Crypto Trader Says One Indicator Pointing to $139,000 Bitcoin Next, Outlines Path Forward for XRP, Solana and Chainlink

Cryptocurrency analyst and trader Ali Martinez says one indicator is signaling Bitcoin ( BTC ) will soon reach new all-time highs.

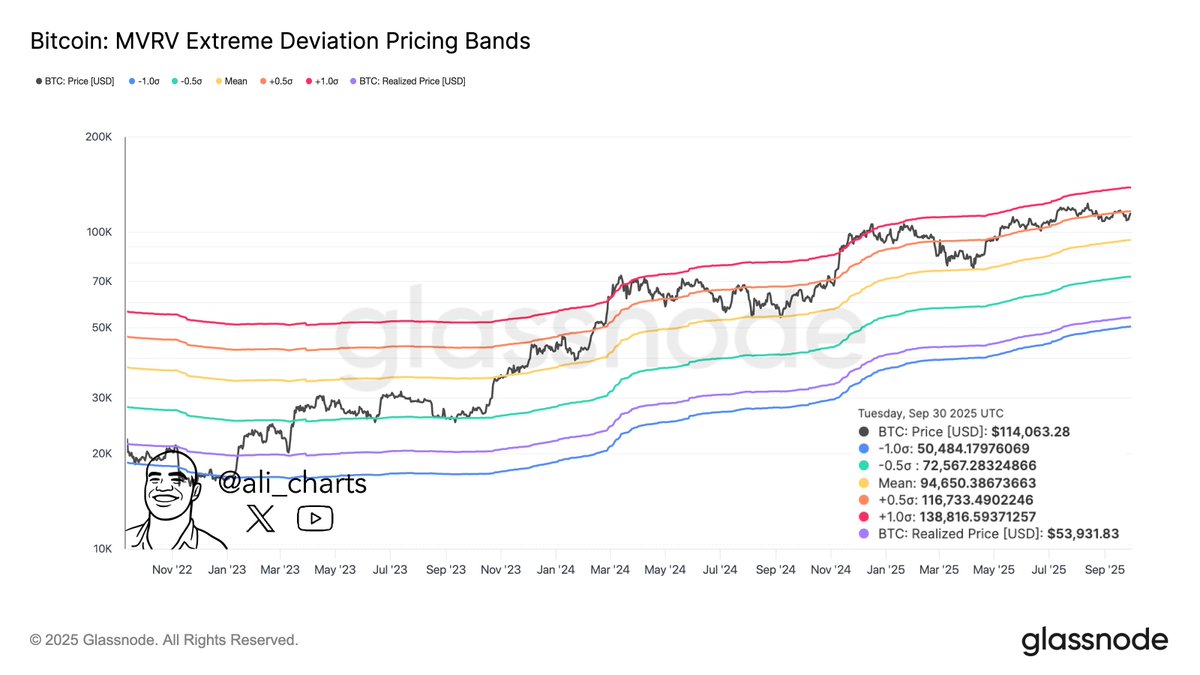

Martinez tells his 158,600 followers on X that Bitcoin may increase more than 16% from its current value based on the MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands.

The MVRV Extreme Deviation Pricing Bands are used in on-chain analysis to identify potential market tops and bottoms.

“Bitcoin breaking past $117,000 points to $139,000 next, according to the Pricing Bands.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Bitcoin is trading for $119,252 at time of writing, up 1.5% in the last 24 hours.

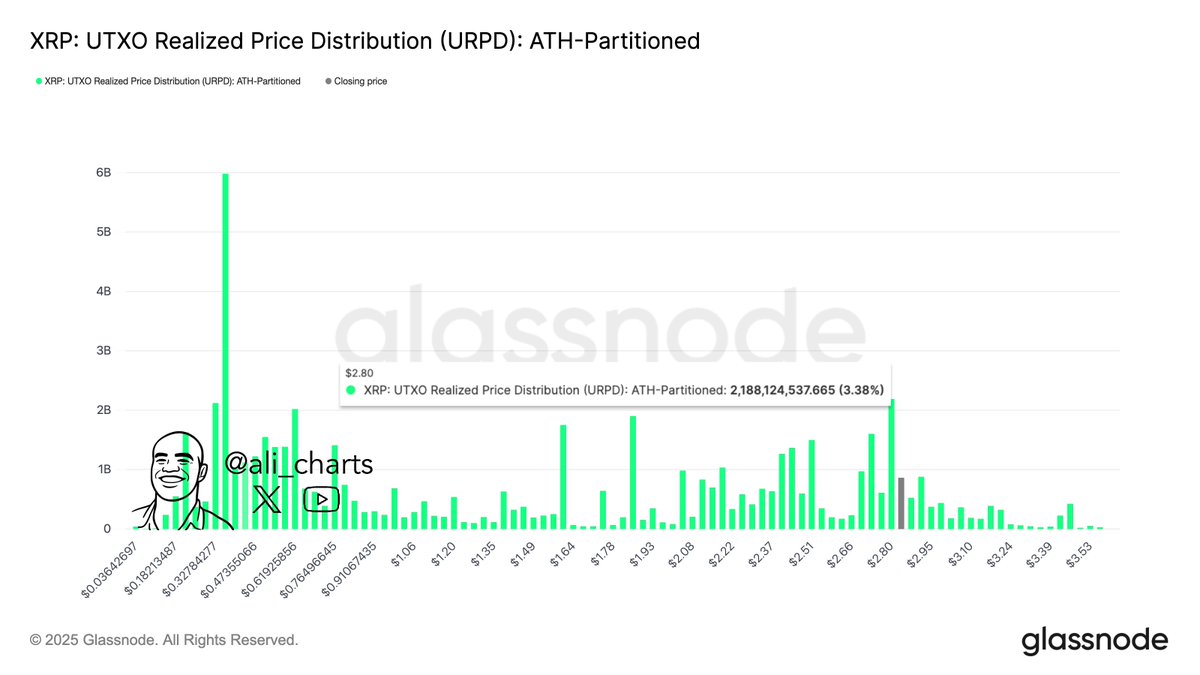

Next up, the analyst says that payments token XRP is looking bullish based on the Unspent Transaction Output (UTXO) Realized Price Distribution indicator, which shows the specific prices at which the current supply last moved.

“XRP held $2.80 as support. As long as it does, there are no major supply walls to block a rebound.”

Source: Ali Martinez/X

Source: Ali Martinez/X

XRP is trading for $2.98 at time of writing, up 1.1% on the day.

Moving on to Ethereum ( ETH ) rival Solana, the analyst says that SOL may increase by 60% from its current value after holding the $205 level as support.

“With the bullish retest complete, Solana could now be ready for $320-$360.”

Source: Ali Martinez/X

Source: Ali Martinez/X

SOL is trading for $225 at time of writing, up 2.7% on the day.

Lastly, the analyst says that decentralized oracle Chainlink ( LINK ) is on the verge of a massive breakout after retesting a key Fibonacci retracement level at around $20.

“$47 could be next for Chainlink!”

Source: Ali Martinez/X

Source: Ali Martinez/X

LINK is trading for $22.24 at time of writing, down marginally in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LUNA Drops 12.63% Over the Past Month as Market Fluctuates

- LUNA rose 0.87% in 24 hours but fell 5.01% over 7 days and 12.63% in a month, reflecting persistent downward pressure. - Market caution persists as technical indicators show short-term bullish signals but long-term bearish trends, complicating recovery prospects. - Backtesting revealed mixed post-10% decline recovery patterns, with 60-day average returns slightly positive but high volatility and variable optimal holding periods.

Whale Purchases 251 BTC, Boosts Holdings to 4,169 BTC

AI Ghost App Concept Lacks Blockchain Presence

Satoshi’s Wallet Theoretical Value Drops $32 Billion