Blockchain network revenues declined 16% in September: Report

Network revenues across the blockchain ecosystem declined by 16% month-over-month in September, mainly due to reduced volatility in the crypto markets, according to asset manager VanEck.

Ethereum network revenue fell by 6%, Solana’s fell by 11%, and the Tron network recorded a 37% reduction in fees, due to a governance proposal that reduced gas fees by over 50% in August, according to VanEck’s report.

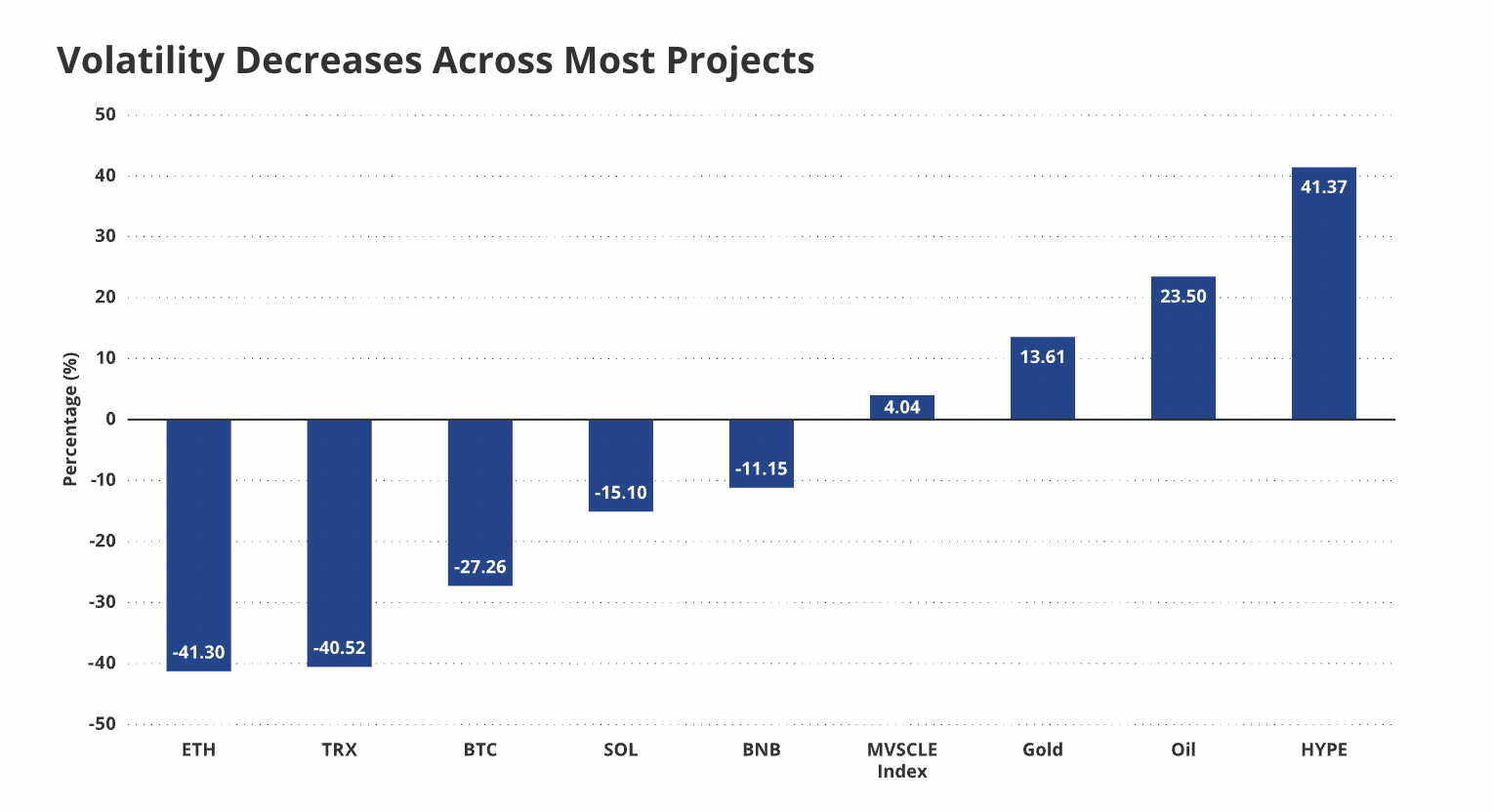

The revenue drop in the other networks was attributed to reduced volatility in the crypto markets and the underlying tokens powering those networks. Ether (ETH) volatility dropped by 40%, SOL (SOL) volatility fell by 16%, and Bitcoin (BTC) fell by 26% in September.

“With reduced volatility for digital assets, there are fewer arbitrage opportunities to compel traders to pay high priority fees,” the writers of the report explained.

Network revenues and fees are a critical metric for economic activity in crypto ecosystems. Market analysts, traders, and investors monitor network fundamentals to gauge the overall health of a particular ecosystem, individual projects, and the broader crypto sector.

Related: Ethereum revenue dropped 44% in August amid ETH all-time high

Tron network continues to dominate revenue metrics

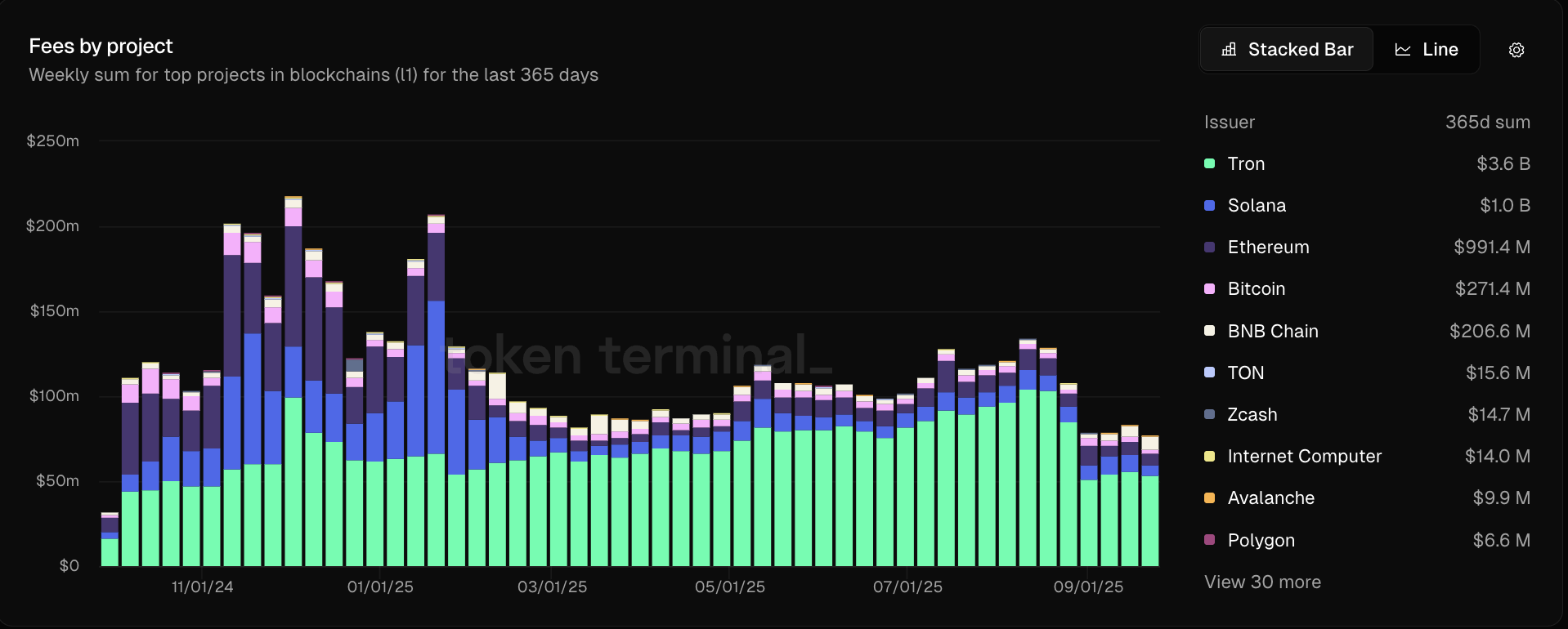

The Tron network is ranked as the number one crypto ecosystem for revenue, generating $3.6 billion in the last year, according to data from Token Terminal.

Ethereum, by comparison, only generated $1 billion in revenue over the last year, despite ETH hitting all-time highs in August, and a market capitalization of about $539 billion — over 16x the TRX (TRX) market capitalization, which is just north of $32 billion.

Tron’s revenue is attributed to its role in stablecoin settlements. 51% of all circulating Tether USDt (USDT) supply has been issued on the Tron network.

The stablecoin market cap crossed $292 billion in October 2025 and has been steadily growing since 2023, according to data from RWA.XYZ.

Stablecoins are a major use case for blockchain technology, as governments attempt to increase the salability of their fiat currencies by placing them on crypto rails.

Blockchain rails allow currencies to flow between borders, with near-instant settlement times, minimal fees, 24/7 trading, and do not require a bank account or traditional infrastructure to access.

Magazine: Ether could ‘rip like 2021’ as SOL traders brace for 10% drop: Trade Secrets

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: SoftBank's PayPay Connects Japan's Conventional Finance with the Crypto Sector

Adherence to regulations and rapid transaction speeds are driving the widespread adoption of cryptocurrency in mainstream business.

- OwlTing Group's "Invisible Rails" strategy enables rapid deployment of compliant crypto gateways via global licensing across Asia and Latin America. - Opera's MiniPay expands Latin American reach by integrating USD₮ stablecoins with local payment systems like PIX and Mercado Pago. - Grayscale rebrands XRP Trust as GXRP ETF, reflecting growing institutional demand for regulated crypto exposure in global markets. - Industry analysis highlights blockchain's convergence with AI data infrastructure, emphasizi

DASH Experiences a Rapid 150% Jump in Value: Unpacking the Causes Behind the Price Fluctuation

- DASH surged 150% in Q3 2025 after listing on Aster DEX, a hybrid AMM-CEX platform boosting liquidity and attracting institutional interest. - Dash Platform 2.0 upgrades, enhanced privacy features, and SEC regulatory clarity positioned DASH as a stable alternative to volatile DeFi assets. - On-chain metrics showed 50% higher transaction volume and 35% more active addresses, though privacy tools like PrivateSend obscured organic growth verification. - Cybersecurity breaches and whale-driven volatility in l

Vitalik Buterin's Advances in Zero-Knowledge Technology: Driving Ethereum's Growth and Enhancing Investor Profits

- Vitalik Buterin advances Ethereum's ZK innovations, prioritizing scalability and efficiency through Layer 2 upgrades like ZKsync's 15,000 TPS Atlas upgrade. - ZK Stack bridges Ethereum's security with off-chain efficiency, driving 150% token price growth and a projected $90B ZK Layer 2 market by 2031. - Modexp precompile removal increases gas costs but optimizes ZK proofs, reflecting Buterin's focus on long-term sustainability over short-term savings. - Investors face high-reward opportunities as ZK-cent