Trader’s $17.6 Million XRP Short Partially Liquidated Again, Total Losses Exceed $3.6 Million

Falllling’s $17.6M XRP short faced another partial liquidation, raising total losses past $3.6M. XRP’s price hovers near $2.90, leaving the remaining position close to its $2.93 liquidation level.

A prominent crypto trader known as “Falllling” has seen another partial liquidation on his reopened $17.6 million short position against XRP, pushing total losses above $3.6 million amid ongoing high-leverage gambles.

As XRP climbs to around $2.90 with a 1.5% 24-hour gain, the remaining $14.3 million position teeters near its $2.93 liquidation threshold, underscoring the trader’s persistent bearish stance in a recovering market.

Losses From Earlier High-Leverage Bets

Falllling’s latest wager follows a costly series of leveraged trades. Blockchain analytics firm Lookonchain shows that Falllling previously shorted 1,366.67 BTC—valued around $150 million at 40x leverage—and 2.78 million XRP worth roughly $7.7 million at 20x leverage.

Both trades had tight liquidation thresholds: $110,280 for Bitcoin and $3.0665 for XRP. When prices moved higher over the weekend, the trader closed both positions at a loss, incurring an estimated $3.4 million setback.

Gambler 's short was partially liquidated again, and the total loss has now exceeded $3.6M!

— Lookonchain September 30, 2025

Despite these losses, XRP climbed 2% in the last 24 hours, trading above $2.80. The rally forced many short sellers to cover positions, while the broader crypto market showed modest recovery.

New $17.6M Short Position

Undeterred, Falllling opened a new high-stakes short on 6.17 million XRP, valued at roughly $17.6 million using 20x leverage. After another partial liquidation, the position dropped to 4.98 million XRP, now valued at $14.3 million.

The liquidation level sits at $2.93—just above the current market price of $2.90. This narrow margin leaves little room for error. On-chain data shows the position already has a paper loss of around $121,000.

Any upward move beyond $2.93 would wipe out the position, while a sharp decline could generate significant gains. Analysts warn that high-leverage strategies can quickly amplify both gains and losses, especially when liquidation levels are close to spot prices.

Broader Market Liquidations

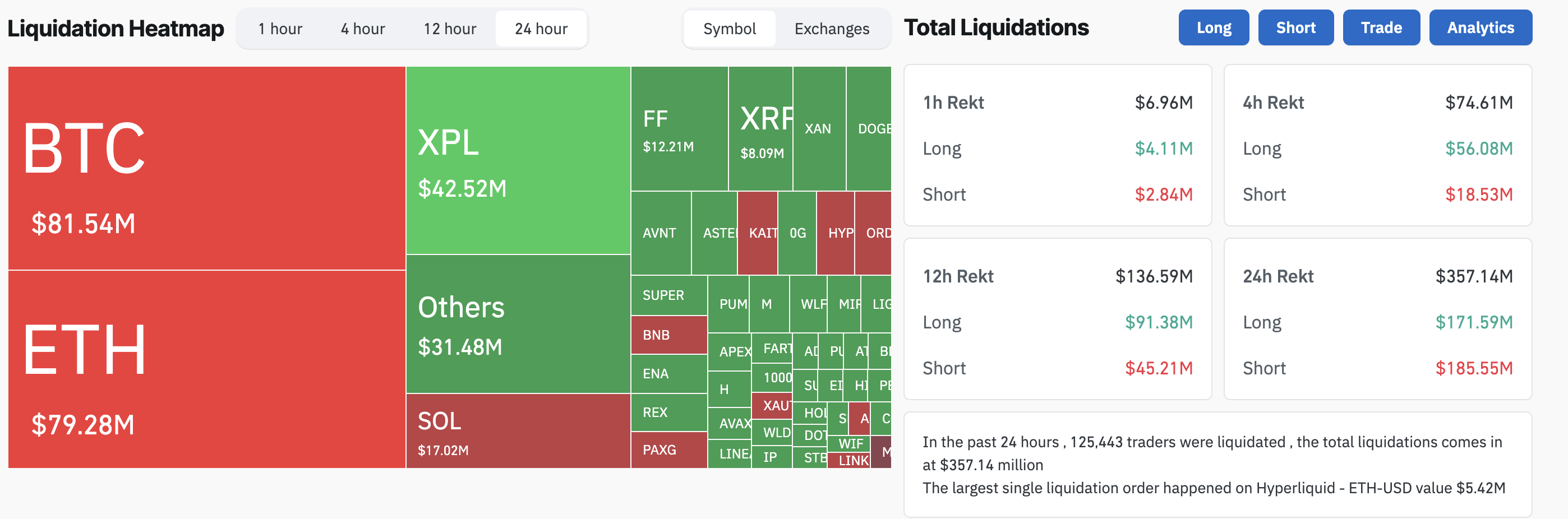

The weekend’s rally sparked liquidations across major cryptocurrencies. According to data, about $357.14 million in positions were liquidated within 24 hours, with short positions accounting for $185.55 million. Bitcoin led the market with $81.54 million in liquidations, while XRP accounted for $8.09 million.

Analysts warn that if XRP rises to $2.93—slightly above Falllling’s liquidation point—nearly $44 million in XRP shorts could be forced to close. The trader’s decision underscores ongoing skepticism from some market participants, even as prices stabilize and sentiment across the digital-asset sector improves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Realizing PoS Capabilities: Authorities Approve Staking for ETPs

- U.S. Treasury and IRS issued guidance allowing crypto ETPs to stake Ethereum and Solana without regulatory risks, advancing PoS blockchain adoption. - Framework requires ETPs to hold single PoS assets, use qualified custodians, and maintain liquidity for redemptions during staking. - Staking yields (1.8-8% annually) now accessible to retail investors via compliant ETPs, with rewards taxed as income at receipt. - Industry leaders called the move transformative, removing legal barriers for fund sponsors wh

SI-BONE's innovative approach fuels both EBITDA gains and increased revenue

- SI-BONE reported Q3 2025 adjusted EBITDA of $2. 3M and raised full-year revenue guidance to $198M–$200M. - Gross margin expanded to 79.8%, while operating losses narrowed by 29.5% despite 11.9% higher operating expenses. - Cash reserves remained stable at $145.7M, with CEO citing growth from minimally invasive solutions and global expansion. - Analysts highlight innovation and expanded indications as key drivers for future orthopedic market share gains.

Ethereum Updates: Treasury's Staking Safe Harbor Redefines Institutional Approaches to Crypto

- U.S. Treasury and IRS issued 2025 guidance allowing crypto ETFs to stake assets, accelerating adoption of proof-of-stake blockchains like Ethereum and Solana . - Solana ETFs (BSOL, GSOL) attracted $659M in inflows, contrasting with $2.7B outflows from Bitcoin and Ethereum funds amid bearish price trends. - Institutional staking yields ($100M+ annualized for Ethereum) and ETF inflows signal maturing crypto markets, with technical indicators hinting at potential Q4 recovery. - Regulatory clarity on staking

Ethereum News Update: Regulatory Green Light for Staking—US Approves Crypto ETFs Offering 7% Returns

- U.S. Treasury and IRS issued guidance enabling crypto ETFs/trusts to stake assets and distribute rewards, resolving regulatory uncertainties. - The "safe harbor" framework requires single-asset PoS custody, liquidity protocols, and prohibits non-staking activities to avoid securities law violations. - Staking rewards are now taxable income for trusts, boosting yields up to 7% and accelerating institutional adoption of Ethereum/Solana networks. - Industry experts call it a "game changer," removing legal b