October Outlook: Bitcoin’s Seasonality, Macro Trends, Gold Correlation, and ETF Bonanza

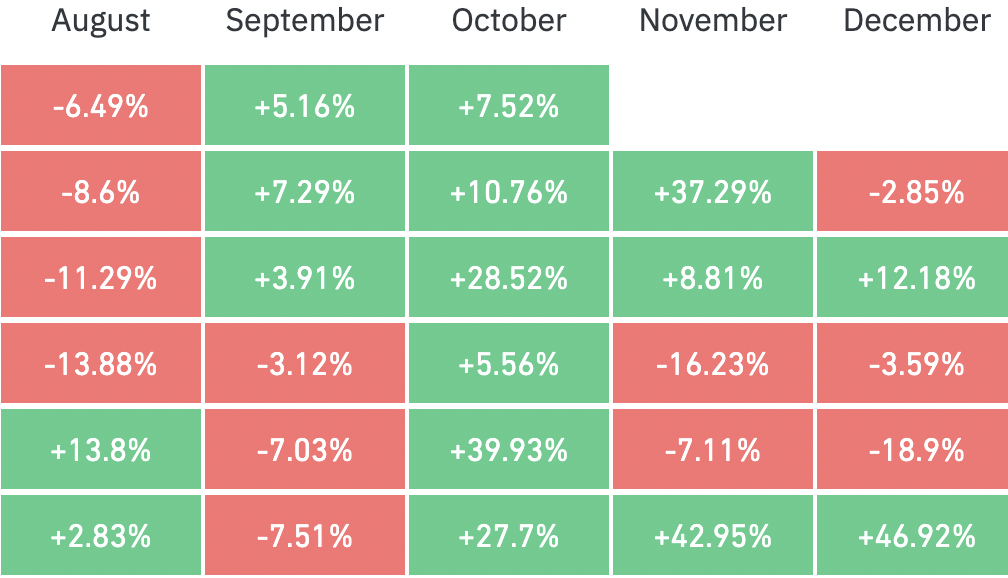

October has been historically the most bullish month for Bitcoin, which earned the month the now-overused "Uptober" moniker within the cryptocurrency community.

The month does live up to its facetious name, given that it has managed to remain in the green for seven years in a row.

In 2023, Bitcoin surged by 28.5% in October. In 2021, the leading cryptocurrency soared by nearly 40%.

There were only two years when Bitcoin was in the red in October (2018 and 2014). Both times, the cryptocurrency was in the middle of rather brutal bear markets that followed the speculative bubbles of 2013 and 2017.

After a strong start, Bitcoin seems to be on track to extend the streak.

Macro picture

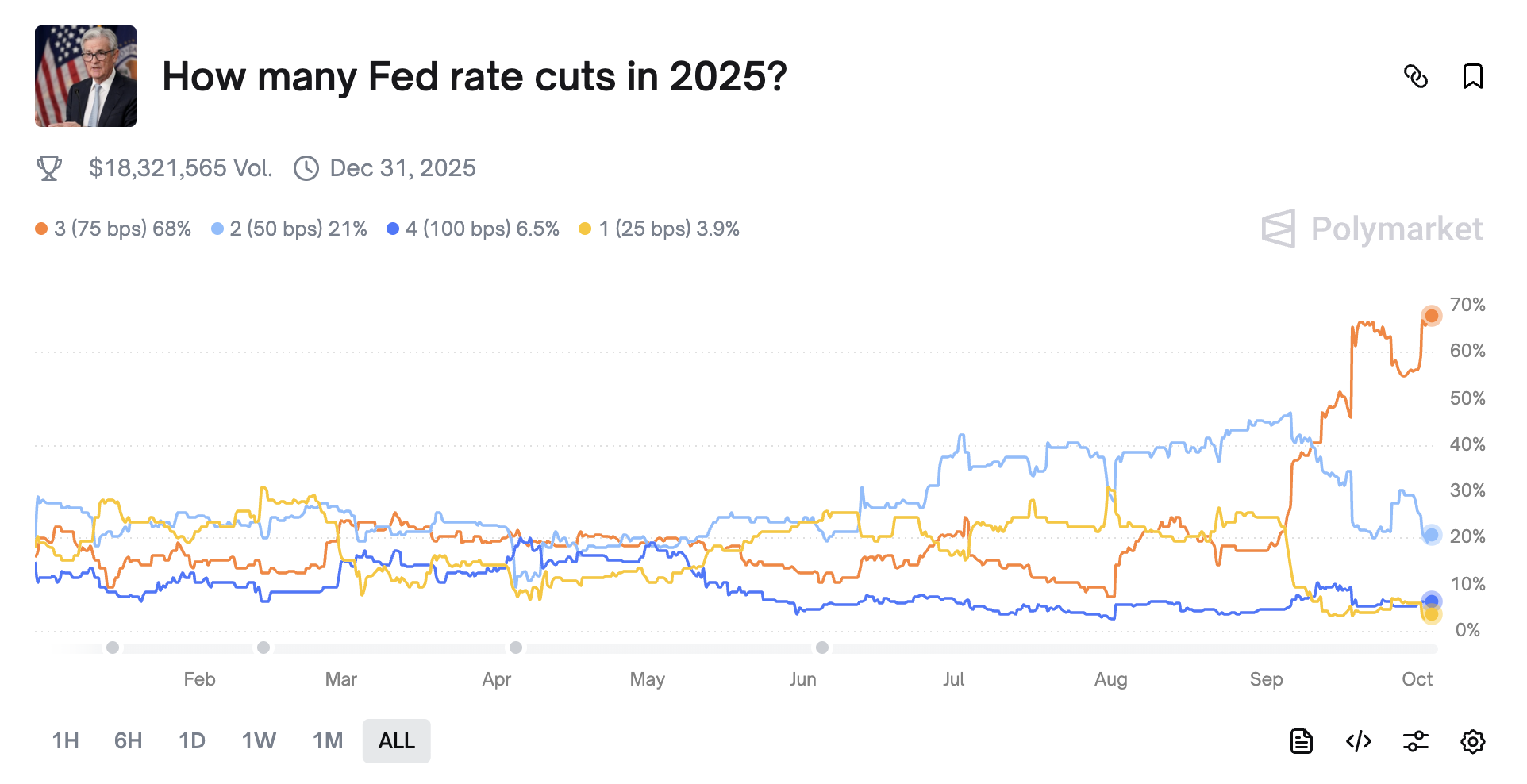

According to Polymarket bettors, there is a 94% chance of the Fed cutting interest rates at the September meeting.

Market participants are overwhelmingly betting on a total of three rate cuts in 2025.

Fed rate cuts, which will make borrowing cheaper, are expected to further bolster risk assets.

At the same time, there is also a lot of uncertainty about the economic impact of the ongoing government shutdown in the U.S.

The U.S. stock market experienced a substantial correction during the longest shutdown to date that took place from Dec. 22, 2018, to Jan. 25, 2019. Back then, Bitcoin was in the late stage of a truly grueling bear market. However, the impact of this shutdown could be dramatically different, and the cryptocurrency is currently approaching a new record high.

Traders will have to keep a close eye on key data from the Bureau of Labor Statistics regarding employment and unemployment, the Consumer Price Index (CPI), the Producer Price Index (PPI), as well as the GDP data.

Bitcoin/gold correlation

Gold has been consistently outperforming Bitcoin this year despite having a significantly bigger market capitalization. As reported by U.Today, Fidelity's Jurrien Timmer previously predicted that gold could pass the baton to its digital rival in the second half of the year, but this has yet to happen.

While gold keeps smashing new record highs, Bitcoin's price action remains stubbornly underwhelming as the cryptocurrency remains below its record peak.

As noted by analyst Chris Burniske, the Bitcoin-to-gold ratio has slipped back to a historically important support level.

If $BTC were gonna run a catch-up trade to gold, the $BTC/$GLD chart, which is back to April 2025 support at the 100W SMA, would imply now's the time... pic.twitter.com/hqqNPkTHFa

— Chris Burniske (@cburniske) October 1, 2025

This level could be a logical place for a future reversal if it actually manages to catch up with gold this year.

$BTC

— CarpeNoctom (@CarpeNoctom) October 2, 2025

$151k is gold ratio ATH pic.twitter.com/zArKpRdOKk

ETF bonanza

October is also on track to be a historic month for the cryptocurrency sector due to the sheer number of crypto ETFs that are expected to be approved this month.

Issuers will be awaiting the SEC's decisions on a slew of altcoin ETFs designed to track such cryptocurrencies as Litecoin (LTC), Solana (SOL), Cardano (ADA), and XRP.

However, the aforementioned government shutdown might delay their approval.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How a Query from an Office Supplies Specialist Transformed a $12 Billion Trucking Approach

- A non-trucking board member's question prompted Ryder System to shift focus from leasing to targeting 80-85% of companies owning their own trucks. - The strategic pivot aligns with growing demand in long-haul freight driven by e-commerce, trade agreements, and tech innovations like IoT fleet management. - Industry consolidation and sustainability trends, including electric trucks, are reshaping competition as firms expand specialized services like temperature-controlled logistics. - Ryder's experience hi

Ethereum News Update: Disorder or Planning? Apeing's Early Sale Breaks the Typical Meme Coin Mold

- Apeing ($APEING) emerges as a structured meme coin contender with a verified whitelist presale offering 10,000% projected gains, contrasting chaotic market norms. - Bitcoin and Ethereum show mixed recovery signals while Pepe ($PEPE) and Bonk ($BONK) dominate headlines amid growing institutional interest in meme coins. - Apeing's hybrid model combines meme virality with AI-driven utilities and audited infrastructure, drawing comparisons to Ethereum's blockchain evolution. - Risks persist due to market vol

Bitcoin Updates: Major Institutions Increase Bitcoin Holdings During Price Drops While Solana ETFs Resist Market Downturn: Opportunity or Crisis?

- Institutional investors and presale participants are buying dips in Bitcoin , Solana , and BNB as market volatility creates accumulation opportunities. - Hyperscale Data (GPUS) boosted its Bitcoin treasury to $70.5M (77% of market cap), aiming to expand to $100M via dollar-cost averaging. - Solana ETFs defied broader outflows with $568M net inflows, contrasting Bitcoin's $3.7B ETF exodus and signaling shifting institutional risk appetite. - Market dynamics hinge on Fed policy, ETF stabilization, and tech

Bitcoin Updates: IMF Warns of Widespread Risks Amid Growing Popularity of Tokenized Finance

- IMF highlights tokenized finance's efficiency gains but warns of systemic risks like smart contract interdependencies and liquidity vulnerabilities. - Upcoming Chainlink ETFs signal growing institutional adoption, with Grayscale and Bitwise advancing regulated exposure to $100B+ oracle network assets. - Analysts predict over 100 new crypto ETFs in six months, but XRP's 18% price drop underscores market volatility despite regulatory approvals. - IMF anticipates regulatory frameworks to address cross-platf