Trader Unveils Line in the Sand Price Level for Ethereum, Predicts Crypto Rallies in Coming Weeks

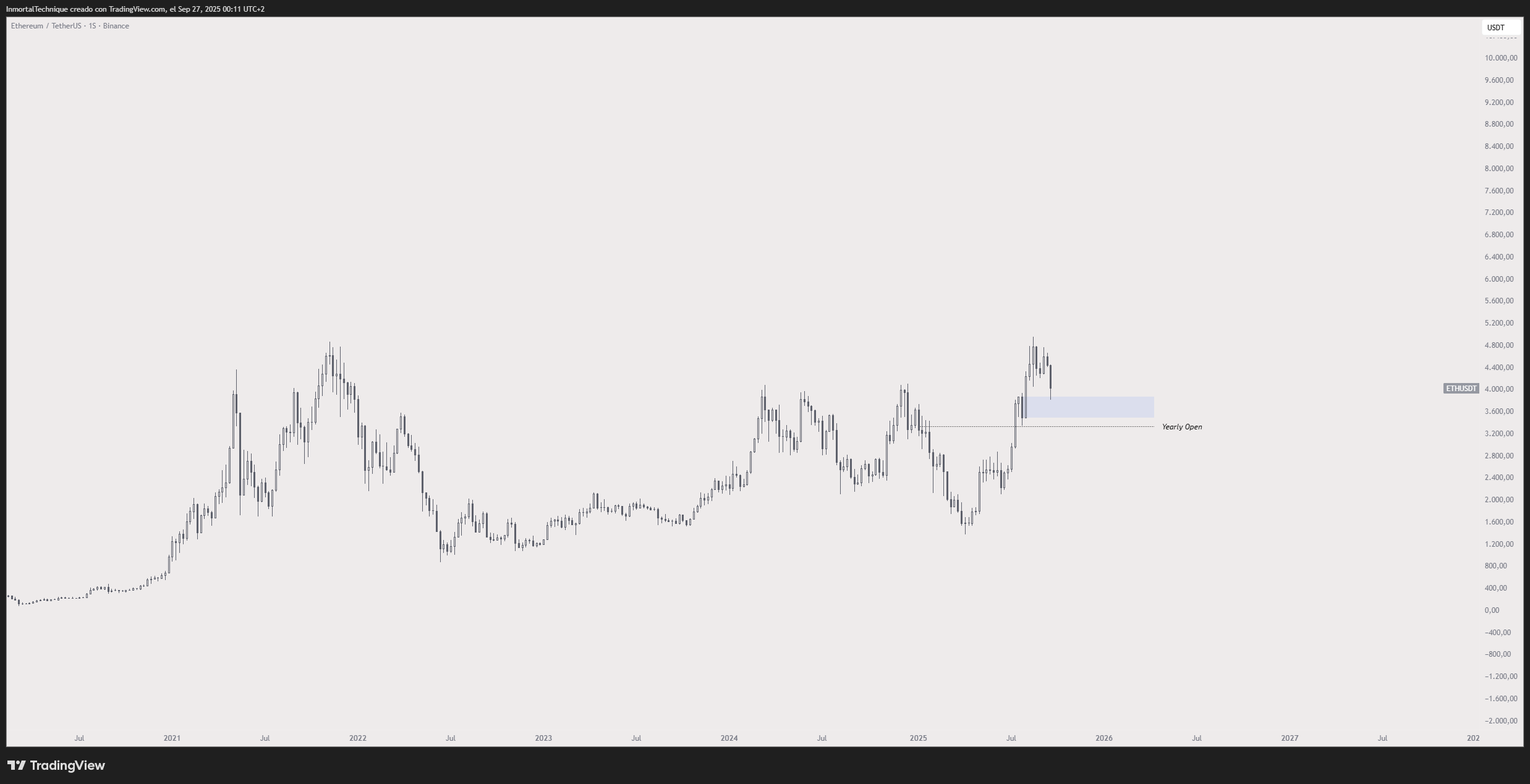

A closely followed crypto trader believes that Ethereum (ETH) bulls should defend a crucial price area to keep its uptrend alive.

Pseudonymous analyst Inmortal tells his 235,500 followers on X that Ethereum needs to stay above its 2025 opening price to sustain its long-term bullish momentum.

“Testing weekly demand.

2025 Open at $3,300 is the line in the sand.”

At time of writing, Ethereum is worth $4,021.

Despite calls that the bull market top is in for crypto, Inmortal believes that the market will soar to greater heights in the next three months.

“Bull market is not over… I don’t know where it will bounce or how much it will retrace. I just know two things. It’s not over. Prices will be higher in Q4.”

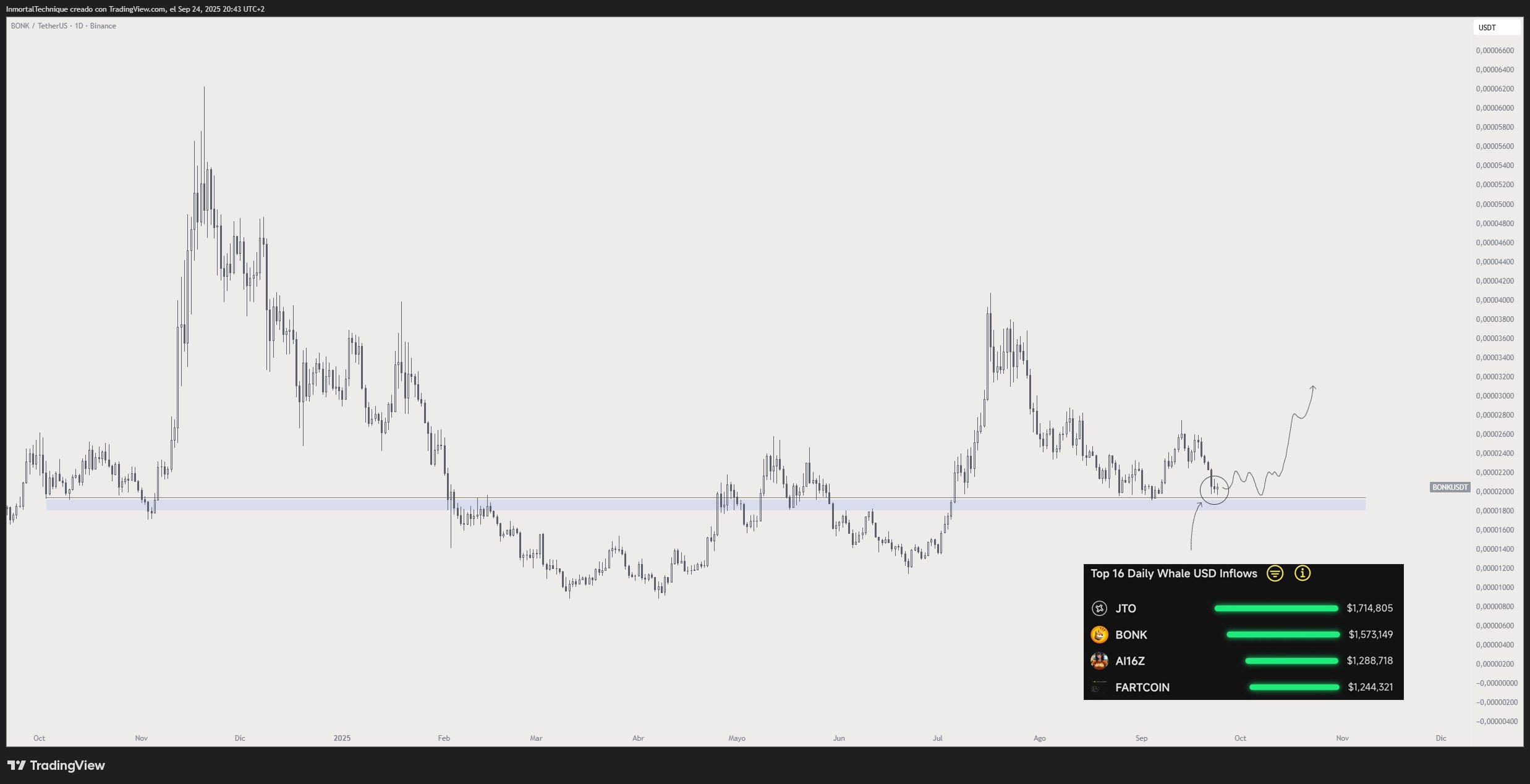

Looking at the altcoin market, the trader predicts that the meme token Bonk (BONK) will surge as long as it stays above $0.000018. He also notes that crypto whales have been accumulating BONK over the past few weeks.

“Checking top memecoins whale inflows. I feel like they know something I don’t…”

At time of writing, BONK is trading at $0.000019.

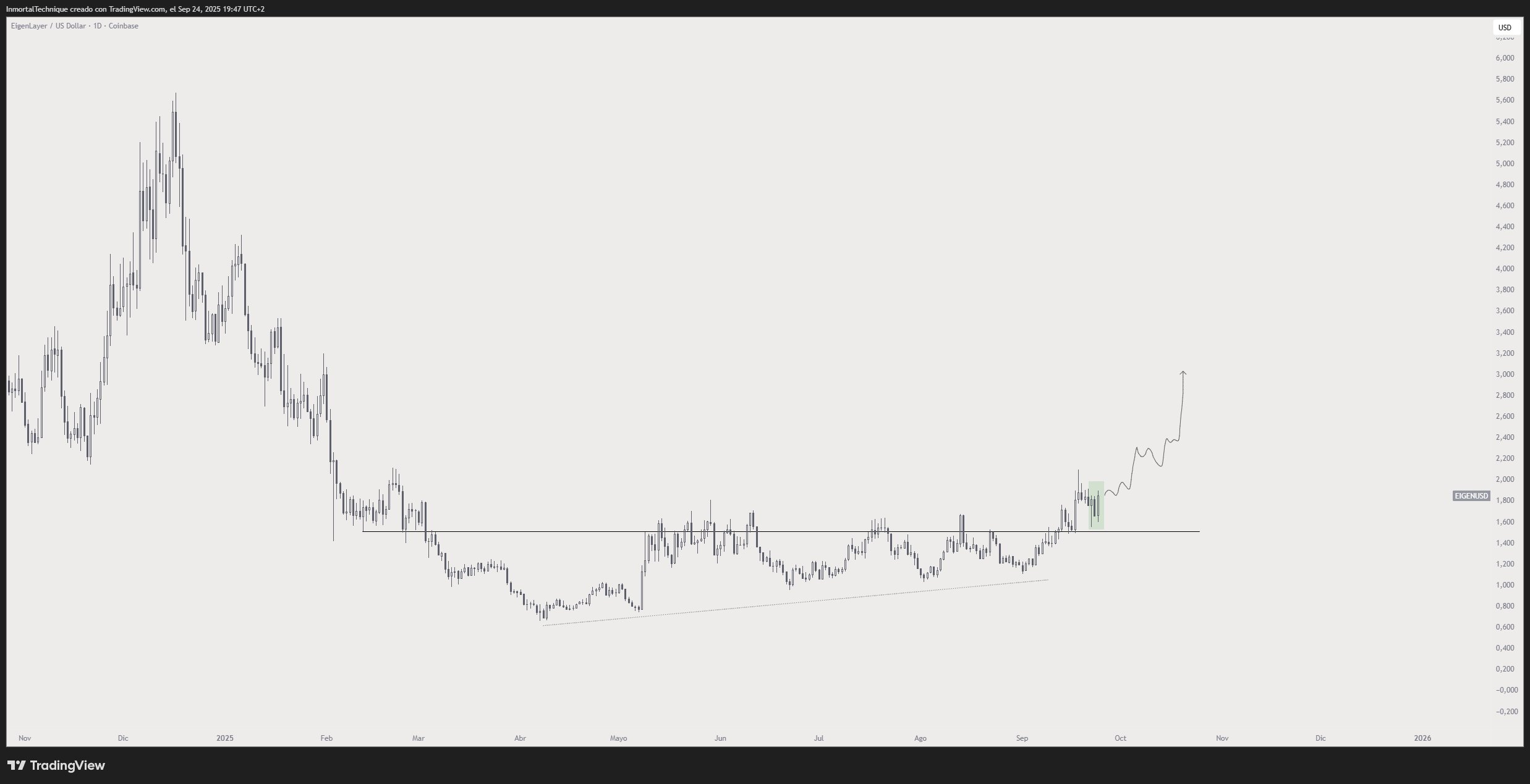

The trader is also bullish on EigenCloud (EIGEN), a platform that aims to bring “verifiability as a service” to both on-chain and off-chain applications. Inmortal appears to be targeting $3 for EIGEN based on its technical and fundamental setups.

“1. Institutions like the verifiable cloud.

2. Web3 arm of Japan’s largest telecom is joining Eigen.

3. EIGEN price action says it all.

Today’s daily candle engulfing the previous one is very telling.”

At time of writing, EIGEN is worth $1.89, up over 7% on the day.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: IMF Cautions That Tokenized Markets Could Face Collapse Without International Cooperation

- IMF warns tokenized markets risk destabilizing flash crashes due to rapid growth and interconnected smart contracts. - XRP highlighted as potential cross-border payment solution but not endorsed, alongside Stellar and Bitcoin-Lightning hybrid models. - Global regulators intensify oversight of tokenized assets, with ESMA, SEC, and central banks addressing governance and liquidity risks. - IMF stresses urgent need for coordinated policy frameworks to prevent fragmentation and systemic vulnerabilities in ev

Solana News Today: Avail's Nexus Mainnet: A Borderless Blockchain Ecosystem

- Avail launches Nexus Mainnet, a cross-chain infrastructure unifying liquidity across Ethereum , Solana , and EVM-compatible chains. - The platform uses intent-solver architecture and Avail DA verification to replace bridges, enabling seamless asset movement and shared liquidity. - Integrations with major chains and partners like Lens Protocol aim to streamline DeFi and trading, while $AVAIL token coordinates cross-chain transactions. - With Infinity Blocks targeting 10 GB blocks, Nexus addresses liquidit

Cardano News Today: ETFs Turn to Alternative Coins While ADA Stumbles and XLM Gains Momentum with ISO Compliance

- Franklin ETF expands holdings to include ADA , XLM, XRP , and others, reflecting institutional altcoin diversification driven by ISO 20022 compliance and SEC-approved rules. - Cardano faces short-term bearish pressure with 31% monthly decline, contrasting Stellar's bullish 2025/2030 price projections ($1.29–$6.19) fueled by RWA and cross-border payment demand. - ISO 20022 adoption (97% payment instructions) positions ADA/XLM as bridges between DeFi and traditional finance, with Ripple's ILP enhancing XLM

AI Crypto Faces a Pivotal Turn: Regulatory Demands Surpass Aspirations in 2025