South Korea's leading shared power bank service, Piggycell: Driving Global Expansion through Blockchain

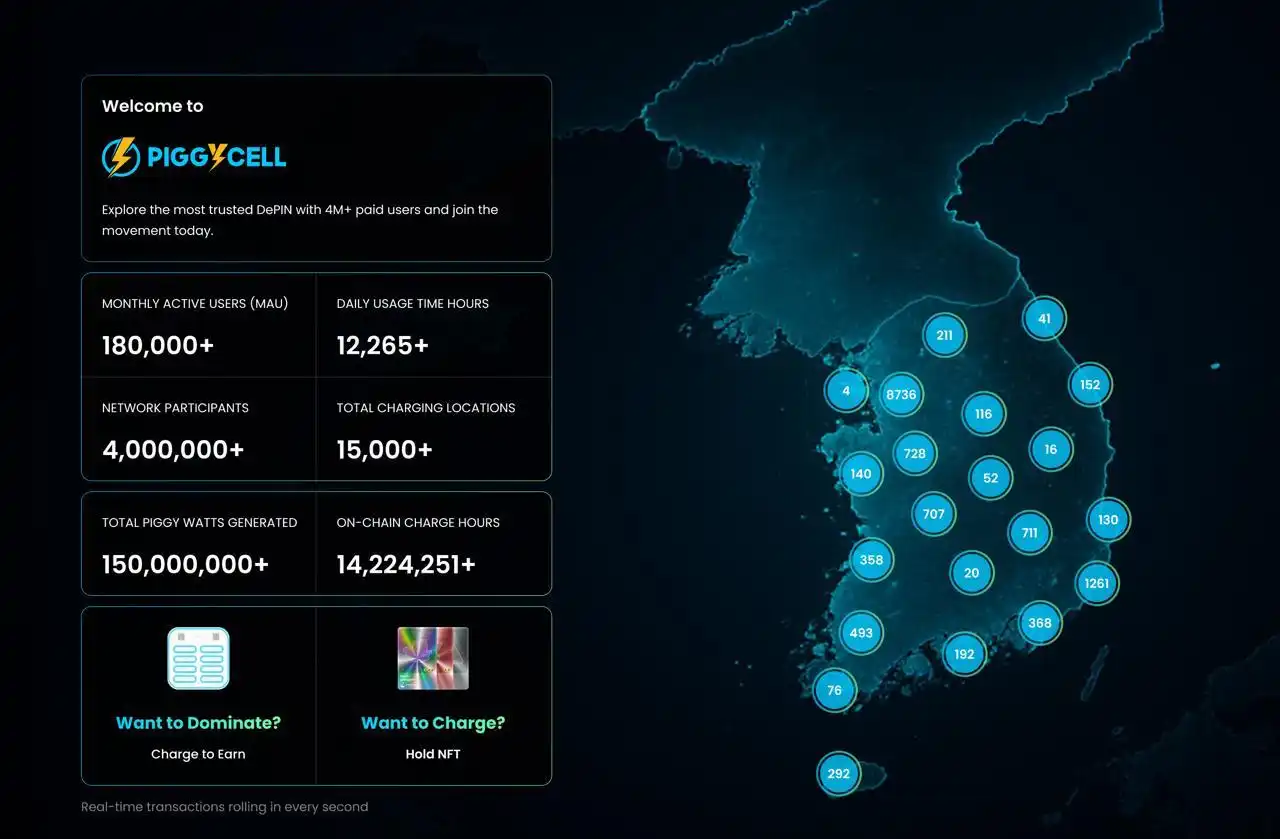

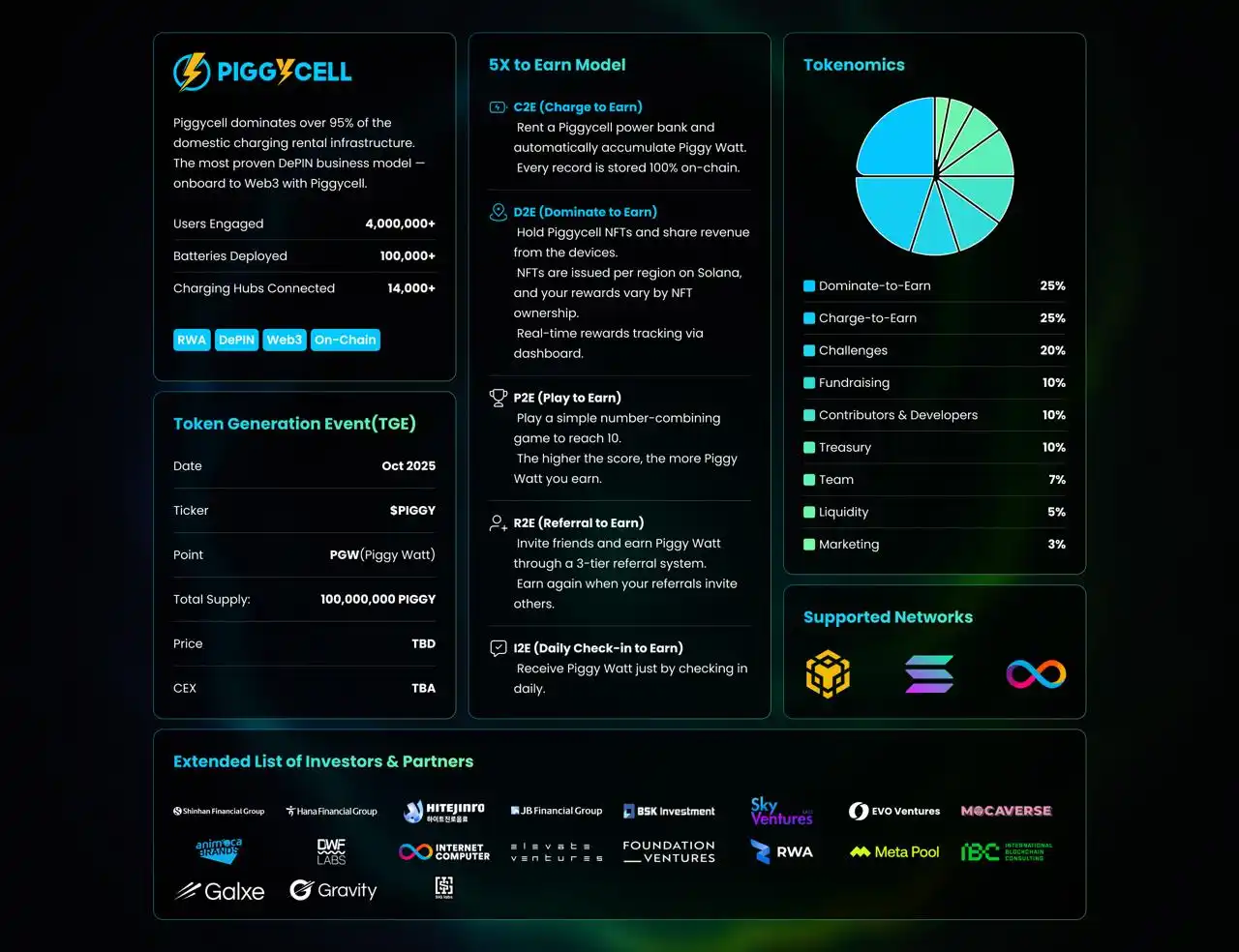

1. Piggycell is the leading company in the South Korean shared power bank market, with a 95% market share, over 14,000 stations, and more than 4 million users. 2. Piggycell utilizes the DePIN + RWA model to transform charging devices into on-chain assets, enabling automatic yield distribution. The core gameplay includes Charge-to-Earn, Occupy-to-Earn, and Challenge-to-Earn. 3. Piggycell has secured a $10 million seed funding round from investors including Animoca Brands, ICP Hubs, and DWF Labs, and receive

Source: Piggycell

South Korea's Leading Shared Power Bank Provider Piggycell: Driving Global Expansion with Blockchain

In South Korea, when it comes to borrowing a power bank on the go, most people turn to Piggycell. This well-established company has captured a 95% market share, with 14,000+ locations and over 4 million users, nearly monopolizing the South Korean shared charging market. Recently, Piggycell has also successfully attracted a new $11 million investment round, which includes participation from large South Korean corporations and banks.

Bringing a Mature Offline Network onto the Chain

Utilizing the DePIN + RWA model, Piggycell has transformed mobile power banks, shared charging stations, and other charging devices into measurable, settleable, and tradable on-chain assets.

Users do not need to understand complex blockchain processes; they simply rent a power bank as usual, and the backend automatically handles profit distribution.

Three Core Gameplay Mechanics that are Intuitive and Easy to Understand:

Charge-to-Earn: Earn token rewards through charging;

Occupy-to-Earn: Hold device NFTs and receive a share based on actual usage;

Challenge-to-Earn: Complete tasks to receive additional incentives.

This model integrates ownership, profit-sharing, and community participation, allowing users to not only be one-time consumers but also directly engage in real cash flow.

Backed by Strong Capital and Data

Piggycell is not concept-driven but is an upgraded solution built on real business and cash flow:

Has received a $10 million seed round investment, with investors including Animoca Brands, ICP Hubs, and DWF Labs;

Operates over 100,000 high-quality batteries and 14,000+ offline service stations;

Annual revenue has been stably above $20 million, validating the sustainability of the business model;

In its latest funding round, received a total of $11 million in support from large South Korean corporations and banks.

Key Sprint Towards TGE

Piggycell has set a clear target to launch its TGE in Q4 of 2025 and plans to debut on a tier-one exchange in mid-October. Currently, the final round of community task activities before the TGE is taking place on the Galxe platform, providing a pre-participation opportunity for global users.

One-sentence Summary

Piggycell combines South Korea's leading shared charging network with blockchain technology, integrating real users and real-world scenarios onto the chain, and sharing the benefits with every participant.

With this step, Piggycell's story is transitioning from Korea to the global stage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Brad Garlinghouse of Ripple sees progress in US cryptocurrency bill.

Germany Pulls Troops from Greenland After US Tariff Move

Scandal in an Altcoin Project: Developers Allegedly Transferred Funds Raised to Prediction Markets – Statement Released