Bitcoin, Ethereum Rebound as Trump Contains China Chaos to the Weekend

Trump’s measured China comments fueled a swift Bitcoin and Ethereum rebound after Friday’s market chaos, hinting at a deliberate de-escalation that steadied investor sentiment before Wall Street’s open.

The Trump-China drama may have been perfectly timed because Donald Trump struck a calm, almost rehearsed tone after Friday’s sudden market crash, before TradFi markets open on Monday.

Crypto is often caught holding the ball as President Trump’s market-moving announcements tend to come on Friday, almost sparing stocks from the carnage.

Trump Calms China Fears, Fuels Bitcoin and Ethereum Recovery

Global markets could be steady by Monday morning, and crypto, which absorbed the shock over the weekend, is already leading the rebound.

Bitcoin was approaching the $115,000 mark, while Ethereum reclaimed $4,100, following Trump’s comments on Truth Social, which eased China fears. Investors interpreted his remarks as deliberate de-escalation after a politically charged sell-off.

“Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment… The USA wants to help China, not hurt it,” Trump noted.

The timing raised familiar eyebrows. The plunge came late Friday, just as Wall Street shut for the weekend, leaving only 24/7 crypto markets to process the fallout.

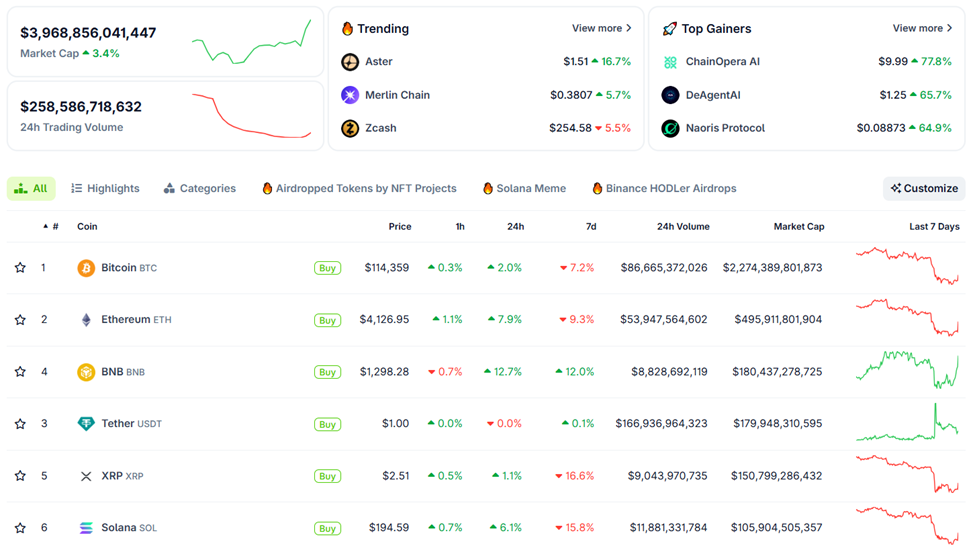

Indeed, markets are already on a rebound, with Bitcoin trading for $114,359 as of this writing, while Ethereum has already reclaimed the $4,100 mark. Notably, Ethereum is up by over 20% from its Friday low.

Crypto Markets on the Rebound. Source:

Crypto Markets on the Rebound. Source:

Sentiment is already flipping, and equities could open Monday largely unscathed. Many traders now suspect that Trump prefers weekend volatility, allowing crypto markets to bleed privately before the S&P 500 can react.

The White House also pointed to Trump’s softer stance, with reports indicating that Vice President JD Vance revealed his boss’s willingness to be a reasonable negotiator with China.

Similarly, White House officials reportedly suggested that markets would “calm down this week.” With crypto markets showing strength, traders may read this as a green light for risk assets.

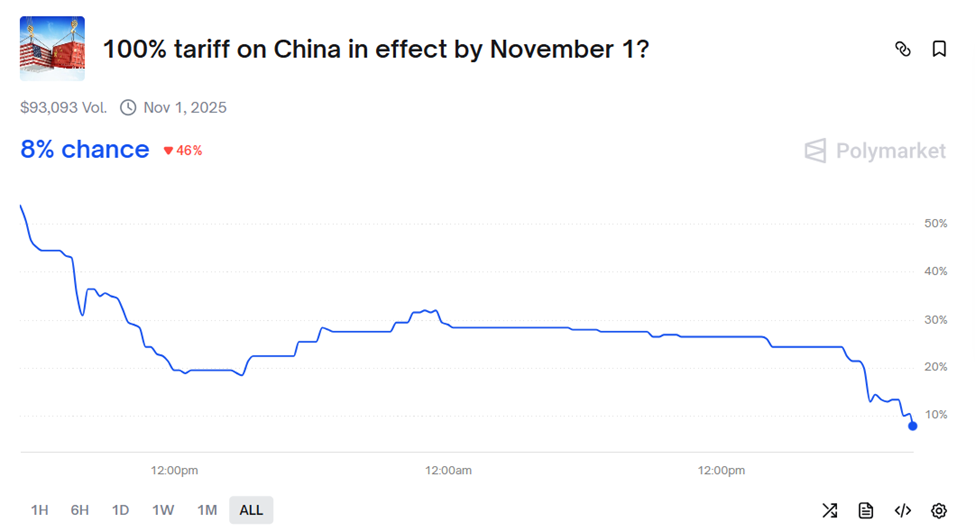

100% Tariff on China in Effect by November 1?

On whether Trump will impose a 100% tariff on China by November 1, Polymarket bettors see a measly 8% chance. This marks a significant drawdown from minutes before Trump’s announcement on Truth Social, where the odds stood at 26%.

Trump China 100% Tariffs by November 1. Source:

Trump China 100% Tariffs by November 1. Source:

The change points to de-escalation, implying most participants see Trump’s rhetoric as bluff, not brinkmanship.

Still, for crypto investors, the pattern feels intentional. Crypto trades nonstop, making it the first asset class to price in sudden political shocks, and the easiest to shake out leveraged players before calmer Monday headlines appear.

“Liquidating everyone just to push prices to new ATHs would be pretty frustrating… and honestly, it seems likely,” Crypto Rover quipped.

In the same tone, Helius Labs CEO, Mert, said the crypto markets are an oracle for Trump’s social media mood.

Whether orchestrated or coincidental, the weekend whiplash reflects how deeply political theater now intersects with digital assets. Trump crashes the market on Friday, calms it by Sunday, and the S&P may never even flinch, only Bitcoin does.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster DEX's Tactical Enhancement and What It Means for DeFi Liquidity Providers

- Aster DEX's 2025 upgrade introduces ASTER token collateral for leveraged trading, enhancing capital efficiency and reducing reliance on stablecoins. - The upgrade offers 5% fee discounts for ASTER collateral users, creating a flywheel effect that boosts token scarcity and protocol revenue. - By integrating risk management tools and multi-chain support, Aster differentiates itself from GMX and Uniswap V3 through active trading incentives and reduced impermanent loss risks. - CZ's $2M ASTER purchase trigge

Toncoin’s Updated Tokenomics: How Changes in Supply Could Attract Institutional Investors and Transform Cryptocurrency Valuations

- Toncoin's 2025 tokenomics reforms aim to align supply dynamics with institutional infrastructure, boosting real-world utility through staking and burn mechanisms. - Strategic treasury operations and protocol upgrades like Jetton 2.0 seek to stabilize supply while enhancing cross-border payment efficiency and DeFi integration. - Institutional partnerships with Tether , Bitget, and Crypto.com highlight TON's growing appeal as a scalable platform with predictable yield generation for large investors. - TON

Bitcoin Updates: ETF Outflows Push Bitcoin to Lowest Point in Seven Months Amid Market Turmoil

- Bitcoin fell below $83,400, its lowest in seven months, as U.S. spot ETFs saw $3.79B in November outflows, led by BlackRock’s $2.47B loss. - Record $903M single-day ETF redemptions accelerated crypto and equity market selloffs, with Nvidia and crypto stocks dropping sharply. - Ethereum ETFs lost $1.79B, while altcoin funds like Bitwise’s XRP gained $105M, reflecting shifting investor preferences amid liquidity concerns. - Analysts attribute the selloff to macroeconomic uncertainty and delayed Fed rate cu

Dogecoin News Today: Grayscale DOGE ETF Debut May Trigger a Wave of Institutional Interest This November

- Grayscale's DOGE ETF launches Nov 24, aiming to boost institutional adoption of the meme coin amid SEC approval. - BlockDAG's $436M+ presale outpaces ADA/BCH, leveraging hybrid PoW-DAG tech and 3.5M miners to attract 312K holders. - Ethereum faces $2,850 support pressure after FG Nexus sells 11,000 ETH, triggering $170M in 24-hour liquidations. - DOGE hovers near $0.15 support with mixed technical signals, while ETF optimism contrasts with ongoing distribution trends.