Is this the real reason behind the $20 billion liquidation in the crypto market?

October 11, 2025, was a nightmare for crypto investors around the world.

The price of bitcoin plummeted from a high of $117,000, falling below $110,000 within hours. Ethereum's drop was even more brutal, reaching 16%. Panic spread through the market like a virus, with many altcoins crashing 80–90% in an instant. Even after a slight rebound, most still fell by 20% to 30%.

In just a few hours, hundreds of billions of dollars evaporated from the global crypto market capitalization.

On social media, wails of despair echoed in languages from all over the world, merging into a single dirge. But beneath the surface panic, the real transmission chain was far more complex than it appeared.

The starting point of this crash was a single sentence from Trump.

On October 10, US President Trump announced via his social media that starting November 1, the US would impose an additional 100% tariff on all imported goods from China. The wording of this message was exceptionally tough. He wrote that US-China relations had deteriorated to the point of "no need for meetings," and that the US would retaliate through financial and trade means, justifying this new tariff war by citing China's monopoly on rare earths.

After the news broke, global markets instantly lost balance. The Nasdaq plunged 3.56%, marking a rare single-day drop in recent years. The US dollar index fell 0.57%, crude oil plummeted 4%, and copper prices dropped in tandem. Global capital markets fell into panic selling.

In this epic liquidation, the popular stablecoin USDe became one of the biggest casualties. Its depegging, along with the high-leverage loop lending system built around it, collapsed within hours.

This localized liquidity crisis quickly spread. A large number of investors using USDe for loop lending were liquidated, and USDe began to depeg across all platforms.

Even worse, many market makers also used USDe as contract margin. When USDe's value was nearly halved in a short time, their positions' leverage passively doubled. Even seemingly safe 1x leveraged long positions could not escape liquidation. The double whammy of small-cap contracts and USDe price collapse caused market makers to suffer heavy losses.

How Did the Dominoes of "Loop Lending" Fall?

The Temptation of 50% APY Returns

USDe, launched by Ethena Labs, is a "synthetic dollar" stablecoin. With a market cap of about $14 billion, it has risen to become the world's third-largest stablecoin. Unlike USDT or USDC, USDe does not have equivalent dollar reserves, but instead relies on a strategy called "delta-neutral hedging" to maintain price stability. It holds spot Ethereum while shorting an equivalent amount of Ethereum perpetual contracts on derivatives exchanges, using hedging to offset volatility.

So, what attracted the flood of capital? The answer is simple: high returns.

Staking USDe itself can yield an annualized return of about 12% to 15%, coming from the funding rate of perpetual contracts. In addition, Ethena has partnered with multiple lending protocols to provide extra rewards for USDe deposits.

What really sent yields soaring was "loop lending." Investors repeatedly operated within lending protocols: collateralizing USDe, borrowing other stablecoins, exchanging them back to USDe, and depositing again. After several rounds, the principal was magnified nearly fourfold, and annualized returns rose to the 40% to 50% range.

In traditional finance, an annualized return of 10% is already rare. The 50% return offered by USDe loop lending was almost irresistible for profit-seeking capital. As a result, funds kept pouring in, and the USDe deposit pools of lending protocols were often "full." Whenever new capacity was released, it would be snapped up instantly.

USDe's Depegging

Trump's tariff comments triggered global market panic, and the crypto market entered "risk-off mode." Ethereum plunged 16% in a short time, directly shaking the balance that USDe relied on. But what truly triggered USDe's depegging was the liquidation of a large institution on Binance.

Crypto investor and Primitive Ventures co-founder Dovey speculated that the real trigger was the liquidation of a large institution using cross-margin mode on Binance (possibly a traditional trading firm using cross-margin). This institution used USDe as cross-margin. When the market fluctuated violently, the liquidation system automatically sold USDe to repay debts, causing its price on Binance to plummet to $0.6 at one point.

USDe's stability originally depended on two key conditions. First, a positive funding rate: in a bull market, short sellers pay fees to long holders, allowing the protocol to profit. Second, sufficient market liquidity to ensure users could always redeem USDe at close to $1.

But on October 11, both conditions collapsed simultaneously. Market panic caused short sentiment to surge, and the perpetual contract funding rate quickly turned negative. The protocol's large short positions shifted from being "fee receivers" to "fee payers," requiring ongoing payments that directly eroded collateral value.

Once USDe began to depeg, market confidence quickly collapsed. More people joined the sell-off, prices continued to fall, and a vicious cycle was fully formed.

The Liquidation Spiral of Loop Lending

In lending protocols, when a user's collateral value drops to a certain level, smart contracts automatically trigger liquidation, forcibly selling the user's collateral to repay their debt. When USDe's price fell, the health of positions with multiple times leverage through loop lending quickly dropped below the liquidation threshold.

The liquidation spiral was thus set in motion.

Smart contracts automatically sold the liquidated users' USDe on the market to repay their borrowed debts. This further increased the selling pressure on USDe, causing its price to fall even more. The price drop then triggered more loop lending position liquidations. This is a classic "death spiral."

Many investors may not have realized until the moment of liquidation that their so-called "stablecoin wealth management" was actually a high-leverage gamble. They thought they were just earning interest, but did not realize that loop lending had multiplied their risk exposure several times. When USDe's price fluctuated violently, even those who considered themselves conservative investors could not escape liquidation.

Market Maker Liquidations and Market Collapse

Market makers are the "lubricants" of the market, responsible for placing orders and matching trades, providing liquidity for various crypto assets. Many market makers also used USDe as margin on exchanges. When USDe's value plummeted in a short time, the value of these market makers' margin shrank sharply, causing their positions on exchanges to be forcibly liquidated.

Statistics show that this crypto market crash resulted in liquidation volumes of tens of billions of dollars. Notably, most of this amount did not just come from retail speculative positions, but also from a large number of institutional market makers' and arbitrageurs' hedged positions. In the case of USDe, these professional institutions originally used sophisticated hedging strategies to avoid risk, but when USDe, regarded as a "stable" margin asset, suddenly crashed, all risk control models failed.

On derivatives platforms like Hyperliquid, a large number of users were liquidated. The platform's HLP (liquidity provider vault) holders made a 40% profit overnight, with profits soaring from $80 million to $120 million. This figure indirectly proves the massive scale of the liquidations.

When market makers are collectively liquidated, the consequences are disastrous. Market liquidity is instantly drained, and bid-ask spreads widen sharply. For small-cap, already illiquid altcoins, this means prices collapse even faster on top of the general market drop due to lack of liquidity. The entire market fell into panic selling, and a crisis triggered by a single stablecoin eventually evolved into a systemic collapse of the entire market ecosystem.

The Echoes of History: The Shadow of Luna

This scene felt eerily familiar to investors who experienced the 2022 bear market. In May of that year, a crypto empire called Luna collapsed in just seven days.

The core of the Luna incident was an algorithmic stablecoin called UST. It promised up to 20% annualized returns, attracting tens of billions of dollars. But its stability mechanism relied entirely on market confidence in another token, LUNA. When UST depegged due to massive sell-offs, confidence collapsed, the arbitrage mechanism failed, and LUNA tokens were minted infinitely, causing the price to fall from $119 to less than $0.0001. About $60 billion in market value vanished.

Comparing the USDe incident to Luna, we can see striking similarities. Both used abnormally high yields as bait to attract large amounts of capital seeking stable returns. Both exposed the fragility of their mechanisms in extreme market conditions, and both ultimately fell into a "price drop, confidence collapse, liquidation sell-off, further price drop" death spiral.

Both evolved from a crisis of a single asset into systemic risk affecting the entire market.

Of course, there are some differences. Luna was a purely algorithmic stablecoin with no external asset backing. USDe, on the other hand, is over-collateralized with crypto assets like Ethereum. This gave USDe stronger resistance in a crisis than Luna, which is why it did not go to zero like Luna did.

In addition, after the Luna incident, global regulators issued red cards to algorithmic stablecoins, meaning USDe has lived in a much stricter regulatory environment since its inception.

However, it seems not everyone has learned from history. After Luna's collapse, many swore they would "never touch algorithmic stablecoins again." But just three years later, faced with USDe loop lending's 50% annualized returns, people once again forgot about risk.

Even more alarming, this incident exposed not only the fragility of algorithmic stablecoins, but also the systemic risks of institutional investors and exchanges. From Luna's blowup to the FTX collapse, from the chain liquidations of small and medium exchanges to the SOL ecosystem crisis, this path was already walked in 2022. Yet three years later, large institutions using cross-margin still used high-risk assets like USDe as margin, ultimately triggering a chain reaction during market volatility.

The philosopher George Santayana once said: "Those who cannot remember the past are condemned to repeat it."

Respect the Market

There is an unbreakable iron law in financial markets: risk and return are always proportional.

USDT or USDC can only offer lower annualized returns because they are backed by real dollar reserves and carry extremely low risk. USDe can offer 12% returns because it bears the potential risk of the delta-neutral hedging strategy in extreme situations. USDe loop lending can offer 50% returns because it adds four times the leverage risk on top of the base yield.

If someone promises you "low risk, high return," they are either a fraud or you haven't yet understood where the risk lies. The danger of loop lending is its hidden leverage. Many investors do not realize that their repeated collateralized lending operations are actually a high-leverage speculative activity. Leverage is a double-edged sword: it can amplify your gains in a bull market, but will also double your losses in a bear market.

Financial market history has repeatedly proven that extreme situations will inevitably occur. Whether it was the 2008 global financial crisis, the March 2020 market crash, or the 2022 Luna collapse, these so-called "black swan" events always arrive when people least expect them. The fatal flaw of algorithmic stablecoins and high-leverage strategies is that their very design is a bet that extreme situations won't happen. It's a game destined to lose.

Why do so many people rush in despite knowing the risks? Human greed, luck, and herd mentality may explain part of it. In a bull market, continuous success numbs people's risk awareness. When everyone around you is making money, few can resist the temptation. But the market will always remind you in the cruelest way: there is no free lunch.

For ordinary investors, how can you survive in this stormy sea?

First, learn to identify risk. When a project promises more than 10% "stable" returns, when its mechanism is so complex you can't explain it to a layperson in one sentence, when its main use is to earn yield rather than practical application, when it lacks transparent, verifiable fiat reserves, and when it's being hyped on social media, you should be on high alert.

The principles of risk management are simple and eternal. Don't put all your eggs in one basket. Don't use leverage, especially hidden high-leverage strategies like loop lending. Don't fantasize that you can get out before a crash—when Luna collapsed, 99% of people didn't escape.

The market is far smarter than any individual. Extreme situations will happen. When everyone is chasing high returns, that's often when risk is greatest. Remember Luna's lesson: $60 billion in market value went to zero in seven days, and hundreds of thousands lost their savings. Remember the panic of October 11: $280 billion evaporated in hours, countless people were liquidated. Next time, this story could happen to you.

Buffett said: "Only when the tide goes out do you discover who's been swimming naked."

In a bull market, everyone seems like an investment genius, and 50% returns seem within easy reach. But when extreme situations occur, you realize you've been standing on the edge of a cliff all along. Algorithmic stablecoins and high-leverage strategies have never been "stablecoin wealth management"—they are high-risk speculative tools. The 50% return is not a "free lunch," but bait on the edge of a cliff.

In financial markets, surviving is always more important than making money.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

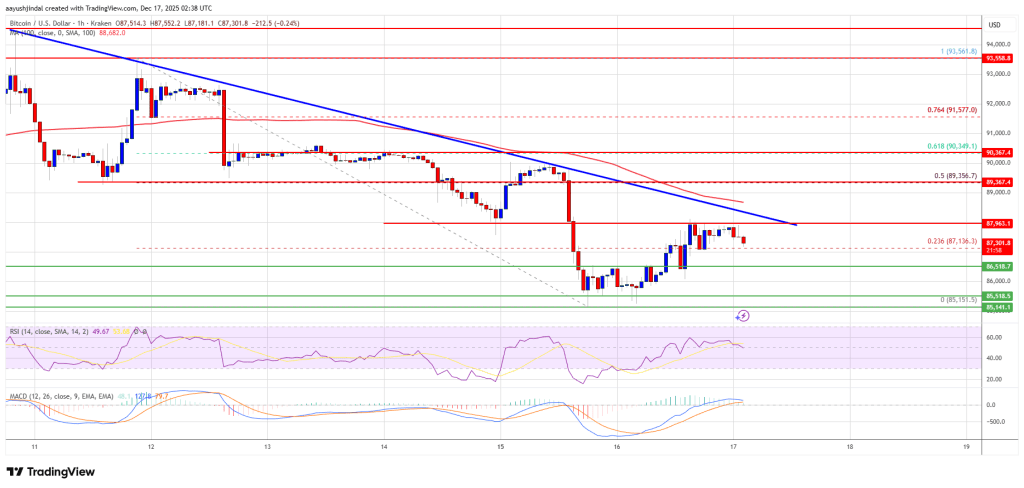

Bitcoin price regroups after decline—Is a directional breakout imminent?

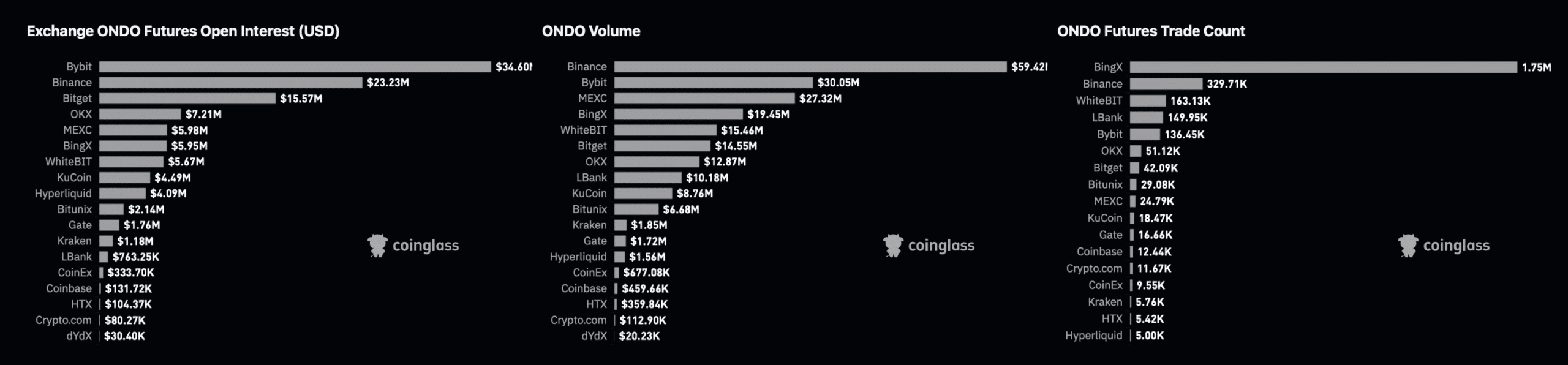

Two main reasons why the current decline of ONDO is only temporary.

Mapping 2 reasons why ONDO’s current dip is only temporary