Solana emerges as institutional hub for RWAs: RedStone Report

A report by RedStone highlights how Solana is becoming the backbone of the blockchain infrastructure for capital markets.

- Solana holds $700 million in RWAs and $13.5 billion including stablecoins

- Network performance is a key driver of Solana’s growing dominance in the sector

- BlackRock, Apollo Global, Janus Henderson, and VanEck are among the big-name adopters

Solana ( SOL ) is emerging as the blockchain backbone of capital markets, capturing a major share of real-world asset tokenization. On Monday, September 29, blockchain oracle network RedStone published a report detailing Solana’s increasing dominance in RWAs.

According to the report, Solana hosts $700 million in RWA assets, and over $13.5 billion if including stablecoins. The RWA figure grew by more than 500% year over year, making Solana one of the largest networks for tokenized assets.

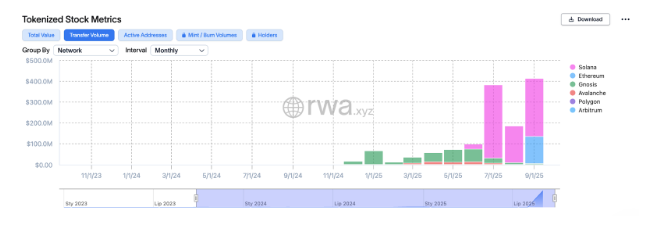

Tokenized stock transfer volumes on Solana compared to other major chains | Source: rwa.xyz

Tokenized stock transfer volumes on Solana compared to other major chains | Source: rwa.xyz

For instance, following the xStocks integration with the network, Solana (SOL) trading volumes for tokenized equities quickly surpassed those for Ethereum. This acceleration benefited from partnerships with exchanges such as Kraken , which aim to enable fast and low-cost transfers for their users.

Solana dominates through performance

RedStone’s report highlights Solana’s performance as one of the main reasons for its dominance in asset tokenization. According to the report, institutional investors rely on high throughput for their RWA applications. Solana, which boasts a capacity to handle up to 100,000 TPS, is a natural choice for many.

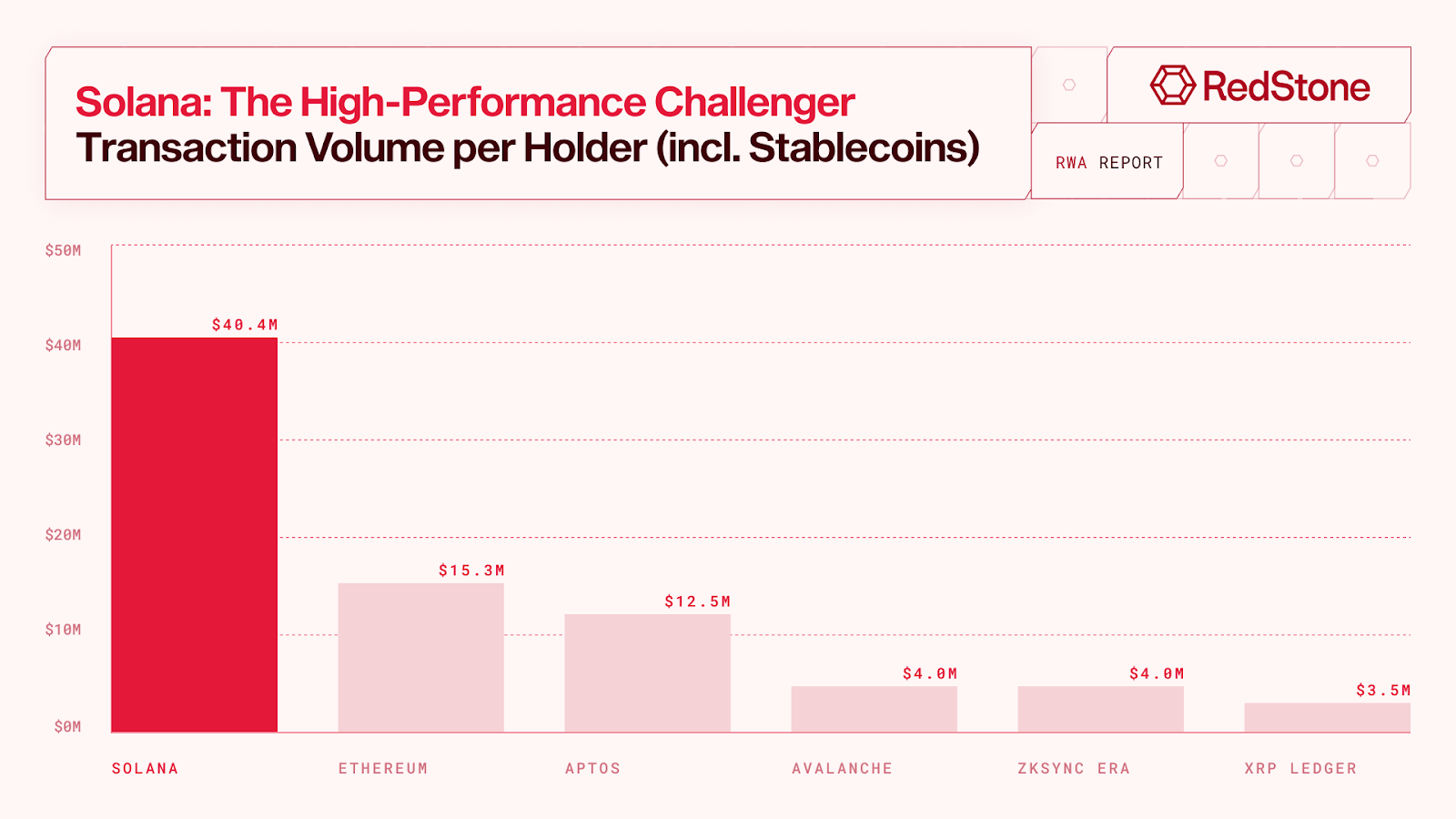

Transaction volume per RWA address on major chains as of June 2025 | Source: RedStone

Transaction volume per RWA address on major chains as of June 2025 | Source: RedStone

“For RWAs, there are really only 2 places: It’s either Ethereum or Solana,” said Robert Leshner, CEO of the tokenization platforms Superstate.

This performance has attracted big names to the network, including BlackRock, Apollo Global, Janus Henderson, and VanEck. Moreover, Solana also hosts popular applications like Phantom, Raydium, Jupiter, and Pump.fun, demonstrating its appeal among retail users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating How Vitalik Buterin's Advancements in ZK Technology Are Shaping Blockchain Investment Trends

- Vitalik Buterin's GKR protocol boosts Ethereum's scalability, enabling 43,000 TPS via ZK computation. - Institutional adoption accelerates with ZK-based compliance solutions, attracting BlackRock and Deutsche Bank partnerships. - ZK startups like zkSync and StarkNet secure $55M+ in funding, with market caps surging as infrastructure matures. - Investors target ZK-EVM compatible projects and hybrid models, aligning with Ethereum's 2026 roadmap.

ZK Technology's 2025 Price Increase: Sustained Value Driven by Blockchain Integration and Growing Institutional Engagement

- ZK technology's 2025 price surge stems from on-chain adoption and institutional investments, signaling a structural market shift. - ZK rollups now process 15,000 TPS with $3.3B TVL, driven by infrastructure upgrades and 230% developer engagement growth. - 35+ institutions including Goldman Sachs deploy ZKsync for confidential transactions, while Nike/Sony adopt it for supply-chain transparency. - Market fundamentals project 22.1% CAGR to $7.59B by 2033, validating ZK as blockchain's foundational infrastr

DASH Experiences 150% Price Jump and Growing Institutional Interest: Examining Blockchain’s Strength During Economic Uncertainty

- DASH surged 150% in June 2025 driven by tech upgrades, institutional interest, and favorable policies. - Platform 2.0 enhanced scalability and token support, positioning DASH as a competitive blockchain platform. - Institutional adoption grew in 2025 Q3-Q4 via merchant integrations in emerging markets and decentralized governance. - Macroeconomic factors like Fed policies and M2 growth boosted liquidity, while volatility persisted due to tightening markets. - Future growth depends on 2026 regulatory clar

The Increasing Importance of Stablecoins in Institutional Investment Strategies

- In 2025, U.S. GENIUS Act and EU MiCA regulations drove institutional adoption of USDC as a compliant, transparent stablecoin. - USDC's 98% U.S. Treasury-backed reserves and monthly audits made it preferred over USDT for regulated entities. - Institutions used USDC to reduce settlement delays by 35% and improve Sharpe ratios by 12% through yield-generating strategies. - With $73.7B circulation and $140B Q3 transaction volume, USDC became a 24/7 global liquidity tool for emerging markets.