Behind the 10.11 Crash: Whales Placed $1.1 Billion Short Positions Three Days in Advance, Profiting $200 Million in a Single Day

Original Title: "The Largest Liquidation Day in Crypto History: The Whale Knife Fight Behind the Scenes—Bears Feast and Leave the Table"

Original Author: Wenser, Odaily

Waking up, I believe I'm not the only one doubting my own eyes.

According to Coinglass data, in the past 24 hours, the total liquidation amount across the network reached $19.133 billions, with as many as 1,618,240 people liquidated. OKX market data shows that BTC once fell to $101,500; ETH once dropped to $3,373; SOL once fell to around $144. For more spot price carnage, see "Night of Panic: Record $19.1 billions Liquidated in a Single Day, Wealth Flows Wildly" and "In the Crash, Who Made Hundreds of Millions by 'Licking Blood from the Knife Edge'? Which Get-Rich-Quick Opportunities Are Close at Hand?"

Although the prices of major mainstream coins have recovered to varying degrees, this is still a feast of wealth for the bears. And the biggest winners who profited handsomely from this extreme market move are undoubtedly a suspected insider trader BTC OG and a crypto whale who opened a nine-figure short position. Odaily will briefly analyze the operations and possible identity of this insider whale in this article.

The Crypto Whale Opened a 10-Figure Short Position, Raking in $200 Million in One Day

Perhaps no one expected such a massive correction after BTC hit a new high, except for some insiders and a few sharp-eyed crypto whales.

Bitcoin OG Whale Opened a Huge Short Position 3 Days in Advance: Operation Record Overview

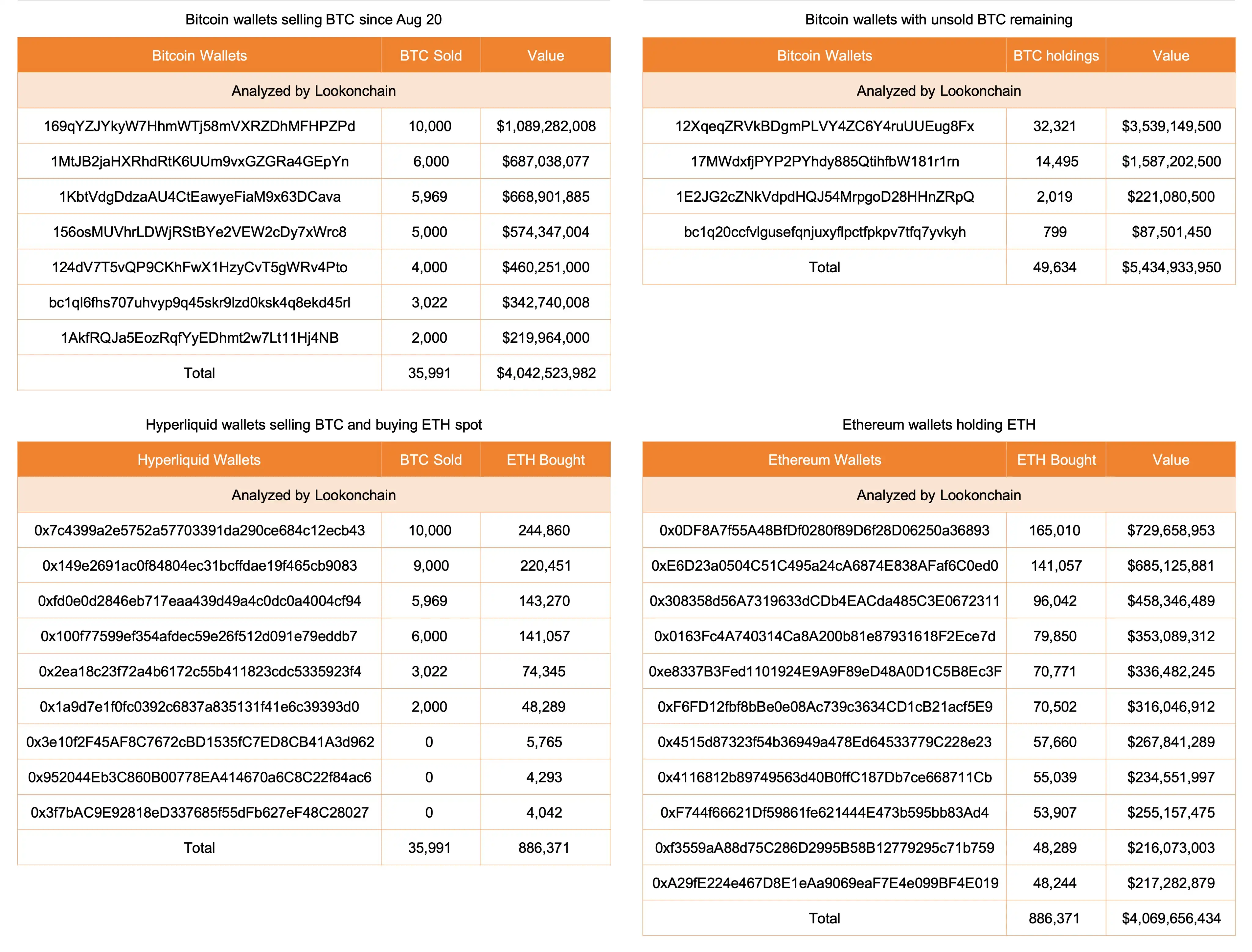

The earliest trading activity of a BTC OG whale, who is currently floating a profit of over $70 million, can be traced back to August 20: According to LookonChain monitoring, since August 20, this trader/institution sold nearly 36,000 BTC on Hyperliquid and bought over 886,000 ETH, when the ETH/BTC exchange rate was 0.0406; in four other wallets, they still hold over 49,000 BTC, worth $5.43 billions.

On October 8, this whale sold another 3,000 BTC, worth $363 million. Among the three related addresses, two have already been cleared; one address still holds

Address list:

bc1pxeg2c8yy5gklex2z8qvmxlwgvf7kzhx07a68xek52kfl0s9dc20qjydsuu (cleared);

0x757f88e931ef4d57c23b306c5a6792fc0d16edb2 (Hyperliquid address, cleared);

0x4f9A37Bc2A4a2861682c0e9BE1F9417Df03CC27C (holding $426 million USDC).

On October 10, this whale began their "insider-style shorting performance"—

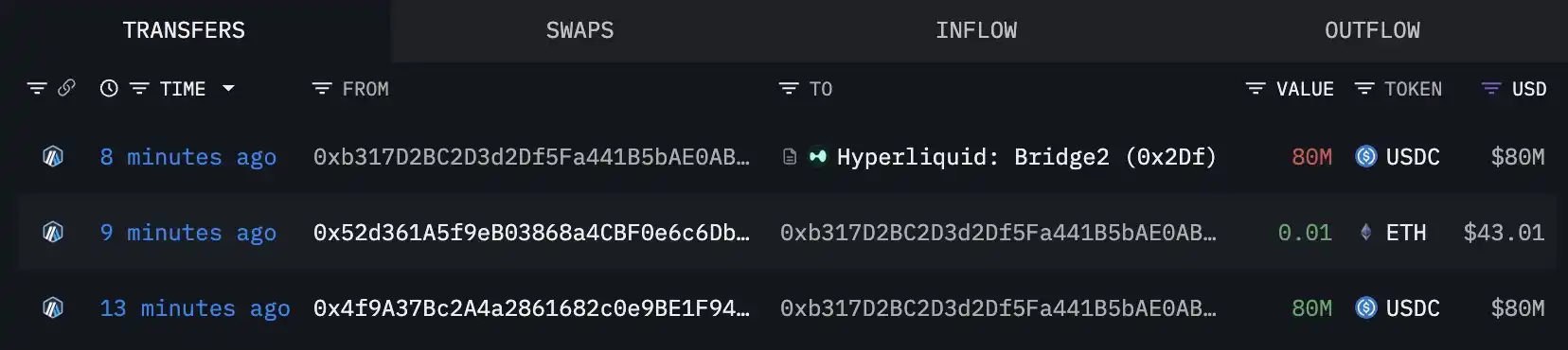

First, they deposited $80 million into Hyperliquid and opened a 6x short position of 3,477 BTC; in addition, they deposited $50 million USDC into Binance. Address: 0xb317D2BC2D3d2Df5Fa441B5bAE0AB9d8b07283ae;

Subsequently, they increased their short position, raising the BTC short position to 3,600 BTC.

Yesterday afternoon, they targeted ETH for shorting, depositing $30 million into Hyperliquid to open a 12x short position of 76,242 ETH. On-chain address can be found here, and this address has now been cleared.

On the evening of the 10th, the whale's short positions continued to increase, once reaching about $1.1 billions, with the BTC short position valued at $752 million and the ETH short position at $353 million.

As the market responded to Trump's renewed tariff war last night and prices fell, the whale's short positions turned profitable, with profits exceeding $27 million at one point;

According to the latest news today, Hypurrsan data shows that the whale who shorted BTC and ETH withdrew $60 million USDC back to Arbitrum, earning $72.33 million in the past 24 hours.

In Extreme Market Conditions, Hyperliquid Emerges as a Winner Again, HLP's Single-Day Profit Exceeds $40 Million

In addition, according to on-chain analyst @mlmabc, the whale's single-day profit on Hyperliquid was about $190 million to $200 million; meanwhile, in these extreme market conditions, Hyperliquid also took a share: HLP's single-day profit reached $40 million; annualized interest rate soared to 190%; overall capital return reached 10-12%.

The Insider Whale's Hidden Identity: Possibly Related to Trend Research?

As for the whale's background, there is currently no definitive conclusion.

However, according to Lookonchain analysis, the Bitcoin OG who made a high-profile switch to Ethereum may be associated with Trend Research under Yilihua. The evidence is that wallet 0x52d3 previously sent 0.1 ETH to this Bitcoin OG address as gas fee, and later deposited 1.31 million USDC to Trend Research's Binance deposit address.

Odaily will continue to follow up on market dynamics and more information about this crypto whale/institution.

Original link

Click to learn about job openings at BlockBeats

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

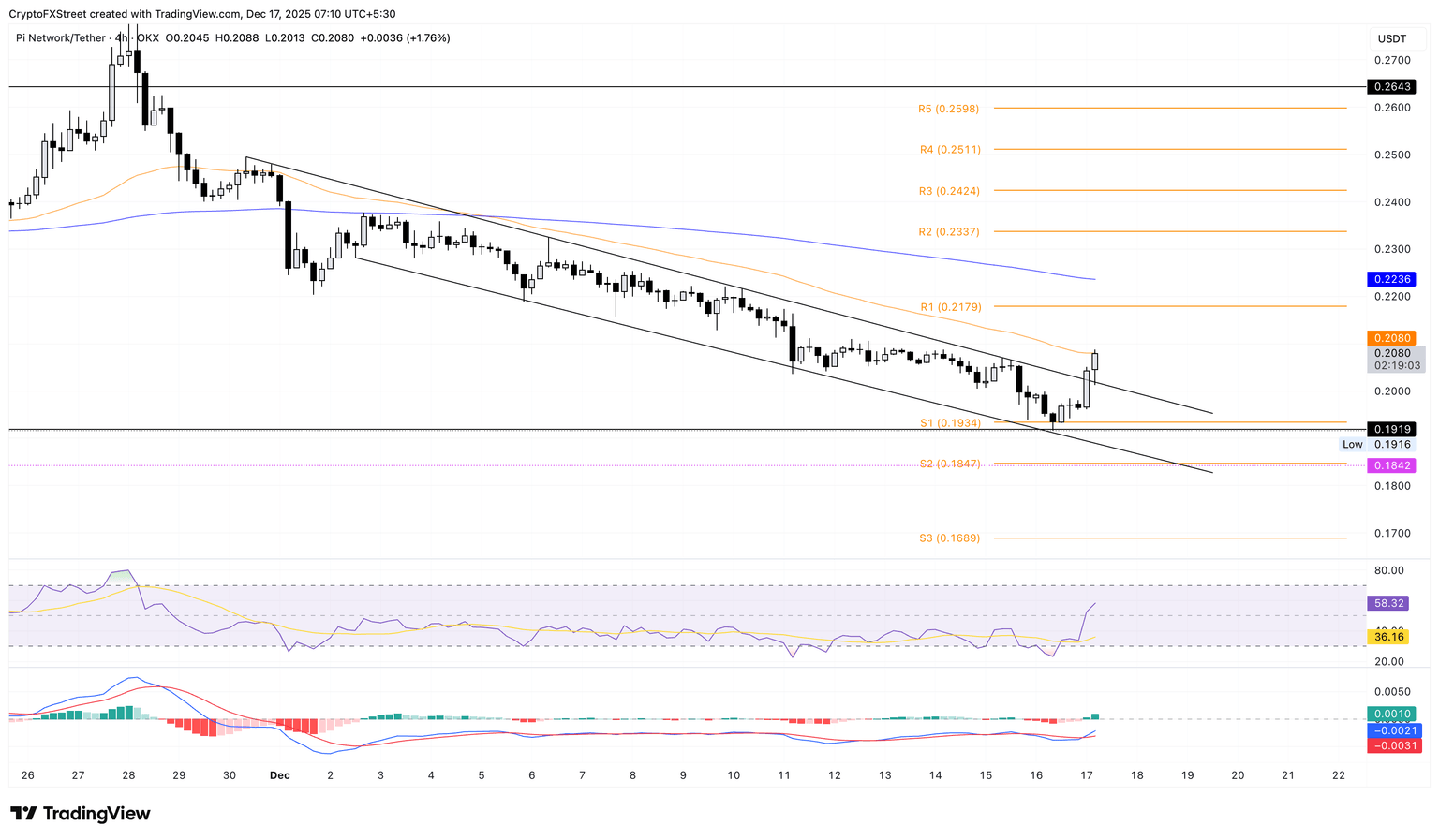

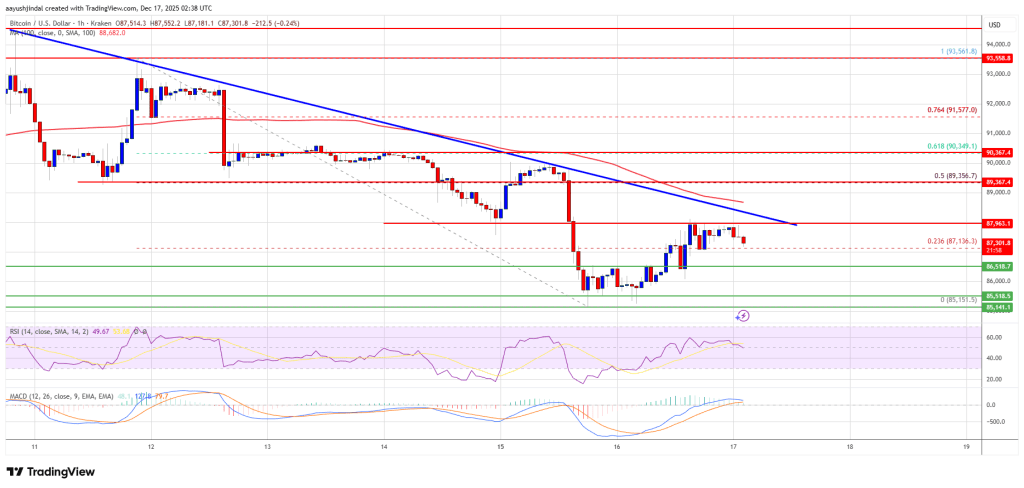

Bitcoin price regroups after decline—Is a directional breakout imminent?

Two main reasons why the current decline of ONDO is only temporary.