XRP Has a Lower Dormancy Rate than Bitcoin and Ethereum: Report

A recent report from XPMarket shows that the XRP Ledger boasts incredibly high on-chain activity, featuring a lower dormancy rate than Bitcoin and Ethereum.

While the XRP price has fallen below $3 in the latest market downturn, the recent XPMarket report confirms that the XRPL continues to show signs of life. According to the report, XRP’s supply moves far more actively than Bitcoin or Ethereum, with less of it sitting idle for years.

Assessment Metrics

The study examined 7.016 million wallets using complete ledger data up to Sept. 23, 2025 (ledger 99,046,276). Importantly, the researchers excluded 35.3 billion XRP locked in escrow and reserves, focusing on the 64.7 billion circulating supply.

By comparison, analysts estimate that more than 20% of Bitcoin is dormant, while Ethereum also shows higher long-term inactivity. The sharp drop between 1 year and 2 years of inactivity suggests that XRPL wallets either become permanently inaccessible fairly quickly or continue to transact regularly.

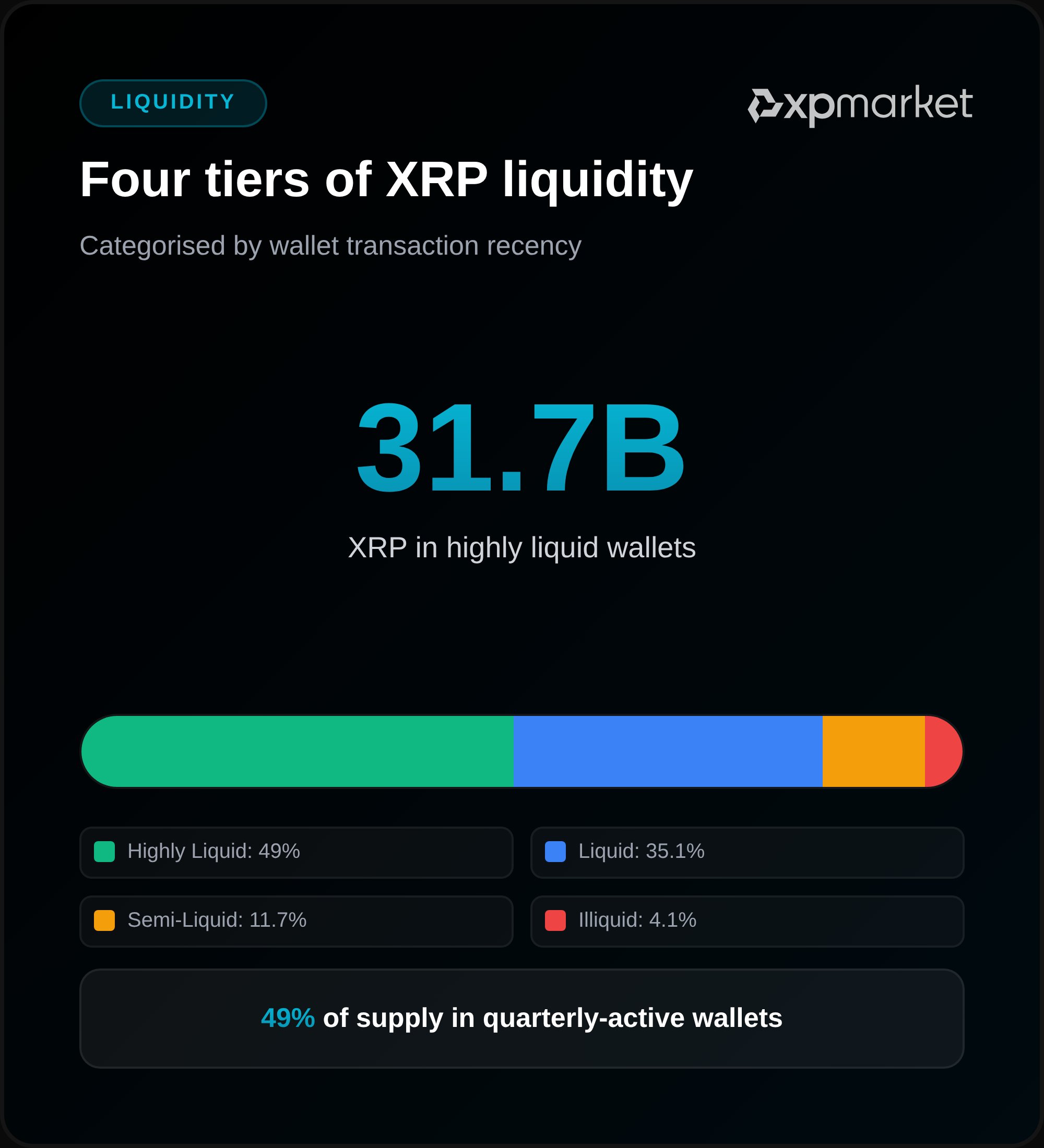

Moreover, liquidity has remained one of XRPL’s biggest strengths, according to the report. In particular, wallets active in the past year control 54.4 billion XRP, equal to 84.2% of the circulating supply. In the last 90 days, 31.7 billion XRP, or 49% of the supply, changed hands.

Meanwhile, another 22.7 billion XRP, or 35.1%, last moved between 3 months and 1 year ago, while 7.6 billion XRP, or 11.7%, shifted 1–2 years ago. Only 2.7 billion XRP, or 4.1%, has stayed dormant for longer than that. Overall, nearly half the supply circulates every quarter.

XRP Ledger Seeing Higher Wallet Activity

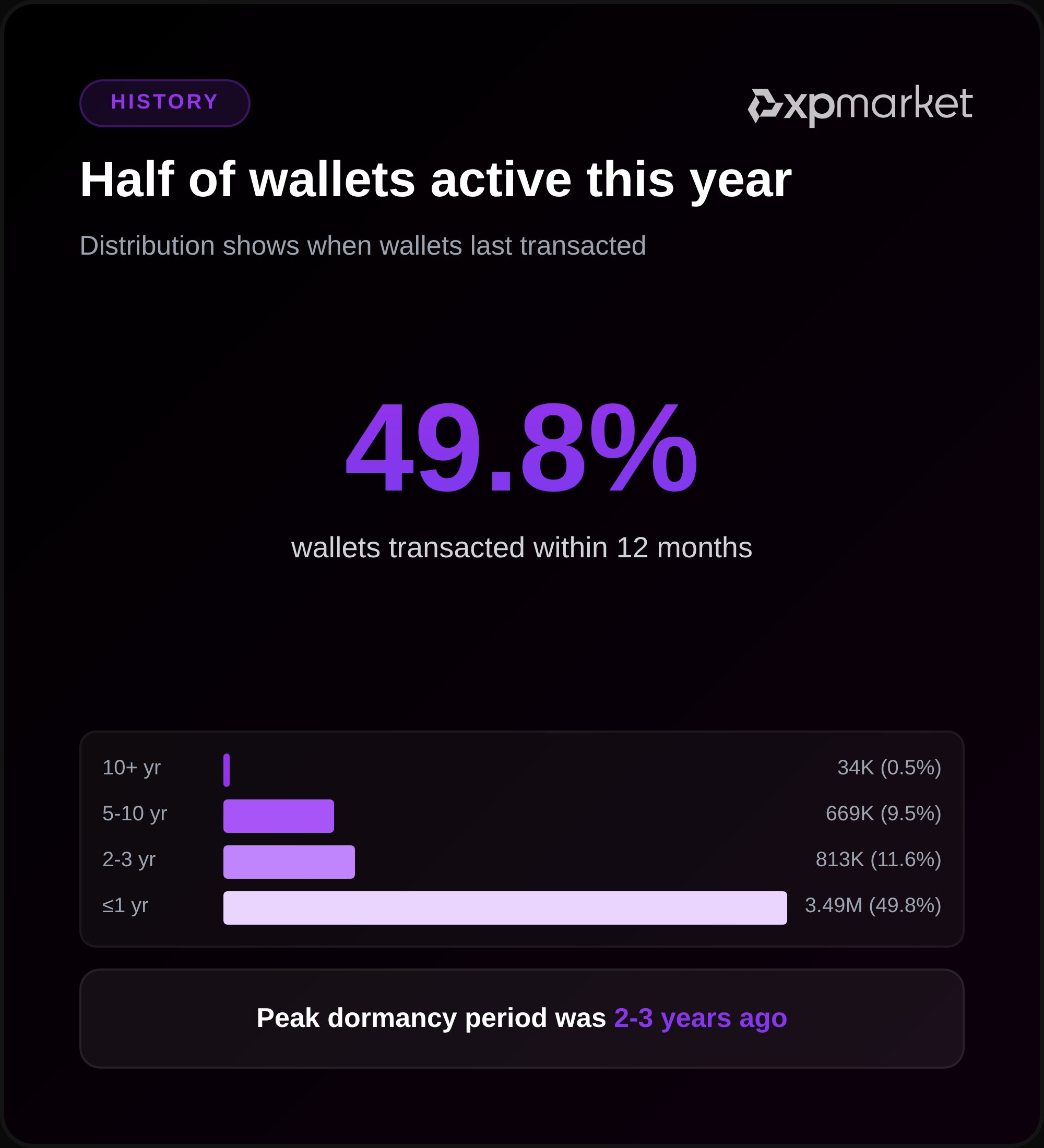

In terms of wallet activity, 49.8% of wallets transacted in the past year, and about 6.7% moved funds in the last 30 days, holding 34.8% of the supply. Another 15.1% transacted between 91 and 180 days ago, holding 30% of the supply. Also, the most recently active wallets carry larger balances, averaging 48,143 XRP for those that moved funds in the last month.

The report also examined wallets that have never sent a transaction. Specifically, XPMarket identified 308,736 such accounts, holding 2.4 billion XRP, or 3.8% of the circulating supply. Their median balance sits at 176 XRP, though large accounts raise the average. These wallets likely represent cold storage, inaccessible keys, or those with long-term holding strategies.

Whale Activity and Transaction Volume

Meanwhile, large holders show even higher engagement. XPMarket tracked 2,693 wallets with at least 1 million XRP. Together they hold 39 billion XRP, averaging 14.7 million each. Of these, 98.6% have been active within the past year, while only 37 wallets have stayed inactive for more than a year.

The network also shows depth across time. Around 11.6% of wallets last moved funds 2–3 years ago, while 0.5% date back to the genesis era and have remained active for more than 10 years.

Notably, independent data supports these findings. According to XRPScan, the XRP Ledger has averaged 23,000 daily active addresses since February 2025. Activity spiked to around 40,000 between November 2024 and January 2025, when XRP surged from $0.50 to over $3.

The network has also processed an average of 1.7 million transactions per day since April, while adding about 4,000 new accounts daily.

Speaking on the findings, XPMarket CEO Dr. Artur Kirjakulov said XRP’s low level of potentially lost supply compared to Bitcoin, along with near-universal whale participation, shows that XRPL has grown into institutional-grade infrastructure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: Tom Lee Wagers on $9K ETH, Challenging $4B in Losses with a '2017 Bitcoin' Strategy

- Tom Lee predicts Ethereum (ETH) could hit $7,500–$9,000 by 2026, supported by Fundstrat's $83M ETH purchase and BitMine's 3.6M ETH accumulation (3% of supply). - Despite ETH trading below $3,000 (vs. $3,120 average cost), Lee views the dip as a buying opportunity, citing Ethereum's "Wall Street blockchain" utility and tokenization trends. - BitMine plans to stake its 3.6M ETH via MAVAN for 4–5% yields, aligning with Ethereum's DeFi growth and Grayscale's first U.S. spot Dogecoin ETF signaling crypto's in

XRP News Today: ADGM's Green Light Boosts RLUSD as a Link Between the U.S. and Middle East

- Ripple's RLUSD stablecoin gains ADGM approval as UAE's first regulated fiat-referenced token, enabling institutional use in payments and collateral management. - With $1.2B market cap and 80% supply on Ethereum , RLUSD's adoption accelerates through transparent reserves and NYDFS compliance, bridging U.S.-Middle East markets. - ADGM's stringent framework attracts major institutions, positioning RLUSD as infrastructure-grade asset with 1:1 USD backing and third-party attestations. - Ripple expands regiona

Bitcoin News Update: Exchanges Compete With Crypto Perpetuals to Regain Importance Among Institutions

- Stock exchanges like SGX and Qatar bourses face pressure to adopt crypto perpetual futures (perps) to retain institutional relevance amid $187B+ global daily trading volumes. - SGX's Nov. 24 Bitcoin/Ethereum perps launch reflects traditional finance's integration with crypto, as $57.7B+ daily Bitcoin perp volumes outpace traditional offerings. - Gulf markets show mixed adaptation: Qatar's Ooredoo QPSC secondary offering contrasts with UAE's $5B+ in 2024 secondary sales, while China's property crisis expo

Ethereum Updates: ZKP Initiatives Rise While Ethereum's $3K Level and Dogecoin ETF Decisions Remain Uncertain

- Ethereum hovers near $3,000 as traders weigh technical levels and the Fusaka upgrade's potential impact on scalability. - Grayscale's Dogecoin ETF (GDOG) underperformed expectations with $1.41M first-day volume, reflecting cautious investor sentiment toward meme coins. - Zero Knowledge Proof (ZKP) projects see surging presale activity as investors seek privacy-focused alternatives amid crypto market uncertainty. - Ethereum's 37% drawdown from highs and DOGE's $0.1540 resistance highlight fragile momentum