Bitcoin Production in September Softens Amid Rising Difficulty — MARA Maintains Lead

September’s surge in Bitcoin mining difficulty squeezed profits across the sector, yet Marathon Digital (MARA) maintained its production lead. With efficiency now defining success, smaller miners face a challenging path amid rising costs and shrinking rewards.

Competition in the Bitcoin mining sector intensified in September 2025 as mining difficulty reached new all-time highs, while production across most major miners declined.

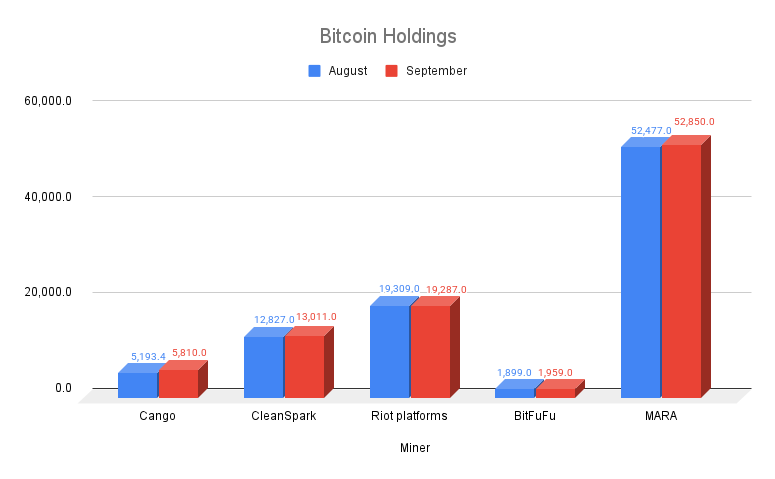

Large-scale companies with strong balance sheets and accumulation strategies continued to thrive in this environment, whereas smaller miners faced growing pressure from operational costs and technical volatility.

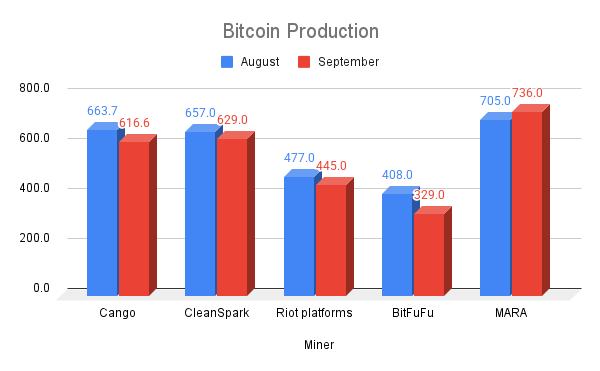

Bitcoin Production Declines as Difficulty Rises

According to publicly released reports, Cango mined around 616 BTC in September, down from 663 BTC in August.

CleanSpark produced 629 BTC, a slight dip from the previous month. Riot Platforms generated 445 BTC, compared to 477 BTC in August. BitFuFu’s output dropped sharply to 329 BTC, while Marathon Digital Holdings (MARA) maintained its lead with 736 BTC mined, further expanding its Bitcoin reserves.

Bitcoin production by major mining companies. Source: BeInCrypto

Bitcoin production by major mining companies. Source: BeInCrypto

The data suggests that while larger miners managed to keep their production relatively stable, smaller operators began to feel the strain from rising difficulty and energy costs.

BTC holdings of selected companies. Source: BeInCrypto

BTC holdings of selected companies. Source: BeInCrypto

Meanwhile, Bitcoin’s network difficulty climbed to 142.34T in September, marking a new all-time high. This consistent increase in difficulty means that each unit of hashrate now yields fewer BTC, driving hashprice (revenue per unit of computational power) lower.

As a result, miners’ profit margins continue to tighten, especially for those with higher energy costs or less efficient hardware.

Bitcoin mining difficulty. Source:

Blockchain.com

Bitcoin mining difficulty. Source:

Blockchain.com

Notably, a new anti-Bitcoin mining bill in New York recently proposed a progressive tax on Bitcoin mining companies, with revenue redirected to lower utility bills for residents. The bill faces uncertain prospects but could disrupt multi-billion-dollar data center plans and increase cryptocurrency regulation in the state.

In summary, Bitcoin production in September revealed mounting technical pressure on the mining industry. As difficulty keeps rising and profit margins shrink, large miners like MARA, which have efficient infrastructure and a strategy of BTC accumulation, remain in a strong position.

Smaller firms must carefully consider selling BTC, cutting power capacity, or scaling operations to navigate the increasingly competitive and volatile landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Assessing Bitcoin's Support Zones—Will Institutional Investments Surpass Federal Reserve Ambiguity?

- Bitcoin faces critical $84,000–$86,000 support after 31% November selloff, with institutional inflows and whale accumulation signaling ongoing bull cycle resilience. - JPMorgan upgrades miners like Cipher Mining amid rising HPC demand, while Fed rate-cut odds hit 71% for December, potentially boosting risk assets. - On-chain data shows historic BTC transfers to long-term holdings, contrasting with Binance's delistings and regulatory-driven liquidity management efforts. - 2025–2030 price forecasts range $

XRP News Today: RLUSD Surges to $1B After Abu Dhabi's Green Light, Advancing Fintech Hub Goals

- Ripple's RLUSD stablecoin surpassed $1B in supply on Ethereum , driven by Abu Dhabi's regulatory approval and institutional demand for compliant assets. - Recognized as an "Accepted Fiat-Referenced Token," RLUSD enables collateral, settlements, and lending in UAE financial hubs through ADGM-licensed entities. - Backed by cash and U.S. Treasuries via a New York trust, RLUSD's multi-chain structure mirrors USDC/PYUSD compliance while expanding cross-border utility. - Ethereum's DeFi infrastructure and $43M

Bitcoin Updates: Market Establishes Support While Crypto ETFs Draw Careful Investors

- Institutional investors cautiously reinvest in Bitcoin/Ethereum ETFs as November 25 inflows hit $207.58M, reversing prior month's $3.5B outflows. - Fidelity's FBTC ($170.8M) and BlackRock's ETHA ($46.09M) lead inflows, while XRP ETFs surge $643.92M in debut month. - Market remains fragile with Bitcoin consolidating at $84k-$90k, one-third of supply still at loss, and altcoins like GDOG underperforming forecasts. - Analysts highlight Fed policy uncertainty and "wait-and-see" institutional sentiment, notin

No, you won’t be able to make your AI ‘confess’ to sexism, though it likely exhibits such bias