Ethereum May Gain Privacy With Institutional Pressure From Wall Street

- Ethereum Privacy Could Be Boosted by Wall Street

- Institutions want confidential transactions on public blockchains

- ZK Proofs Will Be Key to Private Tokenized Assets

The growing adoption of the Ethereum ecosystem by financial institutions is reigniting the debate over privacy on public networks. Danny Ryan, co-founder of Etherealize, believes that Wall Street's demands could become the driving force behind the adoption of private blockchain-based solutions. He believes that "the market does not, and cannot, operate completely in the open," noting that financial transactions require some degree of confidentiality.

Ryan argues that as more assets are tokenized and traded on-chain, full transparency will no longer be feasible. In this context, privacy becomes a basic requirement, especially for companies dealing with treasury strategies and large orders.

Etherealize has just raised $40 million in a funding round to accelerate the development of Ethereum-based infrastructure, focusing on zero-knowledge (ZK) proofs. These solutions allow users to confirm the validity of information without revealing it publicly, making transactions more private and protecting sensitive data from being exposed.

Meanwhile, the Ethereum ecosystem itself is already directing significant investment into ZK-based networks, which, according to Ryan, gives its developers an advantage. However, other companies are choosing to build their own blockchains with privacy built in from the start.

Tempo, incubated by Stripe and Paradigm, aims to offer confidentiality features by default. Arc, backed by Circle, is expected to implement selective balance and transaction protection. This indicates that the pursuit of privacy isn't limited to Ethereum alone, but is also a trend in other blockchain infrastructure initiatives.

Still, Ryan predicts that Ethereum will excel at implementing privacy in a practical way that's compliant with regulatory requirements. He sees custom applications as the primary channel for making privacy a more accessible reality for everyday users, without compromising the transparency required in regulatory contexts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morning Brief | Bitcoin's sharp decline leads to record fund outflows from BlackRock's ETF; U.S. Treasury TGA sees significant drop for the first time; Vitalik Buterin introduces Ethereum in 30 minutes

Overview of major market events on November 19

Interview with Gensyn Co-founder Harry Grieve: With the Mainnet Launch Approaching, How Can Idle Resources Be Used to Break the “Scale Ceiling” of AI Computing Power?

Gensyn co-founder reveals how decentralized computing power can be scaled to empower the next generation of AI.

The quantum threat resurfaces: Is the foundation of cryptocurrencies being shaken?

This will always be the most dangerous threat to the entire industry.

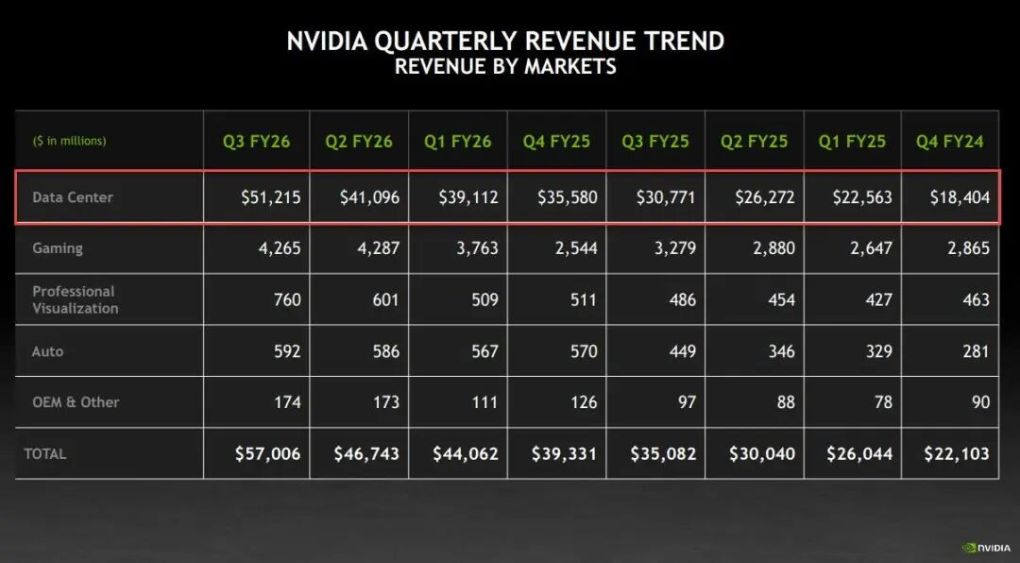

Nvidia ignites on-chain frenzy as AI and the crypto market dance together

Trending news

MoreMorning Brief | Bitcoin's sharp decline leads to record fund outflows from BlackRock's ETF; U.S. Treasury TGA sees significant drop for the first time; Vitalik Buterin introduces Ethereum in 30 minutes

Interview with Gensyn Co-founder Harry Grieve: With the Mainnet Launch Approaching, How Can Idle Resources Be Used to Break the “Scale Ceiling” of AI Computing Power?