Trader Says | Why Did This Epic Market Crash Happen, and When Is the Right Time to Buy the Dip?

October 11, 2025, this date will be etched into crypto history. Triggered by U.S. President Trump’s announcement to restart the trade war, global markets instantly entered panic mode. Starting at 5 a.m., Bitcoin began a near free-fall with almost no support, and the chain reaction quickly spread throughout the entire crypto market.

According to Coinglass data, in the past 24 hours, the total amount of liquidations across the network reached as high as $19.1 billion, with over 1.6 million traders liquidated—both the amount and the number of people have set new records in the ten-year history of crypto contract trading. Some couldn’t sleep all night, some were wiped out overnight, and once again the crypto world staged a “doomsday reboot” amid turbulent waves.

However, why was this liquidation so violent? Has the market bottomed out? BlockBeats has compiled the views of several market traders and well-known KOLs, analyzing this epic liquidation from the perspectives of macro environment, liquidity, and market sentiment, for reference only.

CZ: Buy the Dip

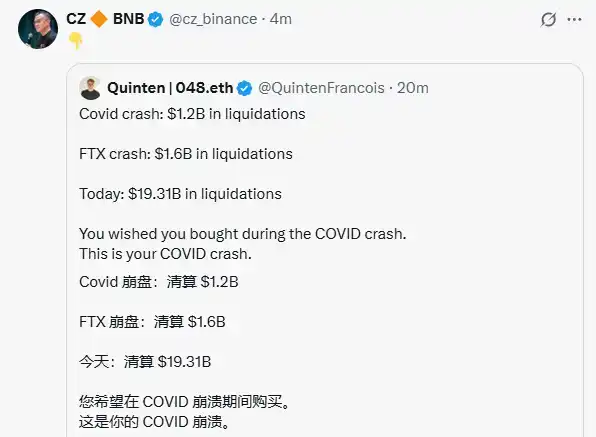

On October 11, CZ reposted the opinion of weRate co-founder Quinten on social media:

“$1.2 billion was liquidated during the COVID crash, $1.6 billion during the FTX crash, and $19.31 billion today. People wish they had bought during the COVID crash, and this is today’s COVID crash.”

Yili Hua (Founder of Liquid Capital)

On October 11, Yili Hua, founder of Liquid Capital (formerly LD Capital), stated that the institution has not yet bought the dip and needs to patiently wait for the situation to become clearer. The drop this time far exceeded previous expectations. This is the first time since calling for ETH that he has fully liquidated (on-chain public), previously only using leveraged lending. There are several reasons worth mentioning:

· First, Bitcoin reached a new high resistance level, and without major positive news to break through, a pullback was inevitable.

· Second, U.S. stocks hit new highs, AI and semiconductor companies played capital games, which cannot be sustained.

· Third, with Japan about to change its prime minister, the risk of rate hikes increases and interest rates keep rising.

· Fourth, altcoins in the crypto space have been in a slow decline, and MEME mania has drained liquidity.

Original link

Vida (Founder of Formula News)

On October 11, Vida, founder of Formula News, posted on social media: “Some time ago, a friend told me there was a sure-win arbitrage opportunity: doing USDE loop lending on Binance, with an annualized rate of about 26%. His institutional friends used $100 million USDT as principal to loop into $500 million USDE for arbitrage within Binance.”

Vida explained that this massive liquidation was likely triggered in a scenario of sharp market decline with low liquidity:

· USDE arbitrageurs’ loop lending positions were forcibly liquidated

· This dragged down the price of USDE

· Resulting in a decrease in the collateral capacity of USDE as a unified account collateral

· Triggering more forced liquidations for market makers using USDE as margin

· Causing financial assets like BNSOL and WBETH to also hit liquidation thresholds.

Although assets like BNSOL and WBETH have high collateral ratios, their value is entirely determined by the order book. Under those conditions, no one was willing to support the peg, leading to price collapse and more liquidations. It can be inferred that some unified accounts used by market makers were also liquidated, which is why many small coins had extremely volatile prices.

Original link

Kyle (Researcher at DeFiance Capital)

On October 11, Kyle, a researcher at DeFiance Capital, posted on social media that, judging by current market sentiment, the last time something like this happened was during the FTX or Celsius crash. This plunge can basically be considered a “cycle-ending event,” but this time BTC and ETH remained rock solid. The evolution of the crypto industry complex is truly astonishing, but altcoins are clearly repeating the same tragedy—despite my repeated warnings over the past few months, I never expected it to be this brutal.

In short, now is not the “best” time to buy the dip, but it is definitely the time when you “should” buy the dip. Extreme panic has been released, and the market is building a bottom, though there may still be room to fall. Looking at the bigger picture, we are definitely closer to the bottom than the top. Asset selection is crucial at this point, as many projects may never recover.

Original link

Benson Sun (Crypto KOL, Former FTX Community Partner)

On October 11, crypto KOL and former FTX community partner Benson Sun posted on social media that many altcoins fell by more than 60% early this morning. In the past, extreme liquidation events were around $1-2 billion, but this time the scale expanded tenfold. It is reasonable for the crypto market to follow the U.S. stock market’s plunge, but such a massive short-term evaporation of altcoin market cap is unusual and does not seem to be simply due to excessive leverage and normal liquidations.

It is more like large market makers actively withdrawing liquidity, causing the market to instantly fall into a deep vacuum. The decline in altcoins was even more severe than the 3/12 and 5/19 events. This round of deleveraging can be called the most thorough in the cycle. The market bubble has been completely squeezed out, and risk leverage has been reset to zero. I am still optimistic about the fourth quarter trend and will spend about a month executing a batch investment strategy.

Original link

@ali_charts (Crypto Analyst)

On October 11, crypto analyst @ali_charts published a market analysis stating that today we witnessed the largest liquidation event in crypto history, which can only be described as a total flash crash. About $19.3 billion in positions were liquidated in a single day, affecting around 1.66 million traders. Many assets plunged sharply during the session, followed by partial rebounds, but the scale of this sell-off has raised serious questions about where the market stands in the broader cycle.

Digging into historical data, the most recent similar event was at the tail end of the 2021 bull market, shortly after Bitcoin peaked at $69,200. The December 2021 flash crash wiped out more than 24% of market cap in a single daily candle, which later proved to be the start of the ensuing bear market. Today’s daily candle for Bitcoin shows a maximum drop of about 17%, which is strikingly similar in scale and context to the 2021 bull market crash. The similarities in local market highs, waves of over-leveraged long positions, and cascading liquidations are hard for traders to ignore. While this rebound may be seen as a buying opportunity, caution is essential. Such large-scale liquidations often mark a shift in market structure, not just a temporary decline. This event may represent a market top, possibly followed by a deeper pullback. If you are currently holding long positions, strict risk management is necessary—traders should ensure stop-loss orders are activated and position sizes are controlled.

Original link

Mindao (Founder of DeFi Protocol dForce)

On October 11, Mindao, founder of DeFi protocol dForce, posted on social media that this crash is similar to the Luna blowup in that both occurred when major trading platforms began accepting illegal stablecoins as high LTV collateral, allowing risk to penetrate between trading platforms. Back then it was UST, today it’s USDe. “Stability” plus high collateral ratios misled most people.

When introducing illegal stable assets as collateral, the worst combination is using market prices for oracles while allowing high collateral ratios; plus, CEXs themselves do not have a fully open arbitrage environment, leading to low arbitrage efficiency and further amplifying risk. LSD-type assets face the same problem. These assets are essentially volatile assets disguised as “stable.”

Original link

Haotian (Crypto Researcher)

To be honest, this 10/11 black swan event made me, an originally optimistic industry observer, feel a sense of despair.

I originally thought I understood the current “Three Kingdoms” situation in the crypto industry, thinking that while the giants fought, retail investors could catch some scraps. But after this bloodbath, peeling back the layers of logic, I realized that’s not the case.

Frankly, I thought the tech side was innovating, exchanges were building traffic, Wall Street was deploying capital, and each played their own game. As retail, we just needed to time it right—follow the tech innovation, catch the hot trends, and ride the capital inflow to get a piece of the pie.

But after experiencing this 10/11 bloodbath, I suddenly realized that maybe these three sides aren’t competing in an orderly fashion at all, but are instead ultimately draining all liquidity from the market?

The First Force: Exchange Monopoly, Vampires Holding Traffic and Liquidity Pools.

Honestly, I always thought exchanges just wanted to build big platforms, big traffic, big ecosystems, and make money selling shovels. But the USDe cross-margin cascading liquidation exposed the powerlessness of retail under exchange-defined rules. The increased leverage and unclear risk controls, supposedly to improve product and service experience, are actually traps for retail.

Various rebate activities, Alpha and MEME launchpads, financial loop lending, and high-leverage contracts emerge endlessly. It seems to give retail more opportunities to make money, but once exchanges can’t cover the risks of on-chain DeFi cascading liquidations, retail will be dragged down as well. Such is life.

What’s truly terrifying is that the top 10 exchanges had a Q2 trading volume of $21.6 trillion, but overall market liquidity is still declining. Where did the money go? Besides fees, it’s all kinds of liquidations. Who is draining the liquidity?

The Second Force: Wall Street Capital, Entering Under the Guise of Compliance

I was really looking forward to Wall Street entering, thinking institutional capital could bring more stability to the market. After all, institutions are long-term players and can inject incremental capital, allowing us to enjoy the industry dividends of Crypto merging with TradFi.

But before this crash, there were reports of whales making precise short profits, with several suspected Wall Street wallets opening huge short positions before the crash and profiting billions. There are many such stories, which sound like insider trading, but happening at such panic moments makes one wonder: why do institutions always seem to have “pre-trade” advantages before black swan events?

These TradFi institutions, under the banner of compliance and capital, are actually doing what? Bundling DeFi ecosystems with stablecoin public chains, controlling capital flows through ETF channels, and using various financial instruments to gradually erode the market’s discourse power? Ostensibly for industry development, but in reality? There are too many conspiracy theories about the Trump family making money to mention here.

The Third Force: Tech Natives + Retail Developers, the Cannon Fodder Under Siege.

I think this is where most retail investors and developers, the so-called builders, truly despair. Since last year, many altcoins have been beaten down, but this time they were wiped out to zero, forcing us to face the fact that liquidity for many altcoins has almost dried up.

The key is, there’s a pile of infra tech debt, application adoption is below expectations, and developers are working hard to build, but the market just doesn’t care.

So, I can’t see how the altcoin market will recover, nor how these altcoin teams will grab liquidity from exchanges or compete with Wall Street institutions in pumping power. If the market no longer buys into narratives, and only MEME gambling remains, it will be a decisive purge and reshuffle for the altcoin market. Developers will flee, industry participants will be structurally reshuffled, and will the market return to nothingness? Sigh, it’s too hard!

So.....

Too much to say, all tears. If the Three Kingdoms situation in crypto continues, with exchanges monopolizing and draining, Wall Street precisely harvesting, and retail techies getting double-killed, this will be a fatal blow to the cyclical gameplay of Crypto in the past.

In the long run, the market will only leave a few short-term winners and all long-term losers.

Original link

Click to learn about BlockBeats job openings

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea plans talks with US to exempt Samsung, SK Hynix from Trump’s 25% chip tariffs

Ethereum : Buterin reveals major upcoming reforms

Samsung set to hand out record bonuses as AI boom translates into profits

Bitcoin Gains Traction As ETF Demand Surges