Former White House Director Backs Avalanche Blockchain Platform

Anthony Scaramucci, founder of SkyBridge Capital and former White House communications director, expressed confidence in digital assets by investing in Avalanche. He has experience as a lawyer, banker, and media professional, which provides him with broad insights into financial technologies and markets. Avalanche Platform and Subnet Functionality In a September 22 interview with CNBC, Scaramucci

Anthony Scaramucci, founder of SkyBridge Capital and former White House communications director, expressed confidence in digital assets by investing in Avalanche.

He has experience as a lawyer, banker, and media professional, which provides him with broad insights into financial technologies and markets.

Avalanche Platform and Subnet Functionality

In a September 22 interview with CNBC, Scaramucci described Avalanche as “a Swiss Army knife of Layer-1 blockchain platforms.” He emphasized that the platform offers flexibility and potential applications for enterprises.

Avalanche’s subnet functionality allows organizations to create custom blockchains for tokenized funds, securities, and other digital assets. As a result, companies can manage operational and regulatory requirements more efficiently.

Enterprise Adoption and Market Perspective

Scaramucci highlighted that major institutions, including BlackRock and Visa, are adopting Avalanche. This adoption indicates that the platform is gaining credibility alongside Ethereum and Solana.

Enterprise adoption provides a practical measure of a blockchain platform’s long-term viability. Analysts note that institutional adoption is particularly relevant for finance and tokenized asset management.

Scaramucci is doubling down on Avalanche. After announcing $300M in tokenized hedge funds, is now the strategic advisor for AVAX One — a $550M AVAX-focused digital asset treasury alongside .

— Avalanche🔺 (@avax) September 22, 2025

While supporting Avalanche, Scaramucci reaffirmed his positive outlook on Bitcoin. He has previously projected a year-end 2025 Bitcoin price target of $180,000 to $200,000, a figure he described as “cautious,” during public remarks at the Wyoming Blockchain Symposium and in subsequent interviews. His investment approach focuses on platforms that combine strong technical capabilities with practical enterprise applications. This endorsement may influence other investors evaluating Layer-1 platforms with modular architecture and tokenization options.

Avalanche’s architecture supports low-latency transaction processing, customizable subnets, and high throughput. These features help financial firms, payment processors, and asset managers explore blockchain solutions effectively. Also, Scaramucci’s remarks reflect growing industry interest in platforms that provide both operational efficiency and technological versatility.

Recent Developments and Institutional Expansion

Building on Scaramucci’s endorsement, Avalanche has advanced its institutional strategy by planning to raise $1 billion through two U.S.-based cryptocurrency treasury vehicles. According to the Financial Times, the first deal involves a private investment of up to $500 million, led by Hivemind Capital in a Nasdaq-listed company. The second deal, also targeting $500 million, is structured as a SPAC backed by Dragonfly Capital. Completion is expected by October.

These funds will purchase AVAX tokens at discounted rates directly from the Avalanche Foundation, aiming to strengthen its role as a digital ledger for capital markets.

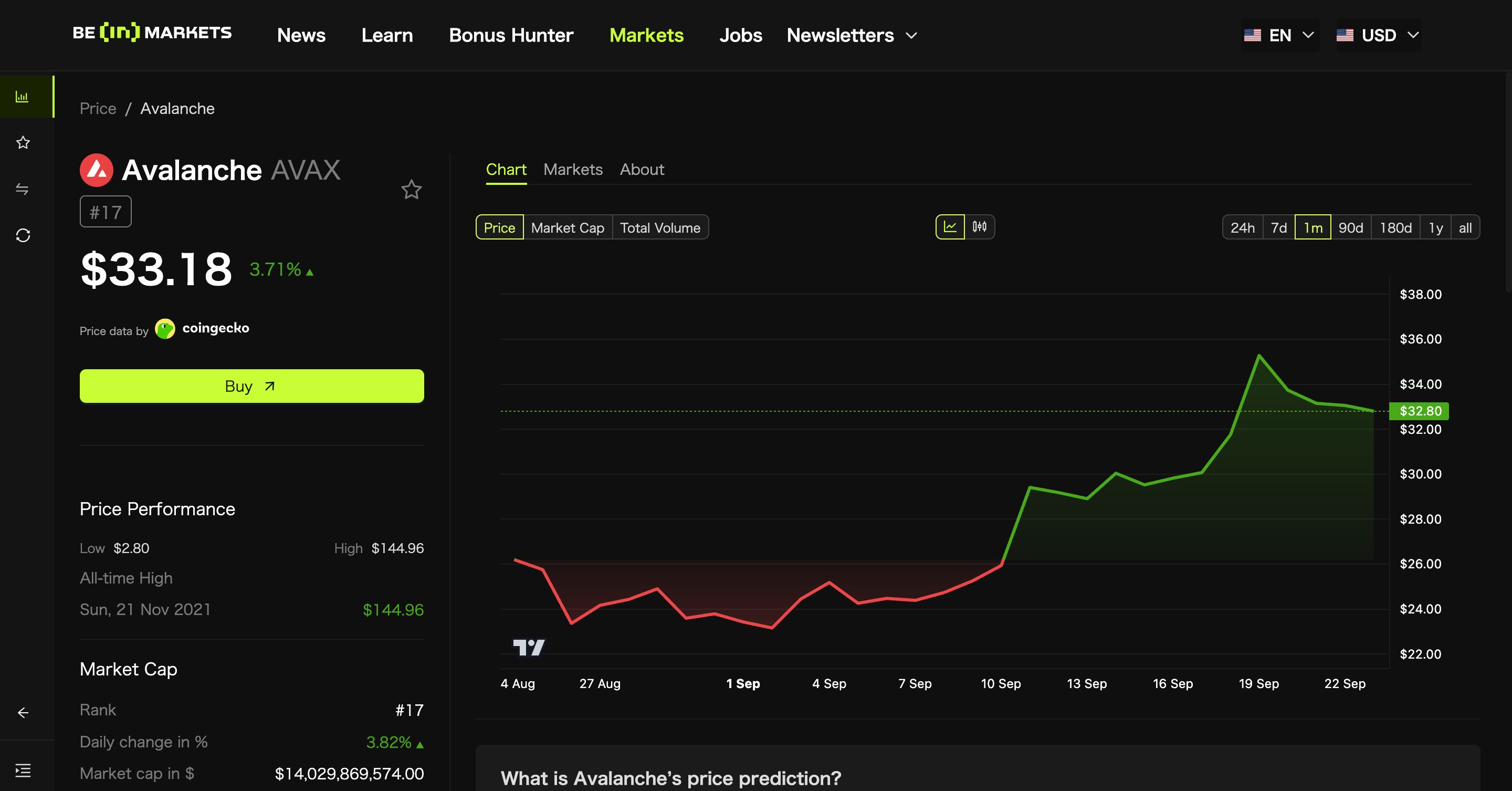

The positive news and strategic initiatives have also influenced AVAX’s market performance. As of the morning of September 23, during Asian trading hours, AVAX was trading at $33.18.

AVAX Price Source:

BeInCrypto

AVAX Price Source:

BeInCrypto

This represents a 3.7% increase from the previous day and a 27.5% gain over the past month. Consequently, the token has attracted renewed attention from institutional and retail investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

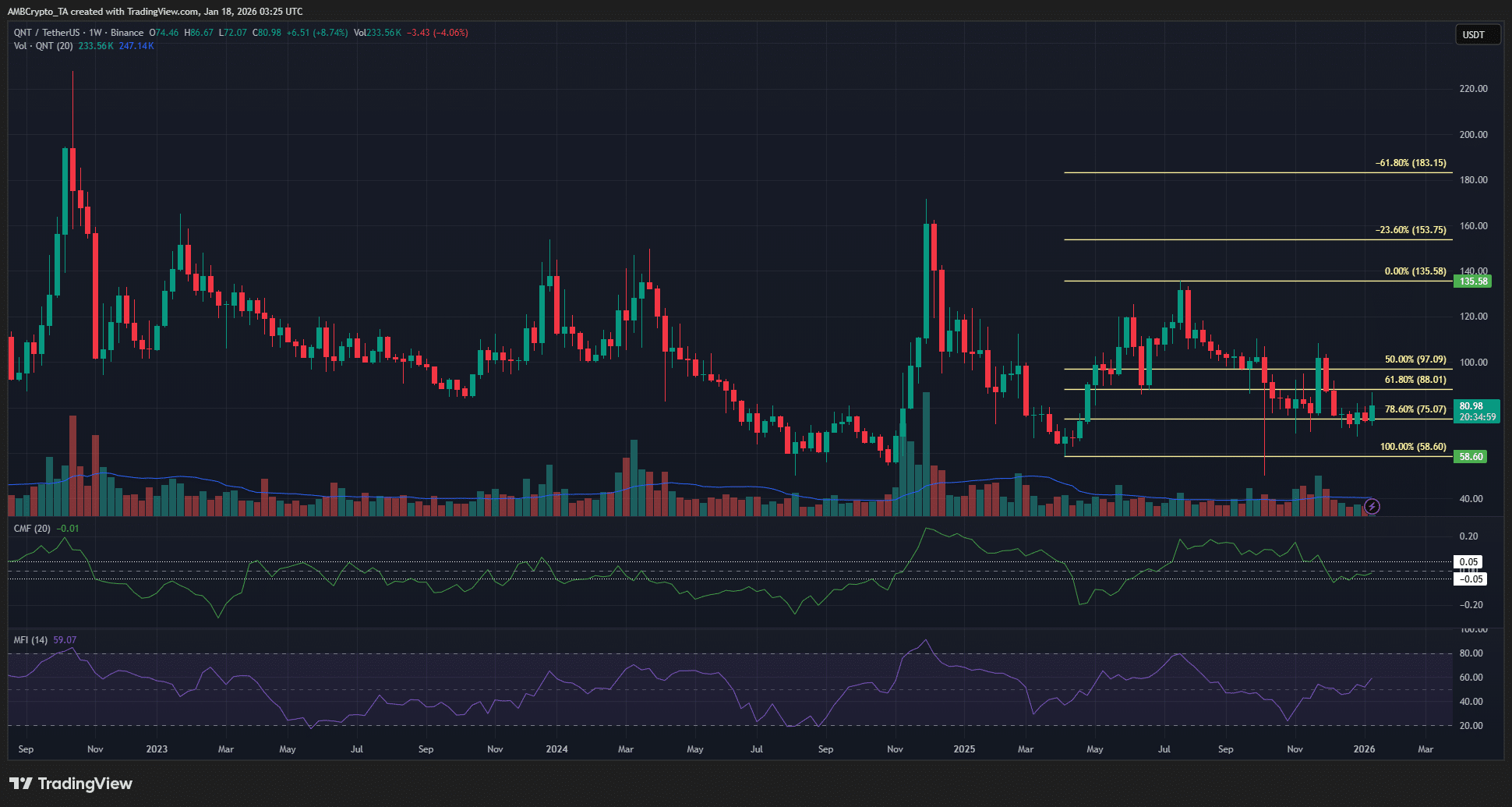

QNT jumps 12% as volume triples — Can Quant bulls defend THIS floor?

GRAM Ecosystem Joins EtherForge to Boost Web3 Gaming Across Chains

Everyone to get their own AI friend in five years, Microsoft executive says

Bitcoin’s Weekend Journey Sparks New Market Trends