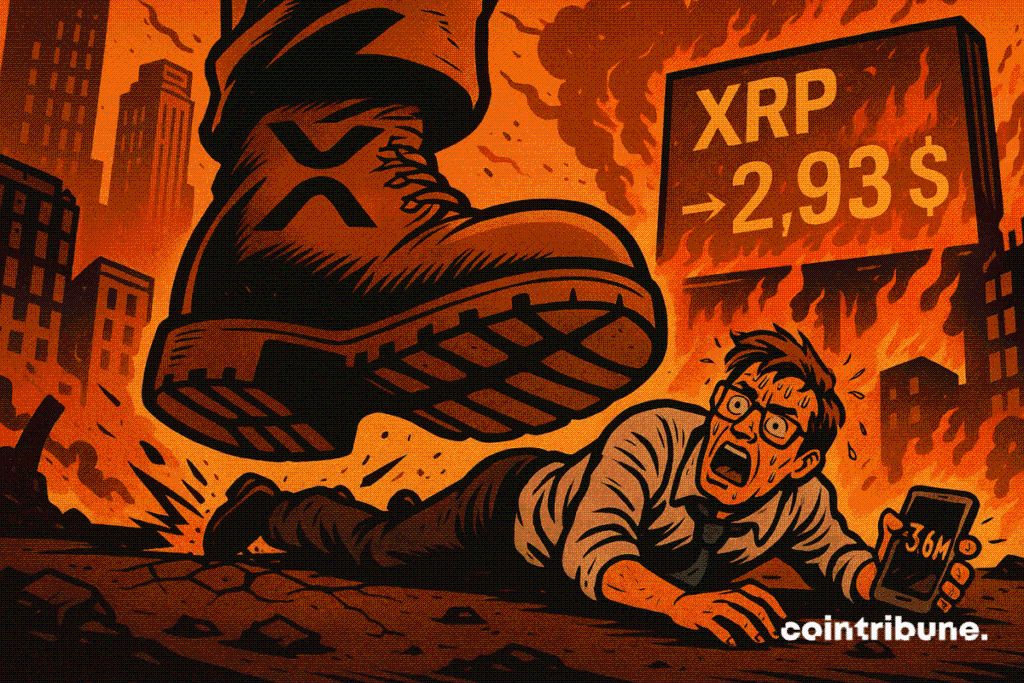

This Trader’s $3.6M XRP Short Is Hanging by a Thread

In the crypto jungle, success is not always guaranteed. One day, you accumulate wins, euphoric. The next day, it’s a cold shower, your portfolio is in tatters. This is exactly what a certain @qwatio, also known as Falllling, is experiencing. He has just surpassed 3.6 million dollars in losses by betting against XRP. And yet, he continues. His latest short is hanging just a few cents from liquidation. Suspended, literally.

In brief

- Trader @qwatio accumulates $3.6M losses on high-leverage crypto positions.

- He maintains a 20× XRP short near a liquidation threshold set at $2.93.

- A $0.07 rise could trigger a full liquidation and a massive short squeeze.

- The market watches his stubbornness, between fascination for risk and lessons in extreme trading.

This crypto bettor doesn’t give up, despite $3.6M lost

This is no longer trading, it’s a duel. Despite colossal losses, @qwatio keeps shorting XRP.

The numbers are dizzying. He shorted 1,366.67 BTC at 40× and 2.78 million XRP at 20×, liquidated above $110,280 and $3.0665 respectively. Result: $3.6M in losses . He is following up with a new position of 6.17M XRP (≈ $17.6M) at 20× leverage. As soon as the XRP price approaches $2.9155, his position shakes.

He doesn’t relent. Even after a partial liquidation, he remains exposed to $14.3M on 4.98M XRP. XRP hovers around $2.90. Needless to say, the slightest upward wave is enough to take him out.

No stop-loss. No plan B. Just the conviction that it will go down.

XRP, the short seller trap that nobody seems to avoid

XRP attracts short sellers like mosquitoes to light. It is liquid, volatile, and offers a perfect ground for those who like to play it tight. But by playing with fire, some seriously get burned.

A slight shiver in the market, and a whole house of cards threatens to collapse. If the XRP price crosses the $2.93 mark, platforms could liquidate up to 44 million dollars in short positions, in a brutal automatic chain reaction. This type of cascade trigger — called a short squeeze — is unforgiving: it forces short sellers to urgently buy back, pushing the price even higher. It is a trap feared even by the most seasoned.

And in this case, the thresholds are so tight that the slightest movement acts like a detonation.

Here are the facts that make people tremble:

- $3.6M: cumulative losses of the trader on his XRP and BTC shorts;

- $2.9155: liquidation threshold of his large position;

- 555,555 XRP: new short opened after losses, at 20×;

- $0.07: variation sufficient to trigger a new liquidation;

- 115.92%: margin used according to Hypercan.

His behavior borders on obsession. He created a new wallet (0x9018), injected 4.22M USDC, and restarted the machine. Observers no longer see a strategy but a form of addiction disguised by the word “conviction.”

Even the greats make mistakes. Billionaire James Wynn also experienced a setback with bitcoin. To bounce back, he bet everything on the ASTER airdrop , hoping to turn this drop into a jackpot. A new bet. A new chance?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Major Institutions Wager on Bitcoin’s Long-Term Potential as Expectations of Fed Rate Cuts Drive Surge to $93K

- Bitcoin surged to $93,000 on Nov 25, 2025, driven by 85% odds of a Fed 25-basis-point rate cut in December. - XRP rose 11% and Ethereum hit $2,900 as improved liquidity and macro sentiment fueled crypto optimism ahead of the Fed's Dec 10 meeting. - Institutional demand grew with Texas and Harvard investing in Bitcoin ETFs, while Abu Dhabi tripled its ETF holdings to $517.6 million. - Risks persist: ETF outflows, leveraged fund liquidations, and regulatory uncertainties offset gains, with derivatives posi

Ethereum Updates Today: MegaETH's $1 Billion Funding Failure Highlights Blockchain Scaling Challenges

- MegaETH canceled its $1B fundraising after technical failures caused unintended deposits and operational chaos during the pre-deposit phase. - KYC system errors and premature execution of a multisig transaction led to $500M in deposits, forcing the team to freeze the raise and abandon expansion plans. - Critics highlighted preventable engineering flaws, with 259 duplicate addresses raising concerns about bot activity and unfair allocation practices. - Despite backing from Vitalik Buterin and Joe Lubin, t

Ethereum News Update: Canton’s Privacy-Centric Approach Attracts Institutions Away from Public Blockchains

- Canton Network's tokenomics strategy prioritizes institutional adoption by avoiding ICOs and focusing on privacy and interoperability. - Its "need-to-know" privacy model enables regulated access to transaction data, aligning with KYC/AML frameworks while maintaining confidentiality. - Institutional backing, including $135M funding and Goldman Sachs integration, highlights Canton's appeal for enterprise blockchain solutions. - Canton's RWA TVL ($96 per $1 cap) outperforms Ethereum ($0.03), emphasizing its

Hyperliquid News Today: SEC Approval Ignites Triple Crypto Rally: ETFs, Cross-Chain Bridges, and Retail Frenzy

- Institutional investors are accelerating crypto adoption via Avalanche-based ETFs, with Bitwise’s 0.34% fee BAVA ETF offering staking yields and cost advantages over competitors. - Avail’s Nexus Mainnet bridges Ethereum and Solana ecosystems, streamlining cross-chain liquidity and reducing fragmentation through a unified network. - Retail hype drives Apeing’s presale as a potential 100x opportunity, leveraging meme coin dynamics and FOMO to attract speculative traders. - SEC’s evolving regulations and in