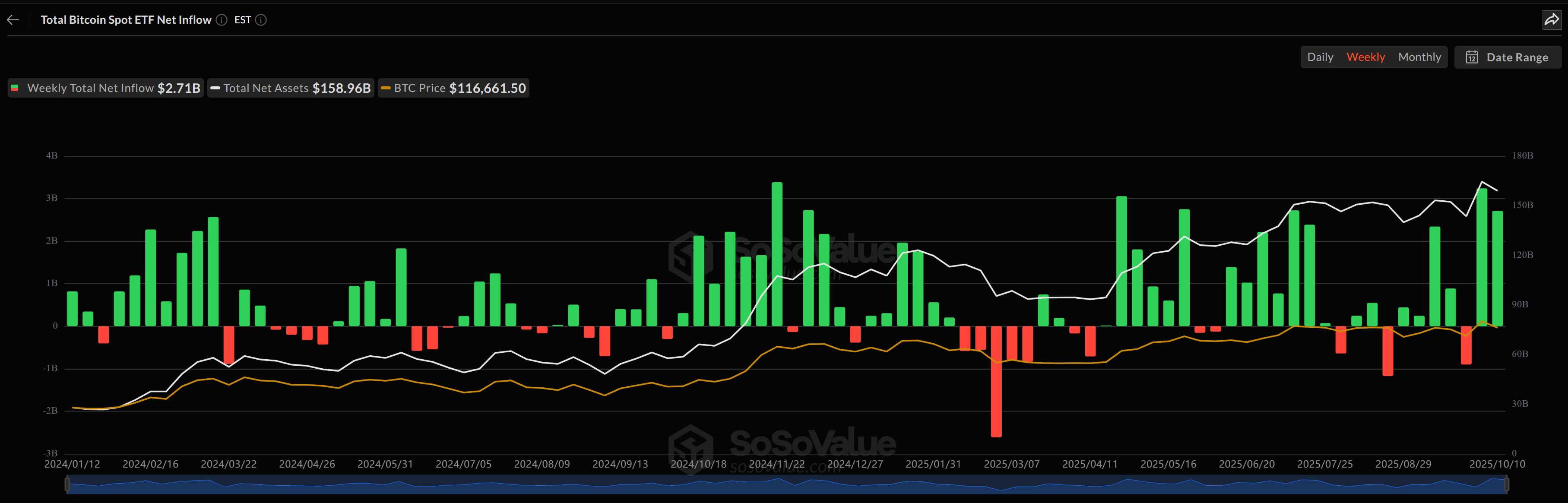

Spot Bitcoin ETFs recorded $2.71 billion in weekly inflows as institutional demand strengthened, pushing total ETF assets to $158.96 billion (about 7% of Bitcoin’s market cap). This inflow surge reflects concentrated daily flows, with Monday and Tuesday accounting for the largest net additions.

-

Weekly inflows of $2.71B into spot Bitcoin ETFs

-

ETF assets under management rose to $158.96B, ~7% of Bitcoin market cap

-

Monday and Tuesday net inflows totaled $2.08B, with a small $4.5M outflow on Friday after tariff comments

Bitcoin ETFs weekly inflows: Spot Bitcoin ETFs logged $2.71B this week — read the analysis and what it means for institutional demand and market momentum.

US spot Bitcoin ETFs logged $2.71 billion in weekly inflows, even as a president’s tariff comments triggered a brief market outflow.

What caused US spot Bitcoin ETFs to log $2.71 billion in weekly inflows?

Spot Bitcoin ETFs saw $2.71 billion in weekly inflows driven by concentrated institutional purchases and strong early-week momentum. Funds recorded a combined $2.08 billion on Monday and Tuesday, lifting total ETF assets under management to $158.96 billion and reinforcing the narrative of growing allocation to digital assets.

How concentrated were the daily inflows and which funds led the week?

Monday provided the largest single-day injection at $1.21 billion, the second-largest since launch. Tuesday added $875.61 million. BlackRock’s IBIT reported the largest daily inflow at $74.2 million and holds $65.26 billion cumulatively across spot Bitcoin ETFs.

Spot Bitcoin ETFs see weekly inflows. Source: SoSoValue

Spot Bitcoin ETFs see weekly inflows. Source: SoSoValue

Why did Bitcoin ETFs record a $4.5 million outflow on Friday?

On Friday, a $4.5 million net outflow occurred after public comments about imposing a 100% tariff on China triggered short-lived market jitters. The outflow was small relative to weekly inflows and reflected short-term risk re-pricing rather than a change in long-term allocation trends.

Which funds experienced notable inflows or outflows?

BlackRock’s IBIT led net inflows for the day with $74.2 million. Fidelity’s FBTC recorded a $10.18 million outflow, and Grayscale’s GBTC posted a $19.21 million outflow. These moves show rotation among product providers amid volatile daily headlines.

How significant is ETF AUM relative to Bitcoin’s market cap?

Spot Bitcoin ETFs reported $158.96 billion in assets under management as of Friday, representing nearly 7% of Bitcoin’s total market capitalization. That concentration highlights the growing role of institutional ETF allocation in overall market liquidity and price discovery.

What does the recent surge in ETF filings indicate for the market?

Over the past two months, 31 crypto ETF applications were submitted to the U.S. Securities and Exchange Commission, with 21 filed in the first eight days of October. Market commentators have described this volume as a potential opening of the “floodgates” for crypto ETFs; as of late August, nearly 100 crypto-related products were awaiting SEC decisions (source: industry commentary by James Seyffart).

Frequently Asked Questions

How do ETF inflows affect Bitcoin price and liquidity?

ETF inflows generally increase spot demand and can improve market liquidity, narrowing spreads and supporting price discovery. However, short-term price moves may still react to macro headlines and geopolitical developments.

What does ‘Uptober’ mean for institutional adoption?

‘Uptober’ refers to the surge in crypto ETF activity and filings in October, signaling heightened institutional interest and potential acceleration of mainstream adoption if regulatory approvals continue.

Key Takeaways

- Large weekly inflows: Spot Bitcoin ETFs netted $2.71B, highlighting robust institutional demand.

- AUM significance: ETF assets reached $158.96B, roughly 7% of Bitcoin’s market cap, underscoring growing ETF influence.

- Short-term volatility: A $4.5M outflow on Friday showed sensitivity to geopolitical headlines but did not derail the weekly trend.

Conclusion

Spot Bitcoin ETFs continue to draw substantial institutional capital, with $2.71 billion in weekly inflows and AUM climbing to $158.96 billion. While headline-driven outflows can cause short-term volatility, the dominant trend points to increasing ETF-driven liquidity and allocation. Watch pending ETF filings and regulatory developments for the next phase of market evolution.

Author: COINOTAG • Published: 2025-10-10 • Updated: 2025-10-10