APAC Leads as Crypto Adoption Grows Across Multiple Regions

Cryptocurrency is spreading rapidly across the globe, with adoption increasing in many regions at once. A recent report from Chainalysis highlights the pace of this growth and identifies the countries and areas driving the expansion.

In Brief

- The Asia-Pacific region leads in on-chain crypto transaction value with India, Pakistan, and Vietnam fueling widespread growth across centralized and decentralized services.

- Latin America sees a 63% increase and Sub-Saharan Africa records a 52% rise in crypto use.

- The global market capitalization reaches over $4 trillion with Bitcoin and Ethereum together accounting for nearly 70% dominance.

Rising Crypto Activity in Asia-Pacific

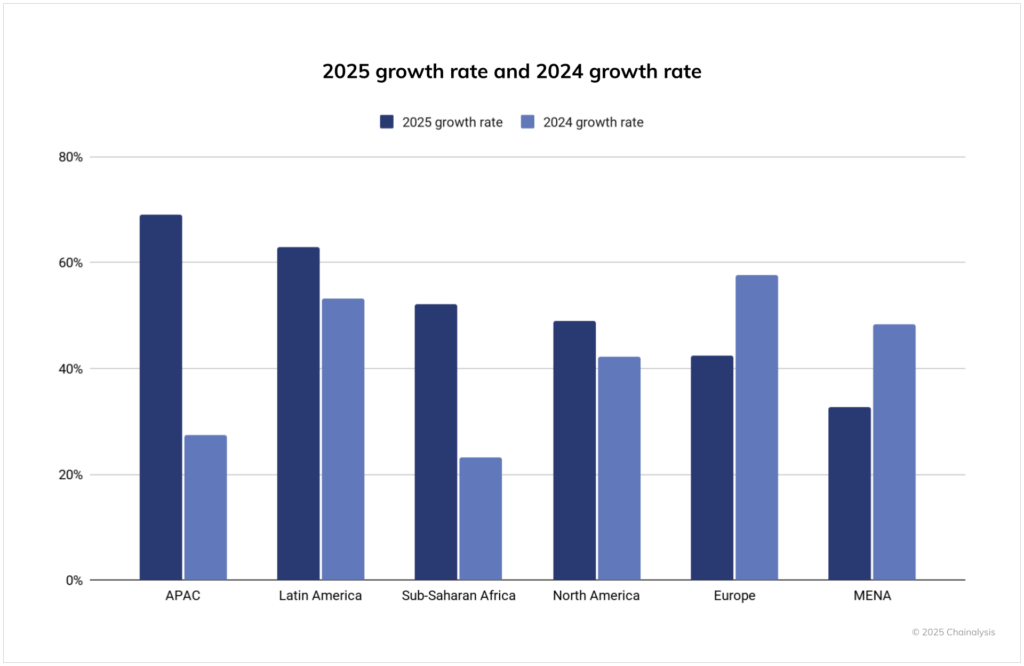

According to Chainalysis, the Asia-Pacific region (APAC) emerged as the fastest-growing market for on-chain crypto activity in the year ending June 2025. The total value received in the region surged 69%, a sharp rise compared with just 27% growth the previous year.

Transaction volumes climbed from $1.4 trillion to $2.36 trillion, with India, Pakistan, and Vietnam standing out as the most active markets driving this expansion.

Growth Beyond Asia-Pacific

Other regions also experienced notable growth. Latin America reported a 63% rise in crypto adoption , improving on the 53% growth seen the year prior. Sub-Saharan Africa posted a 52% increase, with activity largely driven by remittances and everyday payments.

The Middle East and North Africa (MENA) grew at a slower pace, registering a 33% increase. Despite the more modest rate, total transaction volume in MENA still surpassed half a trillion dollars. This shows that cryptocurrencies are gaining traction even in markets with steadier growth.

North America recorded more than $2.2 trillion in total crypto activity. Chainalysis noted that this growth was supported by renewed institutional participation, following last year’s approval of spot Bitcoin and Ethereum ETFs, which provided more structured opportunities for large investors to engage with the market. Europe also maintained strong activity, receiving more than $2.6 trillion in transactions.

APAC tops 2025 crypto growth, outpacing all other regions in global adoption trends.

APAC tops 2025 crypto growth, outpacing all other regions in global adoption trends.

At the same time, individual adoption differs widely across regions. Cointribune reported that only 14% of Americans currently hold or use cryptocurrency , indicating that there is still considerable room for consumer growth in the United States.

Crypto Sees Broad-Based Growth Across Regions

Chainalysis emphasised that the recent surge in adoption is broad-based. The blockchain platform explained that “crypto adoption is broad-based rather than isolated – benefiting mature markets with clearer rules and institutional rails, as well as emerging markets where remittances, dollar access via stablecoins, and mobile-first finance continue to accelerate adoption. In other words, crypto adoption is truly global.”

Supporting this global perspective, CoinGecko reports that the total cryptocurrency market capitalization now stands at $4.01 trillion. Bitcoin accounts for more than 56% and Ethereum makes up 12.5%, giving the two leading cryptocurrencies nearly 70% dominance in the market. Short-term price changes have been modest, with Bitcoin rising about 1% over the past 24 hours and Ethereum slipping roughly 0.8%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Taurus’s Twofold Function Accelerates the Integration of Blockchain into Mainstream Finance

- Taurus SA joins Canton Network as a Super Validator, expanding custody services to support $6T+ tokenized assets via the Canton Token Standard. - As a core infrastructure partner, Taurus enhances Canton's security and governance while enabling 24/7 markets and privacy-compliant operations for institutions. - The partnership with Deutsche Bank , Santander , and State Street underscores Taurus's role in bridging traditional finance and blockchain innovation through interoperable, compliant infrastructure.

Web3 Transformation: Efficiency and Regulation Take Precedence Over Privacy Concepts

- Web3 infrastructure prioritizes performance and compliance over theoretical privacy models like garbled circuits and FHE. - Hanyang University's 108 Gb/s PAM-8 receiver advances data center efficiency with 1.95 pJ/bit energy optimization. - Wemade's KRW stablecoin alliance rebuilds trust through regulated infrastructure, avoiding direct stablecoin issuance. - Coinbase's $1.5B Q2 revenue highlights crypto market volatility, emphasizing institutional infrastructure diversification. - Alphabet's $1B+ cloud

Hyperliquid News Today: MUTM Soars by $19M While MegaETH Plummets: Real Performance Outshines Hype in the Evolving Crypto Landscape

- Mutuum Finance (MUTM) raised $19M in Phase 6 presale, with 250% price growth since 2025 launch and 90% allocation completed. - KuCoin secured AUSTRAC and MiCA licenses, expanding compliance reach across 29 EEA countries while acquiring payment firms to strengthen institutional credibility. - Bitcoin surged past $90K amid Fed rate cut speculation, contrasting MegaETH's $1B token sale collapse due to technical failures, highlighting execution risks in volatile markets. - Crypto exchanges pledged $3.19M for

Bitcoin News Update: Triple Bearish Divergence in Bitcoin Suggests ETF Rally May Be Unstable

- Bitcoin trades near $86.6K, down 31.3% from October peak amid $3.5B November ETF outflows and $2B liquidations. - Technical analysis flags "triple bearish divergence" as price hits higher highs while momentum indicators weaken. - Spot Bitcoin ETFs see $238M inflows but face $90K resistance; Ethereum ETFs gain $175M yet ETH remains below $3,000. - Key support at $85K risks accelerating sell-off to $80K, with 50–60% retracement targeting $34,409–$44,100 if bearish pattern completes.