XRP Ledger Adoption Highlights Ripple’s Vision for Global Finance

Quick Take Summary is AI generated, newsroom reviewed. Ripple CEO Brad Garlinghouse says XRP Ledger could process 14% of SWIFT transactions. XRPL may handle $654 trillion in global value in the future. Faster, cheaper, and more transparent cross-border payments are possible. Adoption by banks and businesses could drive demand and XRP’s value.References RIPPLE CEO BRAD GARLINGHOUSE CONFIRMS THE #XRP LEDGER IS SET TO HANDLE 14% OF SWIFT'S GLOBAL TRANSACTIONS! THAT COULD TRANSLATE TO OVER $100 PER XRP!

Ripple CEO Brad Garlinghouse made big news at a recent event. He said the XRP Ledger (XRPL) could soon handle 14% of SWIFT’s global transactions, as shared by JackTheRippler. This is a huge step for cross-border payments and could change the way money moves around the world.

🚨RIPPLE CEO BRAD GARLINGHOUSE CONFIRMS THE #XRP LEDGER IS SET TO HANDLE 14% OF SWIFT’S GLOBAL TRANSACTIONS! THAT COULD TRANSLATE TO OVER $100 PER XRP!

— JackTheRippler ©️ (@RippleXrpie) October 11, 2025

THE XRP LEDGER NOW STANDS AT THE EDGE OF A MULTI-TRILLION-DOLLAR REVOLUTION, WITH AN ESTIMATED $654.39 TRILLION IN GLOBAL VALUE… pic.twitter.com/UWdS5QThnZ

Garlinghouse explained that SWIFT has long been the main system for banks. But the XRP Ledger offers a faster and cheaper alternative. He said that it can settle transactions in seconds, while SWIFT usually takes hours or days. This speed could save banks a lot of time and money.

A $654 Trillion Opportunity

The XRP Ledger is not just faster. Garlinghouse also estimated that $654.39 trillion in value could flow through XRPL in the future. This number includes payments, settlements and even other global transactions.

If even a small part of that value moves through XRPL, it could have a big impact on the cryptocurrency. Some analysts say this could raise XRP’s price greatly, maybe over $100 per coin. This shows how financial adoption can affect digital assets.

How This Could Change Finance

XRP Ledger adoption could make cross-border payments simpler. Banks could avoid long delays and high fees and transactions would be more transparent and easier to track.

Furthermore, XRPL’s ledger is decentralized, meaning no single company controls it. It also allows tokenization of real-world assets. Basically, this could help banks and companies move money or assets in new ways.

Garlinghouse said Ripple is working with financial institutions to explore these possibilities. Many banks are already testing XRPL for real transactions. This shows growing trust in blockchain technology.

What It Means for Investors

For crypto investors, this news is exciting, because if XRPL handles even part of SWIFT’s volume, demand for XRP could rise. Increased adoption usually leads to higher liquidity and value.

However, there are still some challenges. Wider adoption depends on regulatory approval and technical integration with banks. Also, cryptocurrencies remain volatile, so prices can move quickly.

Despite this, Ripple’s plan signals a strong future for XRP. Investors and traders are watching closely to see how it all unfolds.

How XRPL Could Transform Finance

Ripple is setting up XRP Ledger as a major player in global finance. If Garlinghouse’s predictions are correct, XRPL could handle billions of dollars in daily transactions and could change cross-border payments forever. Banks and businesses will need to test and adopt XRPL systems, meanwhile investors will track its adoption and price.

One thing is pretty clear, that Ripple is aiming high with this XRP Ledger adoption. XRP Ledger is at the edge of a potential multi-trillion-dollar revolution. And as more value moves through XRPL, the world will see how digital payments can reshape global finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genius Terminal Hits Record $650M Single-Day Volume as EVM Chains Drive Surge

SUI Weathers Extended Shutdown with Minimal Price Impact

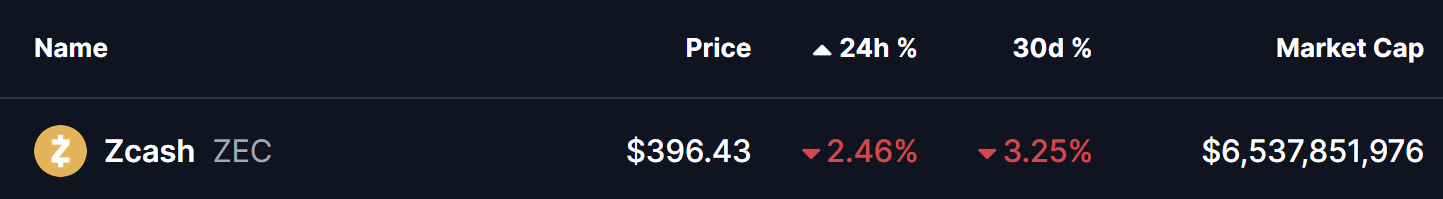

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!