Quant Analyst PlanB Says Bitcoin Now at Point of ‘No Return,’ Similar to 2020, 2017 and 2013 Bull Markets

A popular crypto analyst thinks the Bitcoin ( BTC ) bull market isn’t over yet.

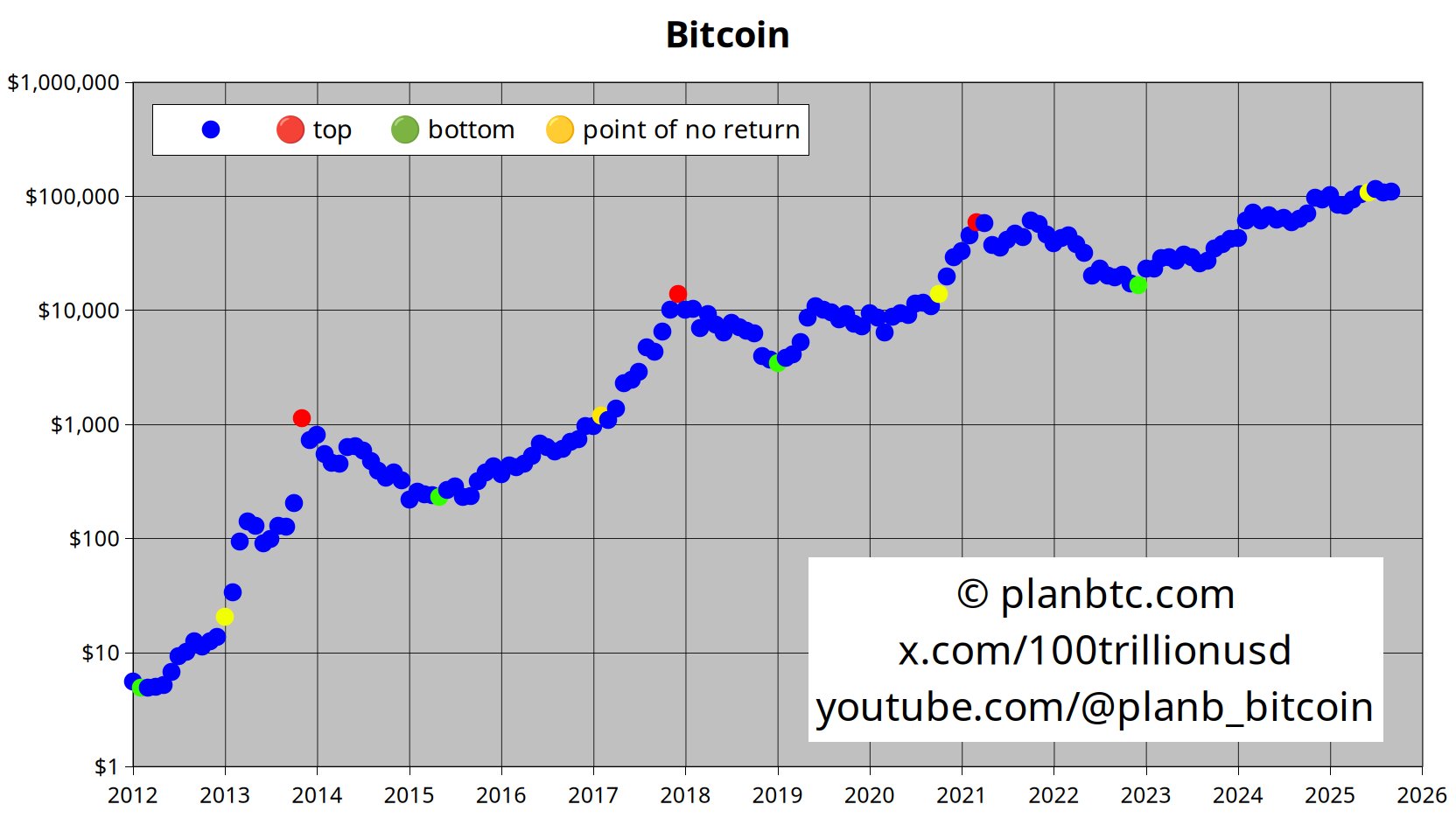

The pseudonymous trader PlanB tells his 2.1 million X followers that BTC has passed the “point of no return.”

“I think [the] Bitcoin bull market has not ended and will continue. I don’t know until when, or how high. It could also be a long, steady uptrend, without FOMO+crash. IMO, we passed the point of no return (yellow dots) in June 2025, similar to October 2020, February 2017 and January 2013.”

Source: PlanB/X

Source: PlanB/X

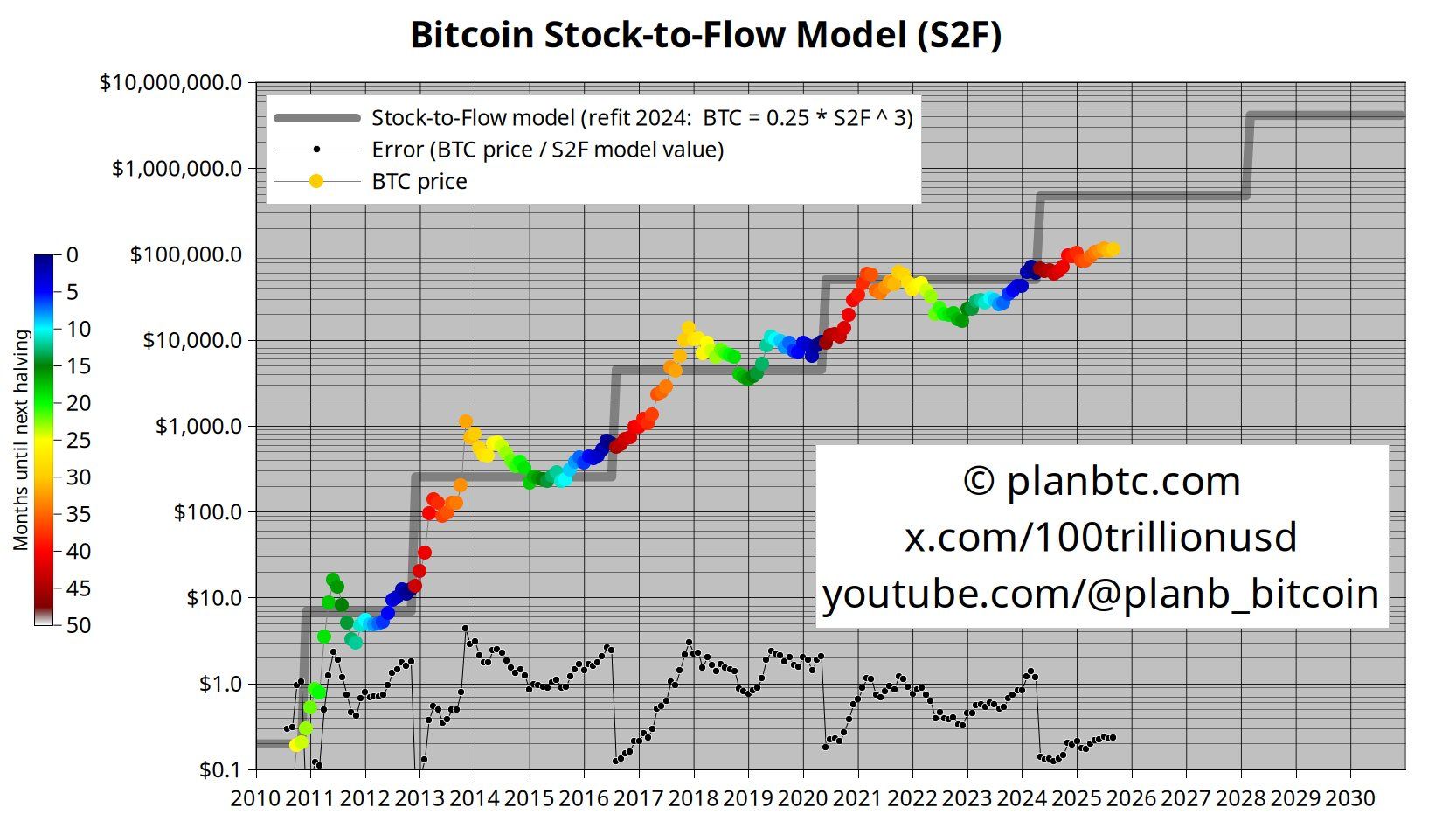

PlanB also shares a graph of the stock-to-flow model, a predictive tool that assumes the scarcity of a commodity drives its price.

“Whether you like it or not, Bitcoin’s value is very much linked to its scarcity. Fiat will be printed, Bitcoin will rise.”

Source: PlanB/X

Source: PlanB/X

While the stock-to-flow model was originally created to track traditional commodities, PlanB was one of the first analysts to apply it to Bitcoin.

Earlier this month, the crypto analyst argued that all asset prices – including gold, BTC, and the S&P 500 – have been rising during the last decade due to the Fed printing money.

“How will there be diminishing returns when debasement is exponential? All asset prices increased exponentially last 10 years (driven by money printing): -Gold 3x (~$1,000 to ~$3,000) -S&P 3x (~$2,000 to ~$6,000) -Bitcoin 250x (~$400 to ~$100,000). In my opinion, it is a unit of account phenomenon.”

BTC is trading at $114,471 at time of writing. The top-ranked crypto asset by market cap is up nearly 2% in the past 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH Aster DEX Listing: Driving On-Chain Advancement and Expanding DeFi Market Reach

- DASH's listing on Aster DEX marks a pivotal DeFi 2.0 milestone, leveraging hybrid AMM-CEX models and multi-chain interoperability to enhance liquidity and privacy. - Aster DEX processes 10,000 TPS with ZKP privacy for 77% of trades, achieving $1.399B TVL and $27.7B daily volume by Q3 2025, surpassing competitors like Hyperliquid. - DASH's 5x leverage perpetual futures on Aster drove 1,650% ASTER token price growth post-TGE, with Q4 2025 trading volume surging 114.5% to $781.43M. - Strategic partnerships

XRP Eyes $2.75 Breakout as BTC Dominance Dips – Bullish Setup Loading

Quick Take Summary is AI generated, newsroom reviewed. XRP closes with a strong bullish daily candle, reinforcing upward momentum. Analysts project a move toward the $2.75 resistance if Bitcoin continues rising. XRP trades around $2.15–$2.20, reflecting a 6% rebound that supports bullish continuation. Lower-timeframe charts show scalp setups forming, though confirmation remains essential.References X Post Reference

ETH Traders Turn Bold as $6,500 Calls Take Over Deribit

Quick Take Summary is AI generated, newsroom reviewed. Traders push $6,500 ETH calls to $380M in open interest Strong clusters form at $4K, $5.5K, and $6K call strikes Market confidence rises despite a 26% quarterly ETH drop ETH price outlook strengthens as crypto market sentiment turns bullishReferences 🚨DERIBIT TRADERS CALL FOR $6,500 ETH! The $6.5K strike leads with $380 MILLION in open interest, with $4K, $5.5K and $6K calls also active. Despite a 26% quarterly drop, BIG REBOUND bets are in

Crypto Market Ignites as Bitcoin and SUI Drive Massive Trading Activity