NFT sales double to $256m, Hypurrr tops the list

NFT sales volume more than doubled, surging by 103.11% to reach $256.9 million. This is a notable turnaround from last week’s $84.6 million in sales volume.

CryptoSlam data shows:

- The number of NFT buyers jumped by 18.25% to 694,348

- Sellers increased by 17.77% to 584,235.

- NFT transactions dipped by 8.67% to 1,874,619.

Bitcoin’s ( BTC ) rally to the $122,000 level has energized the entire crypto market. Ethereum ( ETH ) has followed suit, climbing to $4,500.

The global crypto market cap now stands at $4.2 trillion, up from last week’s $3.78 trillion. This bullish momentum has spilled over into the NFT sector, which has posted impressive gains.

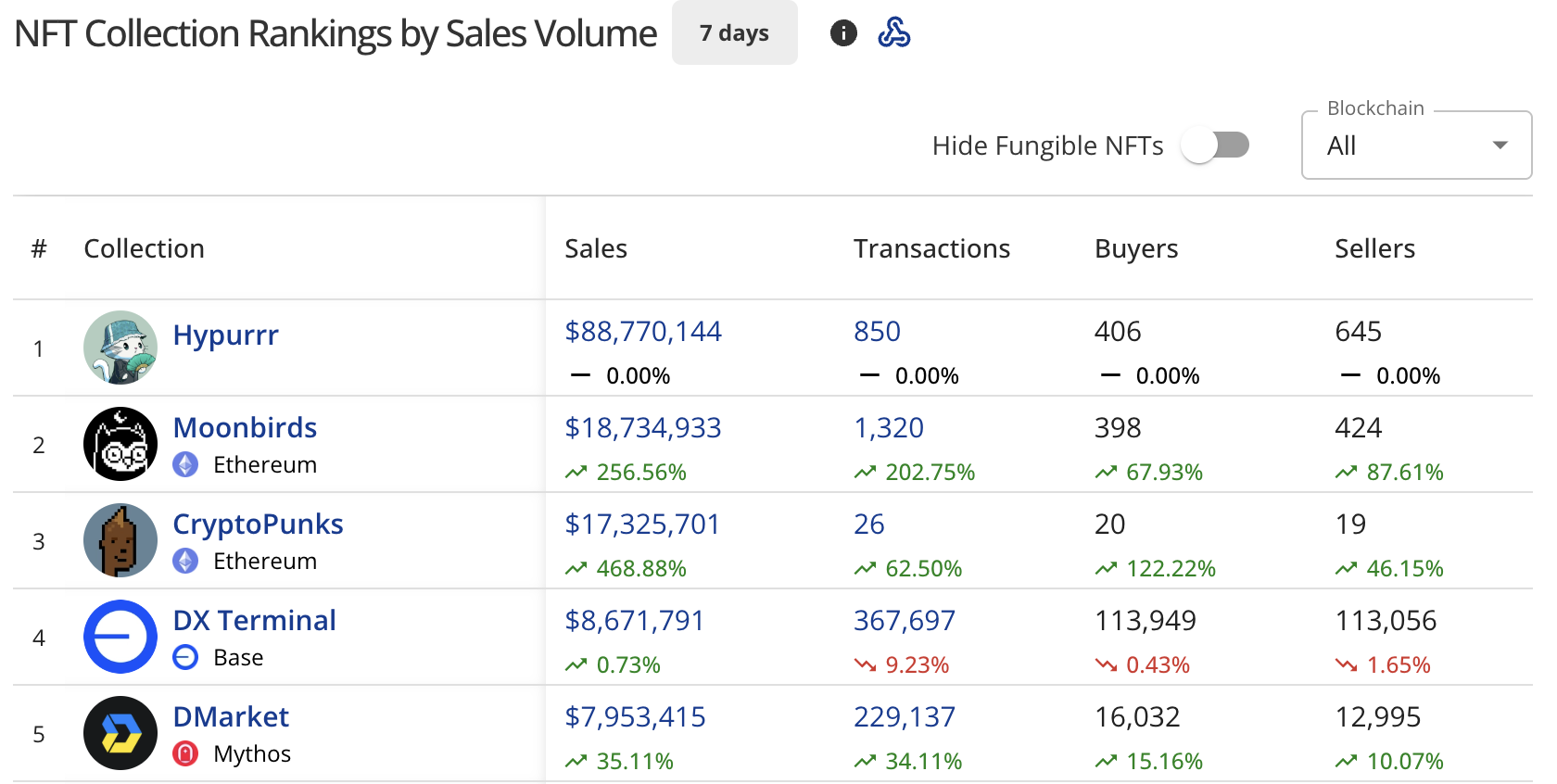

Hypurrr dominates NFT collections

The Hypurrr collection has emerged as the top performer this week, generating $88.77 million in sales across 850 transactions.

The collection attracted 406 buyers and 645 sellers. Hypurrr also dominated the top individual NFT sales, occupying four of the top five spots.

Source: Top collections by NFT Sales Volume (CryptoSlam)

Source: Top collections by NFT Sales Volume (CryptoSlam)

Moonbirds secured second place with $18.72 million in sales, posting a 254.57% increase. The Ethereum-based collection saw 1,319 transactions, with 398 buyers and 424 sellers participating.

CryptoPunks claimed third position at $17.33 million, recording a 468.88% surge. The collection had 26 transactions, with 20 buyers and 19 sellers.

DX Terminal on the Base blockchain came in fourth with $8.67 million in sales, up 0.73%. The collection processed 367,697 transactions and attracted 113,948 buyers.

DMarket rounded out the top five with $7.95 million in sales on the Mythos blockchain, up 34.95% from the previous week.

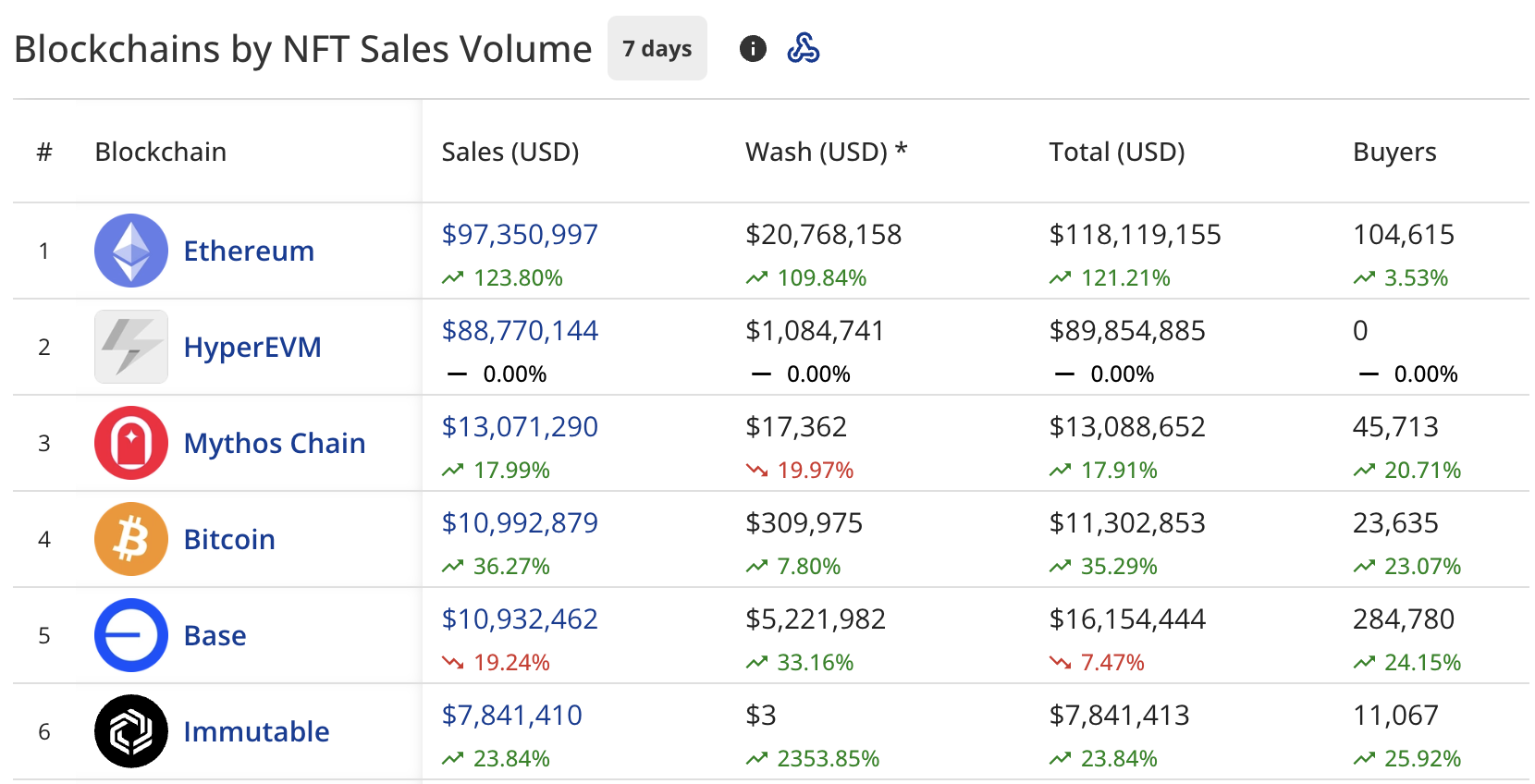

Ethereum leads blockchain rankings

Ethereum maintained its position as the leading blockchain for NFT sales, recording $97.4 million in volume, up 124.35% from last week’s $28.3 million.

The network processed wash trading worth $20.84 million, bringing its total to $118.24 million. The platform saw 104,625 buyers, up 3.55%.

HyperEVM took second place with $88.77 million in sales, driven entirely by the Hypurrr collection’s performance. Interestingly, the blockchain recorded zero buyers in the tracked period.

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Mythos Chain ranked third with $13.07 million, up 17.69% from last week’s $10.9 million. The blockchain attracted 45,713 buyers, up 20.71%.

Bitcoin placed fourth at $10.97 million, which is a 36.20% increase from last week’s $14.12 million. The network saw 23,635 buyers, up 23.07%.

Base dropped to fifth position with $10.92 million, down 19.71% from the previous week. The blockchain had 284,780 buyers, up 24.15%.

Solana ( SOL ) landed in seventh place with $7.74 million, up 56.23% from last week’s $16.1 million. The blockchain recorded 56,811 buyers, up 18.33%.

Top individual sales

CryptoPunks #1563 led individual sales at $12.05 million (2745 ETH), sold two days ago.

Four Hypurrr NFTs followed:

- Hypurrr #3926 sold for $7.86 million

- Hypurrr #175 sold for $7.82 million

- Hypurrr #1131 sold for $7.63 million

- Hypurrr #3460 sold for $6.46 million

All four Hypurrr sales occurred five days ago.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MMT Price Forecast Fluctuations: Changes in Institutional Outlook and Macroeconomic Drivers

- Mazda's stock volatility (2023-2025) stems from institutional investor caution and macroeconomic pressures like inflation, interest rates, and EV transition challenges. - Institutional ownership remains stable (16.8% by Master Trust Bank, 5.1% by Toyota), but firms like Morgan Stanley reduced stakes amid concerns over EV adaptation. - Strategic cost-cutting (85% lower EV investment) and repurposed production lines aim to mitigate risks, yet Q3 2025 showed 9% sales decline and ¥46.1B operating loss. - Div

RLUSD Market Cap Climbs Nearly 18% as XRP Ledger Tokenization Expands

Quick Take Summary is AI generated, newsroom reviewed. The market cap of Ripple's stablecoin RLUSD has increased by nearly 18% over the last 30 days to reach approximately $420 million. Real-World Asset (RWA) tokenization on the XRP Ledger (XRPL) grew by 8.77%, with 47 projects now hosting $158 million in tokenized assets. Vanguard officially began allowing its clients to access crypto ETFs (including those tracking BTC, ETH, and XRP) on its brokerage platform. The combined growth in RLUSD, RWA, and instit

XRP ETF Holdings Reveal Strong Institutional Confidence

Quick Take Summary is AI generated, newsroom reviewed. Franklin Templeton’s XRP ETF holds 53.22 million XRP valued at $107.08M. The ETF’s market value exceeds its NAV, reflecting strong investor demand. ETFs provide regulated exposure to crypto without holding coins directly. Institutional participation could increase market stability and confidence.References Franklin Templeton reports its $XRP spot ETF holding 53.22M $XRP valued near $107.08M and a total NAV of $78.67M.

Vanguard Lists XRP ETFs as Inflows Surpass $756 Million and Institutional Demand Accelerates

Quick Take Summary is AI generated, newsroom reviewed. Vanguard lists XRP ETFs for the first time, marking a major shift from its traditional anti-crypto stance. XRP ETFs from Franklin Templeton and Canary Capital gain approval on Vanguard’s platform. XRP ETFs experience eleven straight days of inflows totaling $756 million. Inflows represent around 0.6 percent of XRP’s market cap, tightening liquid supply.References X Post Reference