Crypto bloodbath sees $19B in leveraged positions erased

Key Takeaways

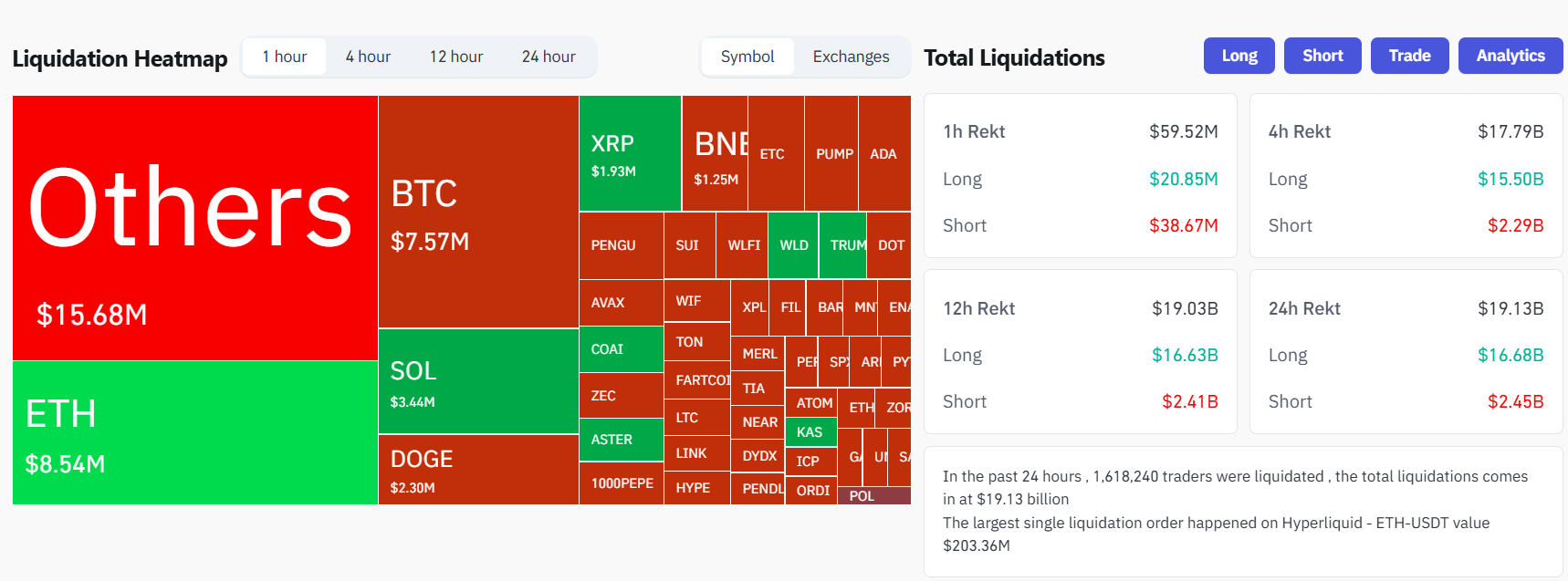

- Over $19 billion in leveraged crypto positions were liquidated in 24 hours, marking the largest single-day wipeout in digital asset history.

- Bitcoin and Ethereum long positions were hardest hit, with over 1.6 million traders affected across major exchanges.

Roughly $19 billion in leveraged crypto positions were liquidated following a brutal sell-off that sent Bitcoin tumbling to $102,000. It was the largest single-day wipeout ever recorded in digital asset markets, according to CoinGlass data .

Most of the liquidations came from long positions, which totaled $16.6 billion in losses, compared to $2.4 billion for shorts.

Over 1.6 million crypto traders were liquidated across major exchanges, with Bitcoin and Ethereum long positions severely impacted during Friday’s US trading sessions.

The liquidation cascade was triggered after President Donald Trump proposed a massive tariff increase on Chinese imports, followed shortly by an announcement of a 100% tariff on Chinese goods in response to China’s planned export restrictions on rare earth minerals.

Bitcoin plunged from above $122,000 to around $102,000 on the news. Ethereum dropped below $3,500, while smaller-cap altcoins saw double-digit losses amid evaporating liquidity.

At the time of writing, Bitcoin traded above $113,000 after recovering from earlier lows but remained below its daily high of $122,500, according to CoinGecko data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink ETF Set to Debut as LINK Slips Amid Market Weakness

Striking baristas win $38.9 million in compensation, yet contract disputes continue

- Starbucks settles NYC Fair Workweek Law violations for $38.9M, including $35.5M restitution to 15,000+ workers. - Striking baristas demand collective bargaining amid ongoing labor disputes and unionization efforts at 550 stores. - Mayor-elect Mamdani and Sen. Sanders join protests, framing demands as moral issues against corporate resistance. - Settlement addresses 500,000 scheduling violations since 2021, with workers receiving $50/week compensation. - Starbucks defends labor law complexity but faces cr

Alphabet's AI-driven ecosystem accelerates flywheel momentum, driving shares up by 68% in 2025

- Alphabet's stock surged 68% in 2025, outperforming peers like Microsoft and Nvidia , driven by strong AI monetization and cloud growth. - Analysts raised price targets to $375-$335, citing Google Cloud's $15.2B Q3 revenue (34% YoY) and $155B cloud backlog growth. - The company's AI ecosystem spans Search, YouTube, and Workspace, generating premium subscriptions and ad yield through Gemini's 650M MAUs. - Projected cloud revenue could exceed estimates by $40B, but risks include regulatory scrutiny and comp

XRP News Today: Vanguard Changes Position on Crypto ETFs, Pointing to Market Maturity and Increased Demand

- Vanguard Group will enable crypto ETF trading on its platform from December 2, 2025, reversing years of opposition to digital assets. - The firm supports Bitcoin , Ethereum , XRP , and Solana ETFs but excludes memecoins, treating crypto as non-core assets like gold . - Market maturation, $25B+ ETF inflows, and regulatory compliance drive the shift, positioning Vanguard as the last major U.S. broker to adopt crypto ETFs. - The move reflects growing institutional confidence in regulated crypto structures a