Pudgy Penguins waddle higher despite overall NFT sales slump

DX Terminal and Pudgy Penguins are hot despite the overall coolness of the NFT (non-fungible token) market.

- NFT sales dropped 34% to $169.7M, but transactions rose by 1.99% to 1,920,271.

- DX Terminal topped collections with $13M in sales, up over 50% this week.

- Ethereum led with $86M NFT sales, though buyers fell more than 80% overall.

According to CryptoSlam data, NFT sales volume has dropped by 33.56% to $169.7 million, down from last week’s $256.9 million.

The pullback has been more severe for market participants, with NFT buyers plummeting by 75.68% to 168,946 and sellers falling by 73.94% to 152,283. Specific NFT collections (i.e. DX Terminal and Pudgy Penguins) bucked the trend.

Bitcoin’s ( BTC ) price has retreated to the $112,000 level following last week’s rally. Ethereum ( ETH ) has also pulled back to $3,700 from its recent highs. The global cryptocurrency market cap has dropped to $3.78 trillion, down from last week’s $4.2 trillion valuation.

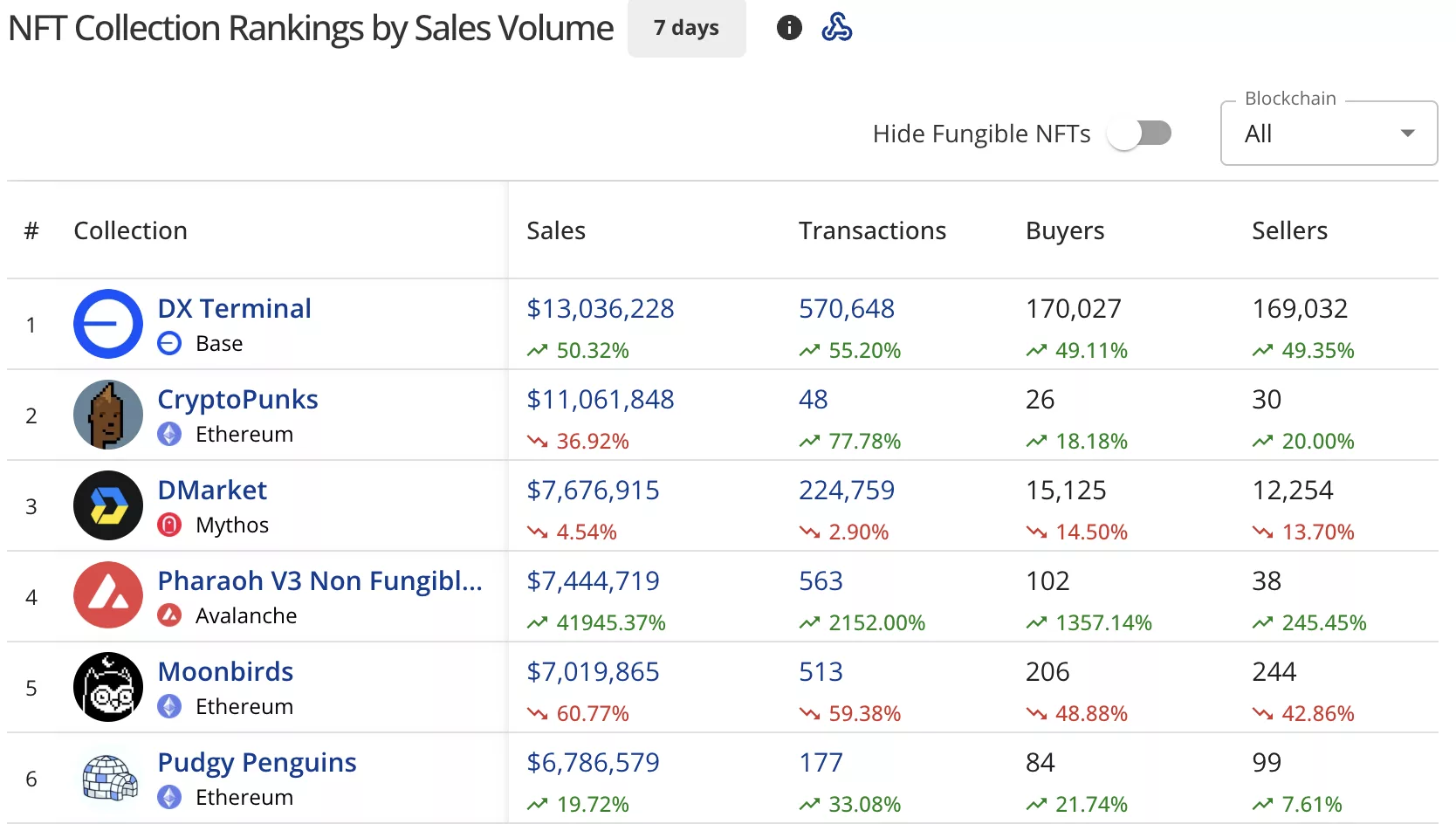

DX Terminal dominates NFT collections

DX Terminal on the Base blockchain has taken the top spot with $13.03 million in sales, up 50.20%. The collection processed 570,066 transactions and attracted 169,973 buyers and 168,979 sellers.

CryptoPunks fell to second place with $11.06 million in sales, down 36.92% from last week’s $17.33 million. The Ethereum collection saw 48 transactions with 26 buyers and 30 sellers.

DMarket maintained third position at $7.72 million, down 3.33% from last week’s $7.95 million. The Mythos-based collection recorded 225,129 transactions.

Pharaoh V3 Non Fungible on Avalanche ( AVAX ) surged into fourth place with $7.34 million in sales, posting a massive 41,365.84% jump. The collection had 554 transactions with 101 buyers and 38 sellers.

Source: Top collections by NFT Sales Volume (CryptoSlam)

Source: Top collections by NFT Sales Volume (CryptoSlam)

Moonbirds dropped to fifth with $7.01 million, down 60.89% from last week’s $18.72 million. The collection processed 512 transactions with 205 buyers and 243 sellers.

Pudgy Penguins claimed sixth place at $6.63 million, up 16.98% from last week’s $5.67 million. The Ethereum collection witnessed 172 transactions, involving 81 buyers and 97 sellers.

Bored Ape Yacht Club rounded out the top seven with $5.30 million, up 90.38%. The collection recorded 174 transactions with 103 buyers and 91 sellers.

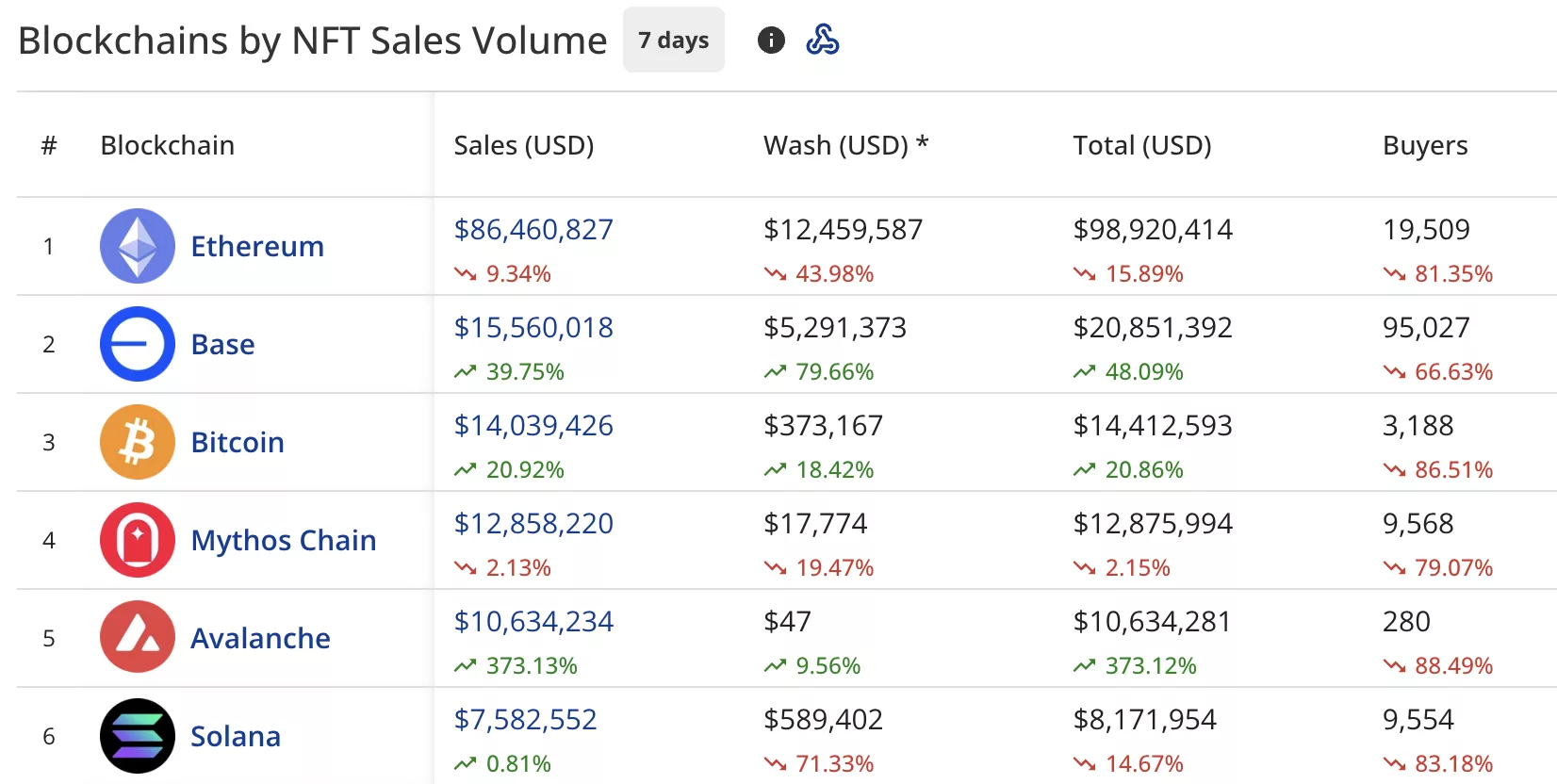

Ethereum maintains lead despite decline

Ethereum remained the leading blockchain for NFT sales with $86.46 million, down 9.34% from last week’s $97.4 million.

The network recorded $12.46 million in wash trading, bringing its total to $98.92 million. Buyers dropped sharply by 81.35% to 19,509.

Base held second position with $15.56 million, up 39.75% from last week’s $10.92 million. The blockchain recorded $5.29 million in wash trading, with buyers falling 66.63% to 95,027.

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Bitcoin climbed to third with $14.04 million, up 20.92% from last week’s $10.97 million. The network saw 3,188 buyers, down 86.51%.

Mythos Chain placed fourth at $12.86 million, down 2.13% from last week’s $13.07 million. The blockchain attracted 9,568 buyers, a 79.07% decrease.

Avalanche jumped to fifth with $10.63 million, surging 373.13%. The blockchain had just 280 buyers, down 88.49%.

Solana ( SOL ) secured sixth place with $7.58 million, up 0.81% from last week’s $7.74 million. The network recorded 9,554 buyers, a decrease of 83.18%.

Top collectible sales

- A Protoshrooms NFT led individual sales at $470,760.50 (3.7811 BTC), sold five days ago.

- CryptoPunks #9205 sold for $416,002.50 (92.5 ETH) seven days ago.

- Wrapped Ether Rock #91 fetched $380,000 (380,000 USDC) six days ago.

- CryptoPunks #3390 sold for $279,243.03 (59.68 ETH) four days ago.

- CryptoPunks #9968 sold for $259,739.06 (58 ETH) three days ago.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: The Tokenomics Debate in Crypto: Inflationary Releases Compared to Growth Fueled by Utility

- Hyperliquid's $314M HYPE token unlock risks market volatility, echoing past destabilizing token releases and triggering investor anxiety over inflationary pressures. - Enlivex Therapeutics raised $212M via private placement for RAIN token-based treasury, with RAIN surging 115% as its utility-driven model contrasts inflationary strategies. - Ethereum fell 9% amid bearish indicators, while DeepSnitch AI's $584K presale highlights demand for stability-focused projects amid macroeconomic headwinds and Fed ha

Bitcoin dominance dips to 23.6 fib level, signals potential altcoin rotation

Bitcoin Above $90K: Can This Rally Last?

Bitcoin stays over $90K, but weak demand and low liquidity raise questions about the rally’s strength.Low Liquidity Adds to Market FragilityShort-Covering: Fuel or Flaw?

U.S. Sanctions Spark Venezuela's Crypto Restrictions and Disrupt Energy Industry

- U.S. sanctions and military pressure drive Venezuela's intensified crypto crackdown, targeting foreign oil partners like Chevron amid geopolitical tensions. - Global crypto trends emerge as Turkmenistan plans state-controlled trading (2026) and Tether exits Uruguay, highlighting regulatory challenges for digital assets. - Chevron faces operational risks in Venezuela due to FTO designation, compliance hurdles, and supply chain disruptions after U.S. naval actions block Russian naphtha shipments. - U.S. mi