Crypto payments firm RedotPay reaches unicorn status following $47 million investment round

Quick Take RedotPay announced the closure of its latest strategic investment round, with participation from Coinbase Ventures, Galaxy Ventures, and Vertex Ventures. The round sees the crypto payments firm reach unicorn status, valued at over $1 billion.

Crypto payments firm RedotPay announced the closure of a $47 million strategic investment round on Thursday, achieving unicorn status with a valuation exceeding $1 billion.

The round included new backing from Coinbase Ventures and an unnamed "global technology entrepreneur," along with increased commitments from Galaxy Ventures and Vertex Ventures, the firm stated in a statement shared with The Block.

"Our mission has always been to make digital finance accessible, secure, and efficient for everyone," RedotPay co-founder and CEO Michael Gao said. "Having Coinbase Ventures join us, along with the continued support from Galaxy Ventures and Vertex Ventures, validates the progress we've made and the confidence investors have in our vision. Their global expertise across both crypto and fintech will help us accelerate growth, strengthen compliance, and expand access to the broader blockchain ecosystem worldwide."

Founded in 2023, RedotPay offers stablecoin cards, multi-currency wallets, and global payout solutions, combining the speed and efficiency of stablecoins with the reach of established payment networks. The company claims to have grown to over 5 million users across more than 100 markets, generating $10 billion in annualized payment volume in two years, expanding access to payment services in underserved markets.

"We believe stablecoins will power the future of payments. The team at RedotPay is executing impressively to bring this value proposition to users around the world. We're proud to support them as part of our common goal to bring billions of users onchain," Hoolie Tejwani, Head of Coinbase Ventures, said.

With the fresh funding in place, RedotPay said it plans to expand its global payment corridors through partnerships with banks, payment networks, and other ecosystem players, while strengthening its focus on compliance and licensing to ensure secure and responsible financial innovation.

Fintech stablecoin push heats up

A number of other fintechs are pushing deeper into stablecoins this year, especially following greater regulatory clarity from the recently passed GENIUS Act in the U.S. PayPal continues to expand PYUSD, integrating it into Venmo and merchant payments. Circle is building beyond USDC with its Layer 1 Arc chain , and Stripe, through its in-development Tempo blockchain, aims to bring stablecoin rails into everyday commerce.

In March, RedotPay announced it had raised $40 million in a Series A funding round led by Lightspeed, with participation from Galaxy Ventures, HSG, DST Global Partners, Accel, and Vertex Ventures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

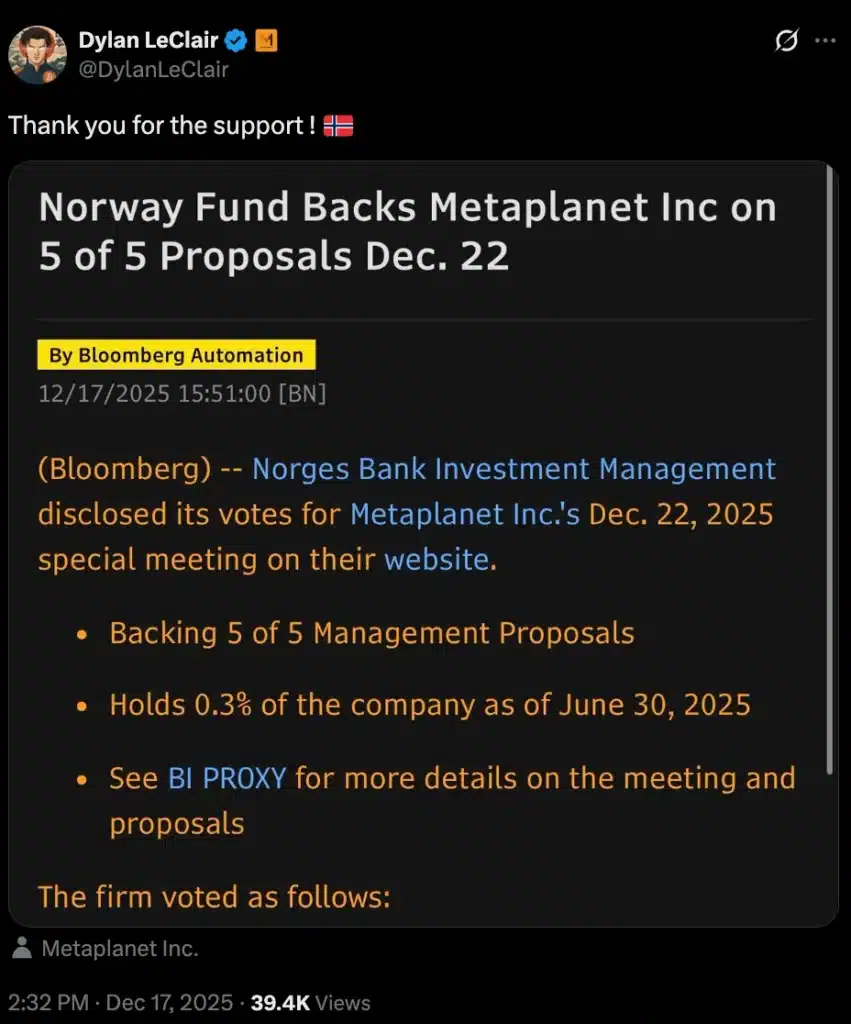

Norway’s $2T fund just backed Metaplanet – What’s happening?

Bitcoin Excluded: TXBC ETF Among 2026 Crypto Index ETFs to Watch, Tracking FTSE Crypto 10 ex-BTC

Bloomberg ETF Analyst Backs Bitwise’s 100+ Crypto ETFs by 2026, Warns Many Could Liquidate by 2027

Stunning Prediction: Bitcoin Volatility to Plummet Below Nvidia’s in 2025