Stablecoin as a Service Drives Growth Amid Liquidity Concerns

SCaaS makes it easy for businesses to issue stablecoins, fueling adoption and yield opportunities. Yet hidden risks in liquidity, reserves, and regulation remain.

With the Stablecoin-as-a-Service (SCaaS) model, any business or platform can issue its stablecoin without building a complex infrastructure.

The opportunity is vast, but it comes with risks of liquidity fragmentation, reserve transparency, and evolving global regulatory frameworks.

Anyone Can Issue Stablecoin

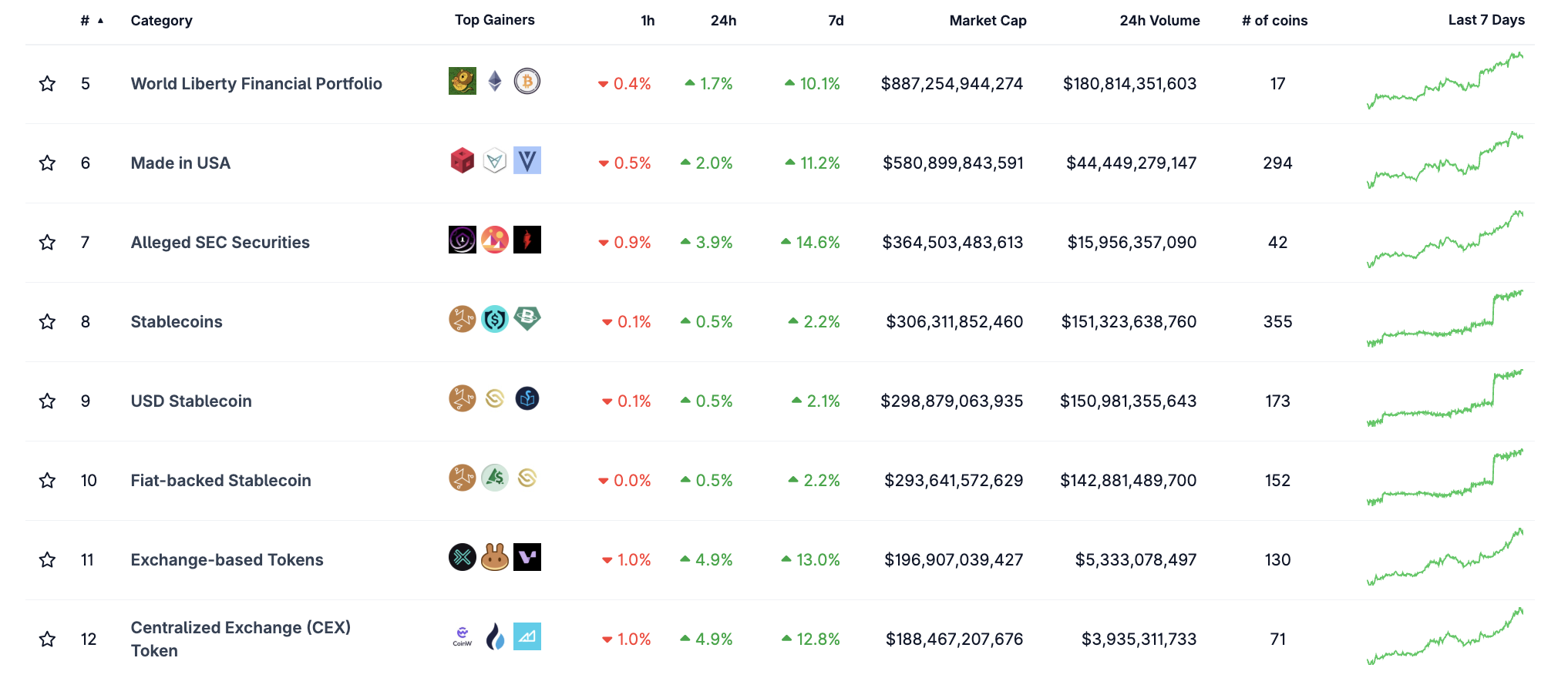

Data from CoinGecko shows that the stablecoin segment currently has a market capitalization of around $306 billion and 355 different coins. Although quite popular today, not everyone can issue and manage stablecoins effectively.

StAblecoin market capitalization. Source:

CoinGecko

StAblecoin market capitalization. Source:

CoinGecko

However, a new stablecoin model allows businesses, platforms, or organizations to issue and manage stablecoins without building the entire infrastructure from the ground up.

This model includes standardized mint/burn, customizable reserve mechanisms and fees, and third-party operating interfaces. This is Stablecoin-as-a-Service (SCaaS).

The most recent example is Stripe’s Open Issuance program (launched in September 2025). It enables businesses to mint/burn stablecoins freely and customize fees and reserve allocations while sharing profits from yield after a certain fee. Ethena Labs provides a white-label solution for applications or blockchains. Tech giants like Google have reportedly tested a payment protocol for AI agents using stablecoins, while custodians such as BitGo have also entered the market.

“Stripe announces Stablecoin as a Service. Any company can deploy stablecoins with just a few lines of code. BlackRock, Fidelity, or Superstate manages reserves. An X user commented about Stripe’s SCaaS.

The SCaaS model lowers entry barriers by allowing virtually any business to issue its stablecoin. It also supports tailored stablecoins for specific products or target markets and gives wallets/exchanges/chains additional tools to distribute products with yield potential.

Some users on X argue that SCaaS will become increasingly important as stablecoins become commodities and distributors (wallets, exchanges, chains) seek yield opportunities. Others suggest that SCaaS could be a lifeline for many blockchains struggling to achieve token-market-fit.

High Potential, High Risk

Nonetheless, the risks are significant. Multi-issuance models create the possibility of liquidity fragmentation. For instance, multiple “USD-pegged” stablecoins may coexist but differ in reserves, transparency, or redemption reliability.

Market dynamics could turn SCaaS into a yield-driven bet: issuers might optimize reserve profits to stay competitive, sometimes taking on liquidity risks or investing in less liquid assets. This leaves vulnerabilities when redemptions suddenly surge.

From a legal and operational perspective, SCaaS demands absolute transparency on reserve composition, insurance/redemption mechanisms, and independent auditing processes.

Regulatory decisions at national or regional levels could drastically reshape the multi-issuance landscape.

Even so, SCaaS is still expected to be a natural step forward as stablecoins steadily evolve into a global payment instrument.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins Recognized by Regulators and Institutions as the Core Link in Crypto

- Stablecoins are increasingly serving as a secure bridge between traditional finance and decentralized systems, supported by institutional adoption and regulatory frameworks like the EU’s MiCA. - Binance’s record $51.1 billion stablecoin reserves highlight their role as a liquidity hub amid market corrections, with traders prioritizing safety over speculation. - Deutsche Börse integrates euro-pegged stablecoins (e.g., EURAU) to expand digital asset offerings, aligning with MiCA’s goals for cross-border ef

Uzbekistan Strives for Crypto Progress While Enforcing Strict 2026 Regulatory Measures

- Uzbekistan will integrate stablecoins and tokenized securities into its regulated payment system from 2026, managed by a central bank-led sandbox. - Pilot programs will test stablecoin transactions and digital securities, aligning with Central Asia's growing crypto regulation trends. - Strict rules require all crypto dealings through licensed providers, with doubled $20,000 monthly fees to enforce compliance. - Despite controls, Uzbekistan's crypto adoption remains strong, with 1.5% of citizens holding d

Astar (ASTR) Price Rally: Exploring Key Drivers and Investment Opportunities in the Changing DeFi Ecosystem

- Astar (ASTR) surged 150% in Q3 2025 due to strategic partnerships, tokenomic reforms, and institutional interest. - Collaborations with Sony's Soneium and Aave boosted ASTR's cross-chain utility and liquidity incentives in Japan's Web3 market. - Tokenomics 3.0 (10.5B supply cap) and 5% token burn reinforced deflationary mechanisms, attracting $3.16M institutional investment. - Analysts project ASTR could reach $0.120 by 2033, driven by 300K TPS scalability and modular infrastructure adoption. - Risks inc

Bitcoin Updates: The 2026 Transformation of Crypto—Shifting from Unpredictability to Organized Expansion

- Cryptocurrency markets anticipate 2026 growth driven by global regulatory clarity, institutional infrastructure, and macroeconomic stability. - Turkmenistan legalizes crypto trading with state oversight, joining UK's tax deferrals and stablecoin regulations in balancing innovation and risk. - Bitcoin Munari's structured $0.22 presale offers predictable investment tiers, contrasting volatile markets amid $3T crypto recovery. - Galaxy Digital's 3.5 GW Texas data center combines Bitcoin mining with AI compu