October 13 Key Market Insights, A Must-Read! | Alpha Morning Report

Featured News

1.Due to Trump's Moderate Speech, Cryptocurrency and Major U.S. Stock Index Futures Rebound

2.Binance Has Compensated $283 Million to Users Affected by USDE and Other Assets' De-pegging, Spot "Zero Price" Only a Display Issue

3.$216 Million Liquidated Across the Network in the Past Hour, Mainly Short Positions

4.Cryptocurrency Total Market Cap Rebounds Above $4 Trillion, 24-hour Increase of 5.6%

5.Macro Outlook for the Week: Powell Speech on Tuesday Night

Articles & Threads

1.《Weekly Review | Epic Cryptocurrency Market Crash Leads to 1.6 Million Liquidations; Monad Airdrop Claim Portal to Open on October 14》

After hitting a historic high of $126,000, Bitcoin experienced an epic crash. The U.S. Bureau of Labor Statistics is expected to release the CPI report during the government shutdown, and Binance Alpha launched various Chinese narrative meme coins on the contract platform.

2.《Traders' View | Why Did This Epic Market Crash Happen, and When Is the Right Time to Buy the Dip?》

October 11, 2025, a day that will be engraved in crypto history. Influenced by U.S. President Trump's announcement of restarting the trade war, the global market instantly entered panic mode. Starting at 5 a.m., Bitcoin began a nearly unsupported cliff-like decline, which quickly spread throughout the entire crypto market. However, why was this liquidation so intense? Has the market bottomed out? ReLive BlockBeats compiled perspectives from multiple market traders and well-known KOLs, analyzing this epic liquidation from the macro environment, liquidity, market sentiment, and other perspectives, for reference only.

Market Data

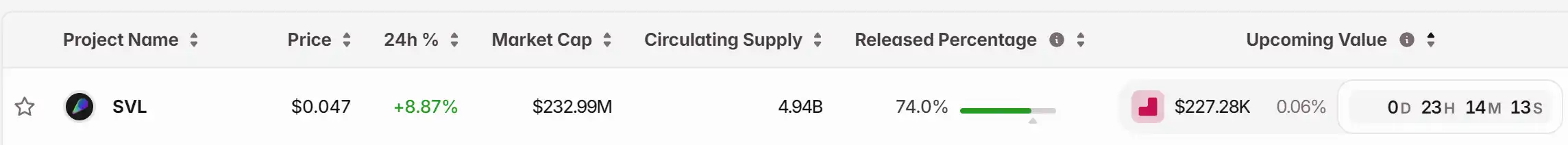

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COAI Experiences Steep Price Drop: Opportunity for Contrarian Investors or Red Flag for Junior Gold Mining Stocks?

- COAI refers to both ChainOpera AI and junior gold miners' index, with this analysis focusing on the latter's market dynamics. - Junior gold miners (GDXJ ETF) fell 27% in six months amid dollar strength, inflation fears, and overbought conditions after a 128.8% rally. - Technical indicators show bearish signals: broken trend channels, negative volume balance, and RSI divergence, though long-term bull trends persist. - GDXJ's 163.9% surge outpaced gold bullion gains, creating valuation gaps, while ChainOpe

Silver Soars Amid Ideal Conditions of Policy Shifts and Tightening Supply

- Silver surged to $52.37/oz as Fed rate cut expectations (80% probability) and falling U.S. Treasury yields boosted demand for non-yielding assets. - China's record 660-ton silver exports and 2015-low Shanghai warehouse inventories intensified global supply constraints, pushing the market into backwardation. - Geopolitical risks (Ukraine war) and potential U.S. silver tariffs added volatility, while improved U.S.-China relations eased short-term trade concerns. - Prices face critical $52.50 resistance; Fe

XRP News Today: As XRP Declines, Retail Investors Turn to GeeFi's Practical Uses

- GeeFi's presale hits 80% of Phase 1 goal with $350K raised, targeting 3,900% price growth as XRP declines 20% monthly. - GEE's utility-driven features like crypto cards, multi-chain support, and 55% staking returns contrast with XRP's institutional dependency and shrinking retail base. - Deflationary tokenomics and 5% referral bonuses drive FOMO, positioning GeeFi as a 2026 crypto disruptor amid XRP's regulatory and adoption challenges.

Sloppy implementation derails MegaETH's billion-dollar stablecoin aspirations

- MegaETH abandoned its $1B USDm stablecoin pre-deposit plan after technical failures disrupted the launch, freezing deposits at $500M and issuing refunds. - A misconfigured Safe multisig transaction allowed early deposits, causing $400M inflows before the team scrapped the target, citing "sloppy execution" and operational misalignment. - Critics highlighted governance flaws, uneven access (79 wallets >$1M vs. 2,643 <$5K deposits), and 259 duplicate addresses, raising concerns about transparency and bot ac