This $45 Million BNB Airdrop Wants To Revive Meme Coin Momentum

BNB Chain’s $45 million Reload Airdrop with Four.Meme targets meme coin traders hit by the crash—hoping to restore confidence and ignite a fresh rally.

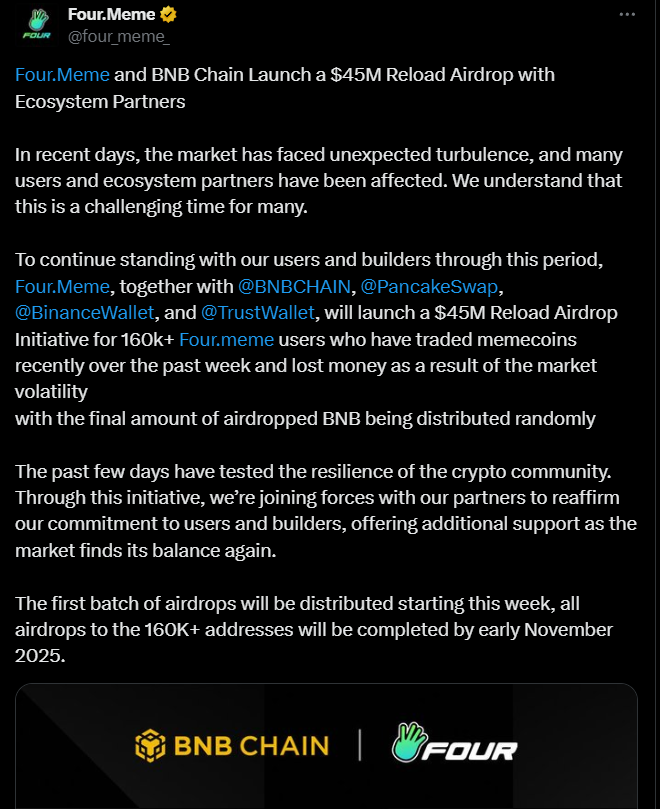

BNB Chain has launched a $45 million “Reload Airdrop” in partnership with Four.Meme, PancakeSwap, Binance Wallet, and Trust Wallet to reignite trading activity across its meme coin ecosystem.

The initiative targets retail traders hit by the recent market crash, where billions were wiped from speculative tokens.

BNB Airdrop To Trigger a Meme Coin Super Cycle

The airdrop will distribute roughly $45 million worth of BNB to more than 160,000 eligible addresses.

According to project details, recipients will be chosen through a randomized allocation system rather than based strictly on trading losses. Distribution will take place in multiple waves between mid-October and early November.

BNB Chain described the initiative as an effort to “reload” user confidence and liquidity in the meme coin sector. Over the past few months, meme coins have been one of the most active yet volatile segments on the network.

Four.Meme Announces BNB Airdrop

Four.Meme Announces BNB Airdrop

The move follows a wave of losses during the October 10 market crash, when several tokens built on Four.Meme suffered steep declines.

Four.Meme, a no-code meme coin launchpad on BNB Chain, allows users to create and list tokens with minimal technical knowledge.

Since launch, it has seen billions in cumulative trading volume, but also faced scrutiny following an exploit earlier this year that exposed flaws in automated liquidity mechanisms.

“The meme coin community is one of the most active and creative communities in the ecosystem, who have been affected the most by recent events especially during the past week,” wrote BNB Chain.

The Reload Airdrop marks one of BNB Chain’s largest coordinated relief efforts, signaling growing institutional and retail attention to its ecosystem.

However, analysts warn that the randomized nature of the airdrop may create disputes over fairness and transparency. Such “recovery” airdrops risk promoting moral hazard by rewarding risky trading behavior.

Overall, the airdrop comes as BNB defies broader market pressure, recently hitting a new all-time high above $1,370.

The altcoin’s resilience and active user base have reinforced its position as one of the strongest performers in 2025’s volatile crypto markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What's Causing the Latest BTC Price Swings: Is It a Macro-Fueled Reevaluation?

- Bitcoin's late 2025 volatility reflects macroeconomic pressures, Fed policy shifts, and regulatory changes impacting institutional demand. - Sharp price swings from $126k to $87k highlight sensitivity to inflation, interest rates, and leveraged trading risks amid delayed economic data. - New U.S. crypto laws and ETF approvals boosted institutional participation, but geopolitical risks and token unlocks maintained uncertainty. - A potential Fed rate cut and stabilizing inflation could reignite risk appeti

The ChainOpera AI Token Collapse: A Cautionary Tale for AI-Powered Cryptocurrency Markets?

- ChainOpera AI (COAI) token's 96% collapse in late 2025 exposed systemic risks in AI-blockchain markets, mirroring 2008 crisis patterns through centralized governance and speculative hype. - COAI's extreme centralization (96% supply in top 10 wallets) and tokenomics (80% locked until 2026) created liquidity crises, undermining blockchain's decentralized ethos. - Regulatory actions intensified post-crash, with SEC/DOJ clarifying custody rules and targeting fraud, yet CLARITY/GENIUS Acts created compliance

The COAI Token Fraud: An Urgent Warning for Individual Investors in the Cryptocurrency Market

- COAI token's 88% devaluation in late 2025 erased $116.8M, exposing systemic risks in AI-integrated DeFi ecosystems. - Centralized control (87.9% tokens in 10 wallets) and algorithmic stablecoin failures enabled coordinated manipulation and liquidity collapse. - Regulatory gaps allowed cross-border operations in jurisdictions like Southeast Asia, highlighting urgent need for AI-powered oversight and standardized protocols. - Investors must prioritize smart contract audits, transparent governance, and on-c

Examining the Latest Decline in PENGU Value: Key Drivers and What It Means for Cryptocurrency Investors

- Pudgy Penguins (PENGU) plummeted 30% in late 2025 due to regulatory uncertainty, algorithmic trading triggers, and a $66.6M team activity event. - The collapse exposed systemic risks in crypto, including stablecoin liquidity crises and interconnectedness with traditional finance via ETFs and leverage. - Investors are urged to prioritize diversification, liquidity monitoring, and regulatory compliance to mitigate risks from opaque projects and volatile markets.