Is ZORA done? 4.8% token unlock hits this month as ZORA price languishes in downtrend

ZORA faces its first major vesting unlock on Oct. 23, putting fresh pressure on ZORA price as the token is already locked in a downtrend.

- 166.7M ZORA (~4.76% of supply) will be released to Treasury, Investors, and Team wallets in October.

- ZORA price is trending in a downward channel, risking decline toward $0.035.

The Zora ( ZORA ) token is set to experience its first major vesting unlock since its TGE on April 23 . On Oct. 23, approximately 166.67 million ZORA tokens, representing 4.76% of the circulating supply, will be released into the market, according to Tokenomist .

This unlock will distribute:

- Treasury: 41.67M ZORA (~$1.98M)

- Investors: 72.5M ZORA (~$3.44M)

- Team: 52.5M ZORA (~$2.49M)

After this first major unlock in October, the supply will begin to grow consistently month by month, following the structured vesting curve laid out in the tokenomics . The monthly releases will primarily flow to the Team, Investors, and Treasury, each unlocking according to their schedules.

Will ZORA price withstand the upcoming unlock?

ZORA price is moving within a clearly defined downward channel. Except for a brief peak above the 20 SMA in mid-September, the token has been trading below it since late August, showing persistent bearish momentum.

ZORA price has also recently lost the 0.382 Fibonacci retracement level at $0.0615, which had been acting as support until about a week ago. This breakdown increases the probability of further downside, with the next support zone likely around the lower boundary of the descending channel near $0.035.

Source: TradingView

Source: TradingView

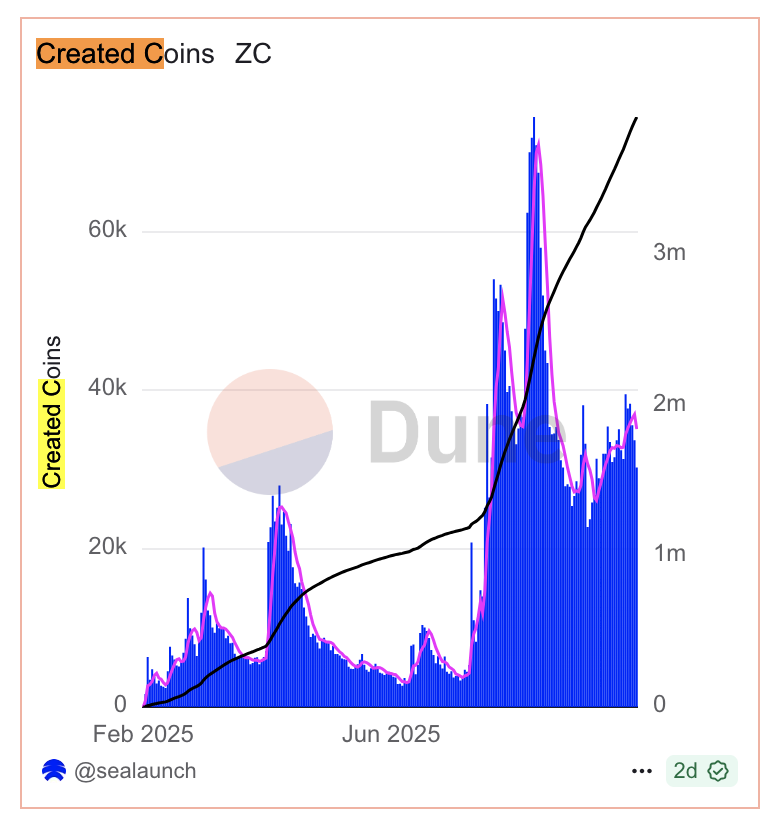

ZORA token gets a boost every time ecosystem activity surges, particularly through the creation of new Zora creator coins . According to SeaLaunch’s Dune dashboard , more than 3.9 million creator coins have already been launched since February. Despite fluctuations, the cumulative trend (the black line in the graph below) continues to climb steadily.

However, while coin creation is robust, the real question is whether trading volume and user participation keep pace with supply expansion. If daily activity and liquidity broaden across the ecosystem, ZORA could absorb the October unlock without catastrophic downside. But if user growth stagnates, the dilution from ~166.7M new tokens entering circulation will likely outweigh demand, reinforcing the bearish technical outlook.

Source: DuneAnalytics

Source: DuneAnalytics

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea plans talks with US to exempt Samsung, SK Hynix from Trump’s 25% chip tariffs

Ethereum : Buterin reveals major upcoming reforms

Samsung set to hand out record bonuses as AI boom translates into profits

Bitcoin Gains Traction As ETF Demand Surges