Bitcoin’s recent decline indicates a reset period, with Swissblock highlighting the potential for a 20-30% upward surge

- Swissblock identifies Bitcoin's late-September 2025 dip as a "reset phase" precursor to 20-30% rallies, citing historical 2023-2024 patterns. - On-chain metrics show low volatility and bullish sentiment despite $110,000 support break, with institutional buying seen as key recovery driver. - Critical support levels at $110,000-$100,000 act as near-term catalysts, with stable derivatives markets reinforcing market resilience against systemic risks.

Swissblock’s review of Bitcoin’s price movement in late September 2025 points to a pivotal moment for the market, with the platform noting that a “risk-off signal” has

Recent figures reveal that 22% of altcoins are showing a negative impulse, which matches Swissblock’s historical range of 15-25% for market bottoms. This indicates a possible turning point for

Bitcoin’s recent price drop below the $110,000 mark—a psychological level that had held for several weeks—has drawn significant attention. Yet, Swissblock’s on-chain data analysis offers a different perspective from the usual bearish outlook. The platform’s unique Bitcoin Risk Index, which combines on-chain valuation and cost-basis information, remains close to zero, indicating low volatility and continued bullish sentiment despite a 5% decline over the week. This contrast between price movement and risk signals has led Swissblock to suggest that the dip represents a “buying opportunity” rather than a sign of broader market danger.

Institutional interest is seen as a major factor for Bitcoin’s next recovery phase. Although September’s price action outperformed expectations, ETF inflows slowed in the latter half of the month, pointing to a need for renewed institutional engagement. Swissblock attributes this to “typical late-cycle behavior” among long-term Bitcoin investors, who are gradually reducing their positions. Still, the lack of a high-risk environment means immediate bearish signals are absent, creating conditions where institutions might absorb the available discounted supply.

The platform’s outlook is consistent with historical trends identified by crypto analyst Lark Davis. Bitcoin’s 8% drop in late September is similar to declines seen in 2023 and 2024, both of which were followed by fourth-quarter rallies of 77% and 101%. This recurring “rektember” pattern suggests a seasonal tendency toward bullishness, with Swissblock forecasting a retest of the $110,000 level as a key short-term event. Should this support fail, the $105,500-$100,000 range could come into play, though Swissblock sees this as a “max pain” scenario likely to shake out short-term traders.

Swissblock and other analytics providers have pinpointed $112,000, $110,000, and the short-term holder cost basis at $111,400 as crucial support levels. These points represent a fragile equilibrium between bullish optimism and bearish pressure; sustained trading below $111,400 could signal a shift toward a more bearish outlook for the medium to long term. Meanwhile, institutional activity and derivatives markets remain steady, with funding rates and liquidation volumes staying within typical ranges, further supporting the view that a systemic downturn is unlikely.

This analysis highlights the need to separate short-term price swings from underlying market fundamentals. While Bitcoin has tested important psychological levels, the absence of a risk-off signal and the alignment of on-chain data with historical bullish trends point to a robust market structure. Institutional involvement and seasonal effects are expected to be decisive in whether Bitcoin reclaims its $120,000 high or consolidates within a broader trading band.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Naver's Cryptocurrency Merger Approaches Completion Despite Regulatory Hurdles and Valuation Issues

- Naver Financial acquires Dunamu via equity swap, making Upbit a wholly owned subsidiary to expand digital finance and crypto markets. - Dunamu's chairman becomes largest shareholder (28%), while Naver's stake dilutes to 17%, raising valuation and governance concerns. - Regulatory scrutiny focuses on antitrust risks as Upbit holds 50.6% market share, amid intensified competition from Bithumb and U.S. crypto firms. - Naver plans a won-backed stablecoin integrated into Naver Pay and explores Saudi partnersh

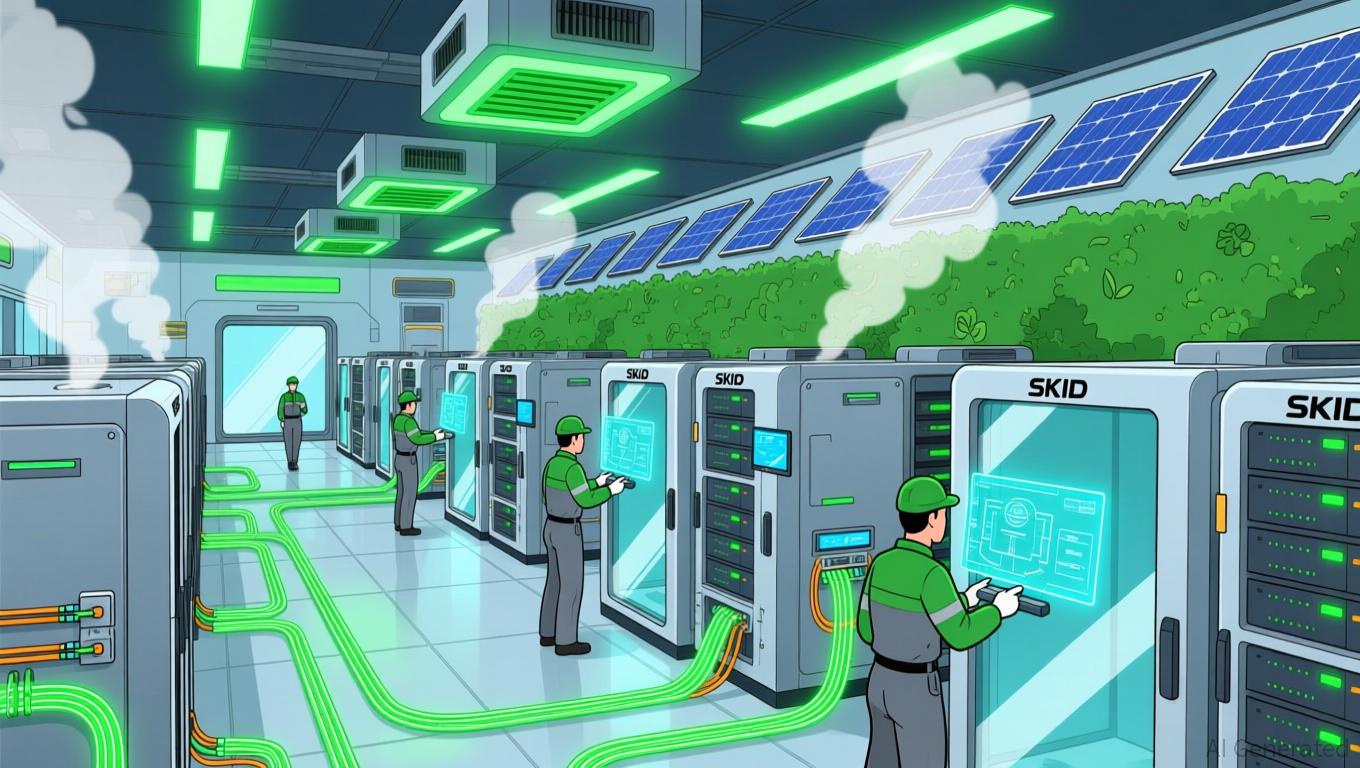

Modular Data Centers Address the Challenge of Balancing AI Performance and Environmental Responsibility

- Siemens and Delta partner to launch modular data center solutions, aiming to cut deployment time by 50%, costs by 20%, and emissions by 27%. - Standardized SKIDs and eHouses integrate power, UPS , batteries, and thermal management for rapid on-site installation. - BIM and digital twins optimize design and monitoring, targeting AI-driven EMEA/APAC markets with scalable, sustainable infrastructure. - Modular designs reduce concrete waste and enable compact power enclosures, aligning with global decarboniza

Ethereum Updates: Unknown Wallet Drains $15M in ETH While London Launches Crypto ETPs

- A mystery Ethereum wallet withdrew $15.5M worth ETH from Binance, coinciding with London's new crypto ETP listings. - 21Shares launched Ethereum/Bitcoin ETPs on LSE, offering institutional exposure to staking rewards and crypto holdings. - The withdrawal timing suggests potential capital deployment into newly approved ETPs requiring custodied crypto assets. - UK regulators approved these products, signaling growing institutional adoption of crypto-backed securities with traditional infrastructure.

Bitcoin News Update: Bitcoin Remains Steady While Altcoins Plunge Amid Market Sell-Off

- Bitcoin stabilizes near $93,555 amid market turmoil while altcoins hit multi-month lows due to $801M in 24-hour liquidations. - A 13-year dormant Satoshi-era wallet triggering 2% price drop and fear index hitting 14/100 heightens bearish concerns. - Cboe's perpetual-style crypto futures and global stimulus packages may reshape liquidity as Bitcoin tests $100,000 threshold. - Galaxy Digital notes algorithmic deleveraging rather than systemic weakness, with $3B in DeFi borrows signaling structural shifts.