The Hashdex Crypto Index US multi-asset crypto ETF (ticker NCIQ) now holds BTC, ETH, XRP, SOL and XLM 1:1 on Nasdaq following the SEC’s generic listing rule change, making it the second U.S. multi-asset crypto ETF and opening faster pathways for similar funds.

-

Five crypto holdings listed 1:1 on Nasdaq under ticker NCIQ

-

SEC’s generic listing standards speed approvals for eligible commodity-based tokens and futures-backed assets

-

Market participants expect a wave of ETF filings and broader institutional access to crypto markets

Multi-asset crypto ETF news: Hashdex adds XRP, SOL, XLM to Nasdaq-listed NCIQ—learn what changes mean for investors and ETF flows. Read more.

What is the Hashdex multi-asset crypto ETF expansion?

Multi-asset crypto ETF: Hashdex expanded its Crypto Index US ETF to include XRP, SOL and Stellar (XLM) alongside Bitcoin (BTC) and Ether (ETH), creating a five-asset fund trading on Nasdaq as NCIQ. The fund holds the listed tokens 1:1 and uses the SEC’s new generic listing standards to qualify faster for trading.

The exchange-traded fund (ETF) is the second multi-asset cryptocurrency investment vehicle approved for trading in the United States.

Asset manager Hashdex announced the Crypto Index US ETF now lists XRP, SOL and XLM after the SEC adopted generic listing standards for eligible cryptocurrencies. The ETF is listed on Nasdaq under the ticker NCIQ and holds the five constituents on a one-to-one basis with on‑exchange custody and surveillance mechanisms in place.

Hashdex’s notice of expanding its ETF under the proposed SEC rule change for generic listings. Source: SEC

Hashdex’s notice of expanding its ETF under the proposed SEC rule change for generic listings. Source: SEC

How did the SEC’s generic listing rule change accelerate approvals?

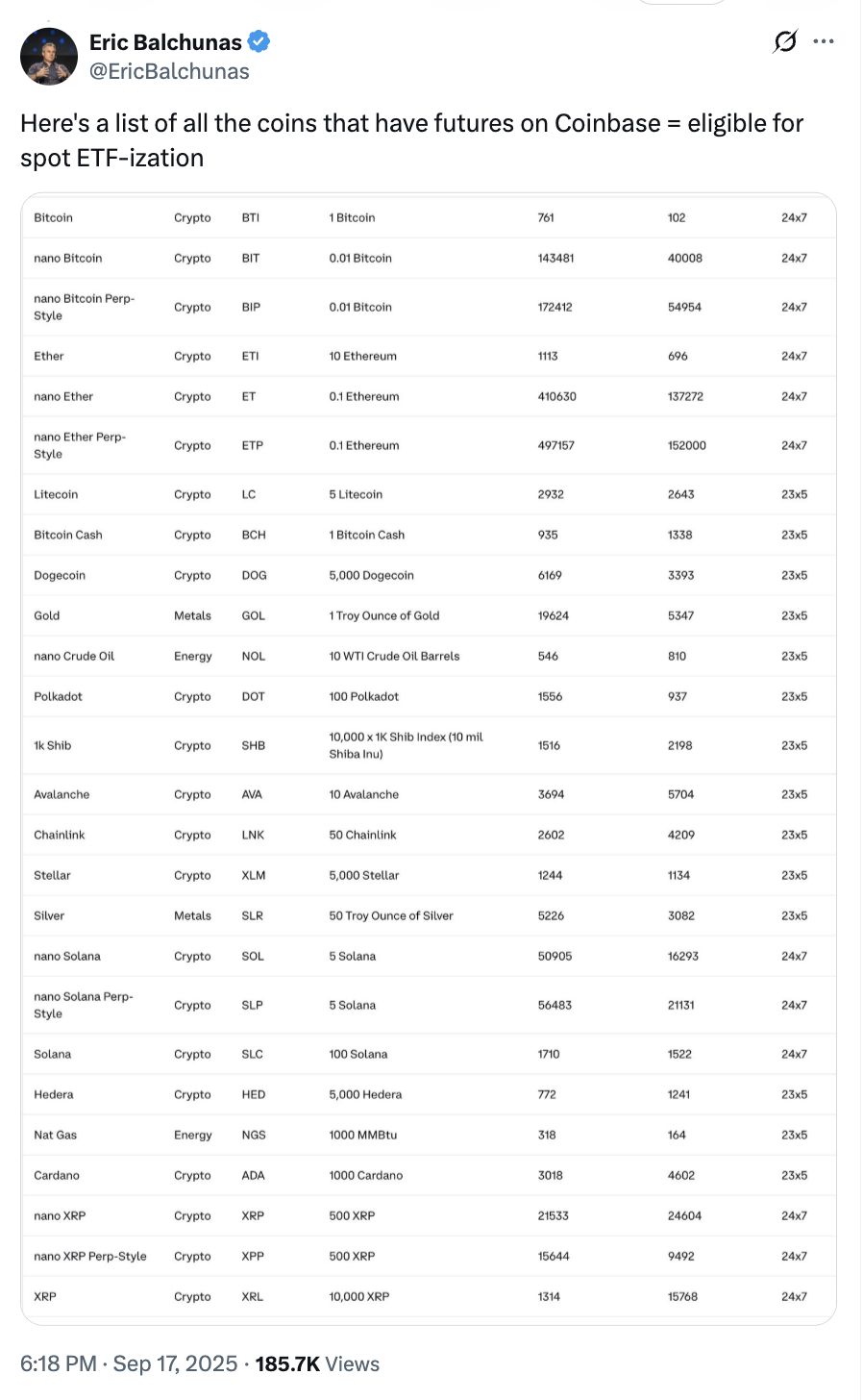

The SEC’s generic listing framework, approved in September, sets objective eligibility criteria for ETFs tied to commodities or futures. To qualify, a cryptocurrency must be classed as a commodity or have futures contracts on regulated exchanges and participate in financial surveillance systems such as the intermarket surveillance group standards.

Under the new process, exchanges can list eligible crypto ETFs using a standardized generic notice, which reduces review time versus individualized 19b filings. Regulators and industry analysts expect this to prompt a surge in ETF filings, improving market access for investors and narrowing the gap between traditional finance and digital assets.

The Grayscale Digital Large Cap Fund, approved Sept. 17, was the first multi-asset crypto ETF; Hashdex’s NCIQ is the second, each reflecting the SEC’s shift toward commodity classification for many tokens. SEC Chair Paul Atkins has advocated policy changes including an “innovation exemption” and clearer market structure rules to support digital finance innovation.

Frequently Asked Questions

What tokens does the Hashdex Crypto Index US ETF include?

The ETF holds Bitcoin (BTC), Ether (ETH), XRP (XRP), Solana (SOL) and Stellar (XLM) on a 1:1 basis, listed on Nasdaq under ticker NCIQ.

How does a cryptocurrency qualify for generic listing?

A cryptocurrency qualifies if it is treated as a commodity or has regulated futures contracts, and if trading is covered by recognized intermarket surveillance and custody arrangements that meet exchange standards.

Will more multi-asset crypto ETFs launch in the U.S.?

Industry participants and market analysts expect increased filing activity due to the generic listing rules, though approval still requires exchanges and ETFs to meet surveillance and custody criteria.

Source: Eric Balchunas

Source: Eric Balchunas

Key Takeaways

- Faster ETF listings: Generic listing standards reduce the time for eligible crypto ETFs to list on exchanges.

- Broader crypto exposure: Hashdex’s NCIQ provides diversified exposure to BTC, ETH, XRP, SOL and XLM in a single fund.

- Institutional bridge: Rule changes and policy shifts aim to align digital assets with existing market infrastructure and surveillance.

Conclusion

The expansion of Hashdex’s Crypto Index US ETF under the SEC’s generic listing framework marks a significant step for multi-asset crypto ETFs in the U.S. The approval of NCIQ, alongside Grayscale’s large‑cap fund, signals a regulatory pivot toward commodity treatment and standardized listings. Investors should monitor ETF filings and market surveillance disclosures as more multi-asset products seek Nasdaq listings in the months ahead.

Published: 2025-09-25 Updated: 2025-09-25

Author/Organization: COINOTAG

Sources referenced in reporting: U.S. Securities and Exchange Commission statements, Nasdaq listing notices, Grayscale announcements, and public comments from SEC Chair Paul Atkins. Related industry commentary appeared from independent ETF analysts and Eric Balchunas (public Twitter commentary).