Key Notes

- In the early hours of September 25, crypto liquidations came in at $407.81 million.

- Ethereum is leading the 24-hour losses, with long traders suffering the bigger brunt.

- Coincidentally, the Bitcoin price has plunged further to around $111,000.

On Sept. 25, the broader cryptocurrency market experienced a sharp sell-off, triggering up to $400 million in liquidations. It coincides with a recent decline in the price of flagship cryptocurrency Bitcoin BTC $111 453 24h volatility: 1.4% Market cap: $2.22 T Vol. 24h: $51.32 B to around $111,000.

BTC, ETH, SOL, AVAX, and Others in Crypto Liquidations

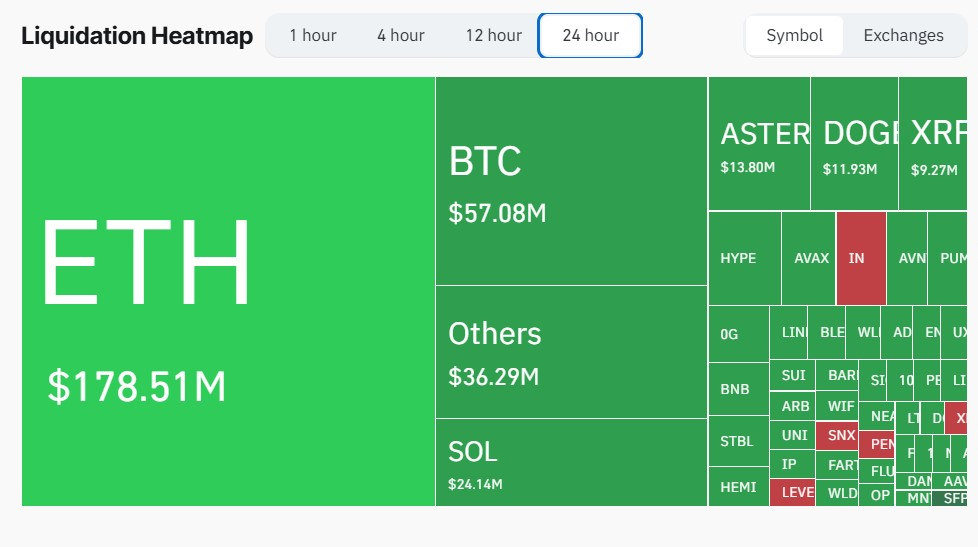

Over the past 24 hours, the digital asset industry has seen 129,655 traders liquidated, resulting in a total liquidation value of $407.81 million. According to insights gathered from CoinGlass data, the largest single liquidation order took place on Hyperliquid and was valued at approximately $29.12 million.

The 24-hour crypto liquidation heatmap shows that most of the liquidations were from Ethereum ETH $4 005 24h volatility: 4.2% Market cap: $483.83 B Vol. 24h: $41.17 B , with Bitcoin following. Precisely, ETH liquidations were capped at $159.92 million, and long traders suffered the biggest loss. Long traders’ liquidations for the second-largest cryptocurrency by market cap were $152.63 million, while short traders recorded losses of only $7.29 million.

Crypto market liquidations topped $400 million amid market shift | Source: CoinGlass

Liquidations from Bitcoin were capped at $41.36 million, with long traders’ losses at $39.88 million and short traders at $1.49 million. Other affected digital assets are Solana SOL $201.2 24h volatility: 5.2% Market cap: $109.36 B Vol. 24h: $8.02 B and Pump.Fun , Avalanche AVAX $30.53 24h volatility: 11.0% Market cap: $12.89 B Vol. 24h: $1.45 B , and even Ripple-associated XRP XRP $2.81 24h volatility: 2.3% Market cap: $168.04 B Vol. 24h: $6.87 B .

The effect of these liquidations on long traders suggests that investors were looking forward to more price gain.

Unfortunately, the market took a different turn and triggered the liquidations. Bitcoin price has plunged significantly from its All-time High (ATH) of more than $123,000. According to CoinMarketCap data, BTC price is currently worth $111,909.50, corresponding with a 0.54% dip over the last 24 hours.

On the flip side, analysts and market observers are still optimistic about a further price rally for the firstborn coin. Brian Armstrong, the CEO of Coinbase Global Inc, recently predicted that the Bitcoin price will reach $1 million within the next 5 years. He highlighted a few structural factors, like improved regulations and institutional demand, as the catalyst that BTC price needs for a push.

Maxi Doge Adoption Soaring

Current price: $0.000259

Amount raised so far: $2.48 million

Ticker: MAXI