Dogecoin ( DOGE 3.49%) began as a humorous meme coin, unexpectedly gaining lasting popularity and achieving significant success along the way. Now, after several years, the leading meme coin could be on the verge of major upgrades that might transform it from a sentiment-driven novelty into a digital asset with genuine investment potential.

What could Dogecoin’s status be by the close of 2028? The answer hinges on a few important variables, so let’s take a closer look at them.

Image source: Getty Images.

A promising new direction may be forming

Before considering the potential for a brighter future, it’s important to recognize what is unlikely to change—such as the coin’s tokenomics.

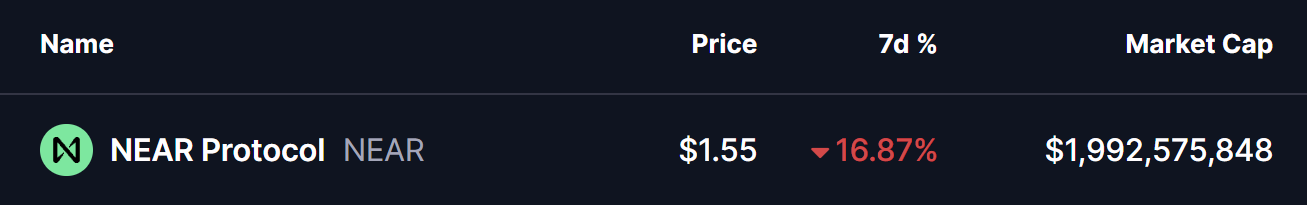

Dogecoin’s issuance schedule is steady and predictably inflationary; each year, 5 billion new coins are created, which causes the inflation rate to decrease as the total supply increases. Currently, there are about 151 billion DOGE in circulation. This means anyone purchasing DOGE today must accept that the coin needs to outperform its gradual supply growth to yield solid returns. At present, there is no built-in coin burning, so the supply situation is not expected to improve significantly over time.

That could change, however, if new features are introduced to the protocol. This is exactly what the Dogecoin developer community is currently debating.

There is an active discussion about enabling Dogecoin nodes to support zero-knowledge (ZK) proofs, which could allow specialized layer-2 (L2) solutions and off-chain virtual machines to process advanced operations while settling on the main Dogecoin blockchain. You don’t need to fully understand ZK proofs—just know they are cryptographic methods that verify information without exposing the underlying data.

If these conversations lead to concrete proposals that are approved and developed, Dogecoin could gain smart contract capabilities without needing to overhaul its core blockchain. This aligns with the Dogecoin Foundation’s long-term plan to encourage more development through community-driven projects, and it would significantly expand the chain’s features and its ability to create value for holders.

Should a robust L2 solution launch and attract meaningful activity, Dogecoin could transition from a meme coin to a platform with a self-reinforcing cycle—greater utility brings in more users and capital, which draws more developers, further boosting utility. While it may not reach the complexity of leading smart contract platforms, the potential upside for investors could still be substantial.

The more likely scenario is less thrilling

While the idea of Dogecoin evolving into a smart contract platform via L2 is intriguing, investors should also consider the more probable outcome: little will change. If no significant new utility emerges, Dogecoin will likely look much the same in three years as it does today.

It will probably remain culturally significant, accepted by a limited and scattered set of payment providers, possibly held by a few more corporate treasuries and exchange-traded funds (ETFs), and its price will continue to be driven primarily by its meme status and hype rather than by any underlying cash flows. The most notable changes in this period may be the effects of its addition to ETFs—some of which have recently launched in the U.S.—and the fact that some supply is being acquired and held by digital asset treasury (DAT) firms.

In this scenario, Dogecoin’s price could still be higher in the future than it is now, largely due to demand from ETF issuers and DATs. However, unless developers unite to implement the discussed upgrades and collaborate with investors to foster an ecosystem that drives demand, Dogecoin will lack a reliable way to increase in value. So, it’s even more likely that it will still lack a solid investment rationale, even three years from now.

Ultimately, the investment outlook is quite binary. If by late 2028 Dogecoin launches an L2 that enables smart contracts and successfully attracts significant value and users through new applications, the case for investing in DOGE could improve considerably. If not, it will remain a meme coin whose value is shaped by cultural trends rather than growing utility—in other words, it will likely stay an unconvincing investment unless something unexpected happens.