$100 Million Lost in One Hour: Bitcoin Drops Spark Rampaging Liquidations

Bitcoin’s $4,000 drop sparked $700 million in liquidations, proving retail traders still wield power despite institutional dominance. Analysts now eye how these dual forces will shape BTC’s next move.

Retail Bitcoin traders made themselves heard today, causing $700 million in crypto liquidations. The price of BTC fell by around $4,000 as on-chain activity spiked, even though institutions kept buying.

Whether or not BTC keeps dropping or recovers soon, we need to pay attention to these dynamics. Corporate liquidity is very influential in the market, but it’s not the final arbiter of price.

Bitcoin Causes Surprise Liquidations

When Bitcoin hit two successive all-time highs earlier this week, it caused a little consternation in the community. This took place despite a lack of retail activity, with institutional investors powering the growth.

Crucially, these corporations continued making huge purchases while BTC’s value was inflated.

In other words, there have been fears that these inflows could profoundly alter market cycles. Arthur Hayes even proclaimed that the four-year cycle was dead and that global institutional liquidity would determine token prices now.

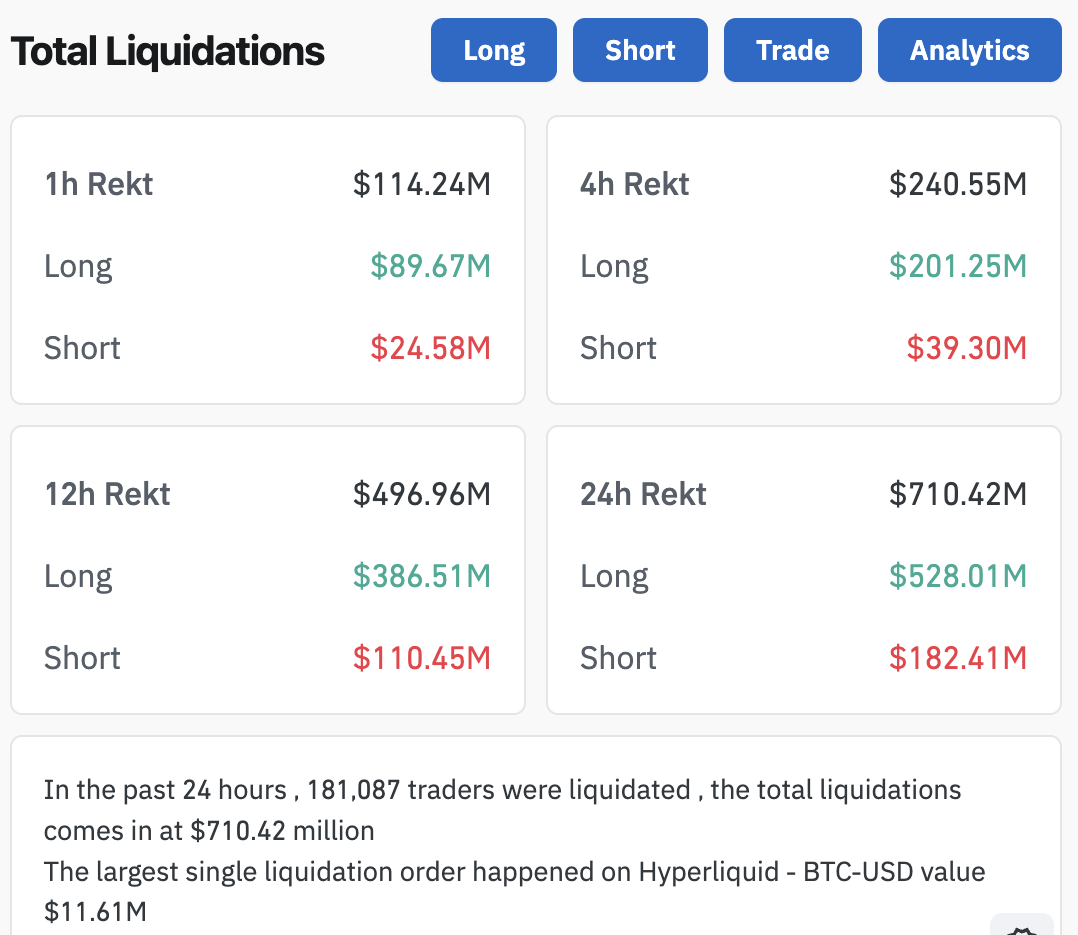

Today, however, these concerns seem less serious. Bitcoin fell around $4,000 in the last 24 hours, spawning a frenzy of crypto liquidations. Over $114 million in total short positions were eradicated in one hour:

Bitcoin Drops Cause Liquidations. Source:

CoinGlass

Bitcoin Drops Cause Liquidations. Source:

CoinGlass

Retail Traders’ Impact

A few key factors suggest that retail Bitcoin traders caused all these liquidations. For one thing, ETF issuers continued buying BTC at elevated rates, and the products are seeing huge inflows. Meanwhile, BTC’s on-chain trading activity has spiked between 4% and 5%, showing that activity is stirring awake.

Analysts have already identified some of the most likely causes for Bitcoin’s retreat to $120,000, which triggered these liquidations. They seem like pretty standard price actions; long-term traders are taking profits, holder accumulation rates sparked low confidence, etc.

Furthermore, there are even signs that BTC could rebound in the near future.

This, too, presents a useful opportunity to gather valuable market data. These new structural forces are very powerful, but they aren’t all-powerful.

Retail activity still spurred a major Bitcoin price dump, causing a cascade of liquidations. What new narratives can help explain this behavior and enable accurate predictions?

Whether Bitcoin keeps going up or down, these questions should be at the forefront of traders’ minds. These institutions are apparently going to keep stockpiling Bitcoin either way.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The PENGU USDT Sell Alert: Is This a Turning Point for Stablecoin Approaches?

- PENGU/USDT's 2025 collapse triggered a $128M liquidity shortfall, exposing algorithmic stablecoin fragility and accelerating market shift to regulated alternatives. - USDC's market cap surged to $77.6B by 2025, while MiCA-compliant euro-stablecoins gained $680M in cross-border adoption amid regulatory clarity. - DeFi protocols adopted oracle validation and reserve-backed models post-PENGU, reducing exploit losses by 90% since 2020 through institutional-grade security upgrades. - Regulators now prioritize

Emerging Prospects in EdTech and AI-Powered Learning Systems: Ways Educational Institutions Are Transforming Programs and Enhancing Student Achievement

- AI is transforming education by reshaping curricula, enhancing student engagement, and optimizing institutional efficiency. - Universities like Florida and ASU integrate AI literacy across disciplines, offering microcredentials and fostering innovation. - AI tools like Georgia Tech’s Jill Watson and Sydney’s Smart Sparrow boost performance and engagement through personalized learning. - AI streamlines administrative tasks but faces challenges like ethical misuse and skill gaps, requiring structured train

Anthropological Perspectives on Technology and Their Impact on Education and Workforce Preparedness for the Future

- Interdisciplinary STEM/STEAM education integrates technology tools like AI and VR to bridge theory and real-world skills, driven by $163B global edtech growth. - U.S. faces 411,500 STEM teacher shortages and 28% female workforce representation gaps, prompting equity-focused programs like Girls Who Code. - STEM occupations earn $103K median wages (vs. $48K non-STEM), with 10.4% job growth projected through 2033, driving investor opportunities in edtech and workforce alignment. - Strategic investments in t

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov