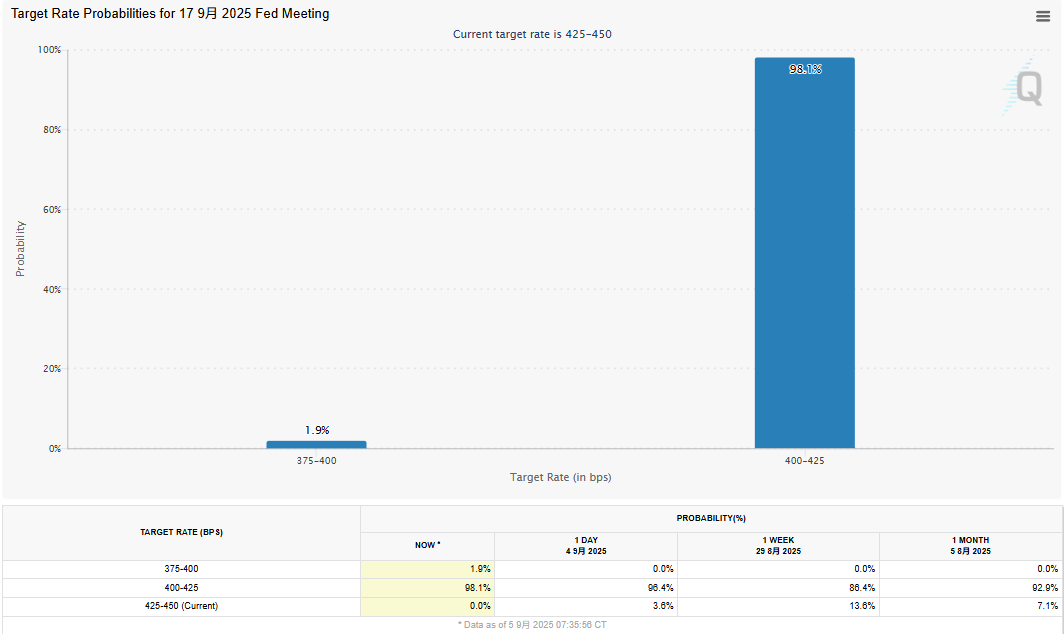

The latest non-farm payroll data undoubtedly confirms the weakness in the labor market. After the report was released, the market's expectation that the Federal Reserve will resume rate cuts and cut rates by 25 basis points at this month's FOMC meeting rose to 98.1%, making it almost a certainty. The probability of a double rate cut in September also emerged, rising from 0 to 1.9%.

Meanwhile, the market has also increased its bets on Fed rate cuts in October and December. According to the CME Fed Watch tool, after a 25 basis point cut in September, the probability of another rate cut in October has already reached 78%, a significant increase from 53.6% the previous day.

Rising Probability of Economic Recession

However, it is worth noting that although the Fed appears poised to resume rate cuts, economists have previously pointed out that the unexpectedly weak performance of the labor market has also heightened concerns about a potential economic recession.

Against this backdrop, after the release of the non-farm report, the spot price of gold climbed again to $3,587, setting a new historical record, indicating that market risk aversion sentiment continues to rise.

Volatility in the Crypto Market

After the report was released, the cryptocurrency market experienced significant volatility. There was intense long-short competition immediately after the data was published, followed by a period of choppy trading. At the time of writing, bitcoin was trading at $112,423, up 2.7% in the past 24 hours (UTC+8); ethereum was trading at $4,425, up 2.8% in the past 24 hours (UTC+8).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hopes for a December rate cut fade? Bitcoin erases its yearly gains

After the release of the delayed U.S. September non-farm payroll data, which was postponed by 43 days, the market has almost abandoned expectations for a rate cut in December.

Gold Rush Handbook | Circle Arc Early Interaction Step-by-Step Guide

Remain proactive even during a sluggish market.

Mars Morning News | Nvidia's impressive earnings boost market confidence, while growing divisions in the Fed minutes cast doubt on a December rate cut

Nvidia's earnings report exceeded expectations, boosting market confidence and fueling the ongoing AI investment boom. The Federal Reserve minutes revealed increased disagreement over a possible rate cut in December. The crypto market is seeing ETF expansion but faces liquidity challenges. Ethereum has proposed EIL to address L2 fragmentation. A Cloudflare outage has raised concerns about the risks of centralized services. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved during iteration.

Surviving a 97% Crash: Solana’s Eight-Year Struggle Revealed—True Strength Never Follows the Script

Solana co-founder Anatoly Yakovenko reviewed the origins, development process, challenges faced, and future vision of Solana, emphasizing the transaction efficiency of a high-performance blockchain and the comprehensive integration of financial services. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the iterative update stage.