PunkStrategy Token Surges as NFT-Linked Model Gains Attention

PunkStrategy (PNKSTR) combines NFT trading with token buybacks, spurring an 87% surge in market value. Experts caution investors about significant price volatility and speculative risks in this emerging crypto strategy.

PunkStrategy (PNKSTR), a token linking NFT trading with reinvestment mechanisms, has recorded substantial growth, reflecting increasing interest in crypto-NFT hybrid strategies.

Analysts caution, however, that volatility remains high in such experimental tokens.

PunkStrategy’s Innovative Model and Recent Performance

PunkStrategy, developed by TokenWorks, utilizes a trading model that allocates 10% of transaction fees to purchase Cryptopunk NFTs. These NFTs are then resold at a markup, and proceeds are reinvested into buying back PNKSTR tokens. This cyclical approach aims to support both the NFT market and the token’s liquidity.

In the past 24 hours, PNKSTR surged by 87%, pushing its market capitalization to approximately $36.4 million. While the model has attracted attention for its innovative structure, experts emphasize that its speculative nature can lead to significant price fluctuations.

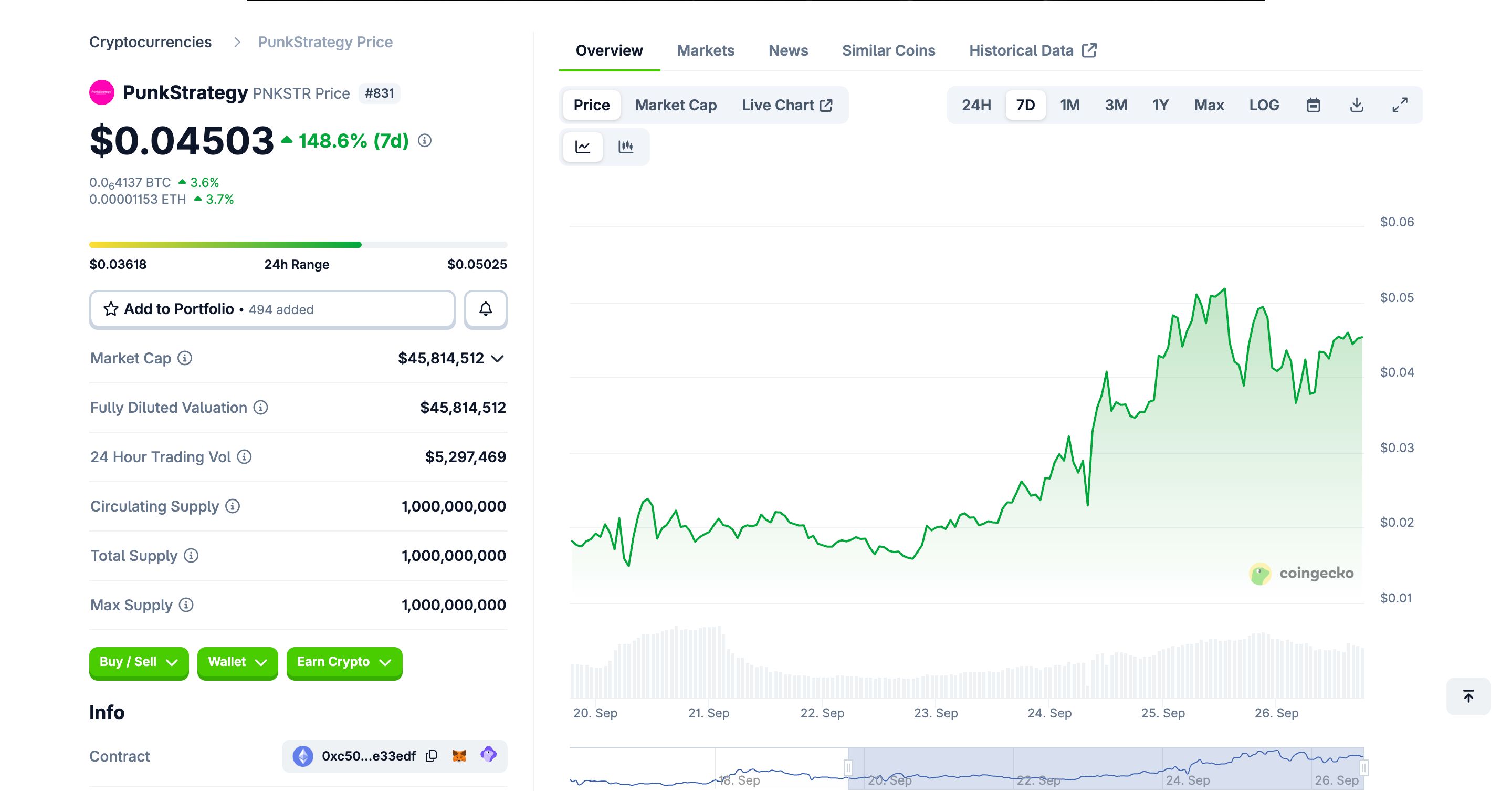

PNKSTR surged by approximately 150% over the past week. Source:

PNKSTR surged by approximately 150% over the past week. Source:

The strategy builds on earlier NFT-centric approaches, expanding the concept of tokenized art and collectibles as investment instruments. Analysts note that while the gains are notable, underlying risks remain prominent, such as NFT market illiquidity and speculative trading. Investors must evaluate the potential upside and inherent market volatility before committing funds.

Market Implications and Investor Considerations

The rapid appreciation of PNKSTR illustrates a broader trend in integrating NFTs into crypto tokenomics. By creating a flywheel effect—where NFT sales fund token buybacks—the model attempts to stabilize token price while fostering NFT demand. However, industry observers, including ChainCatcher, caution that the approach is untested at scale and may experience abrupt price swings.

Financial analysts stress that such tokens exemplify the growing intersection of digital art and blockchain finance. Institutional investors and retail participants are observing PNKSTR as a case study in NFT-token synergy. Despite impressive short-term gains, the model’s long-term sustainability depends on continued market interest in NFTs and the token’s ability to maintain liquidity amid price volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster News Today: Optimism Faces Prudence: ASTER Approaches $1.21 Following RSI CEO's 16% Stake Sale

- Aster (ASTER) rose 8% toward $1.21 as Binance-backed DEX hit $3T in cumulative trading volume. - RSI CEO sold 16% stake ($11M+), raising doubts despite Q2 revenue growth (19.7%) and EPS beat. - ASTER faces mixed signals: bullish triangle pattern vs. declining fees, 50% open interest drop, and stagnant adoption. - Analysts remain divided: RSI's 22% YTD gain contrasts with ASTER's uncertain breakout potential amid waning trader enthusiasm.

The ChainOpera AI Token Crash: An Urgent Warning for Cryptocurrency Projects Powered by AI

- ChainOpera AI's COAI token collapsed 96% in late 2025, exposing systemic risks in AI-driven DeFi ecosystems. - Centralized governance (10 wallets controlled 87.9% supply) and misaligned incentives exacerbated panic selling during crises. - Technical flaws included untested AI models with 270% increased vulnerabilities and inadequate smart contract security audits. - Regulatory shifts like the GENIUS Act compounded liquidity challenges, highlighting the need for compliance-ready AI crypto projects. - Inve

How large a portion of the AI data center surge will rely on renewable energy sources?

Amazon satellite network receives a new name — and no longer emphasizes its low-cost promise