ARK Invest reports Solana revenue hits $223M in Q3 2025

ARK Invest’s third-quarter report shows that Solana has generated the largest share of blockchain revenue compared to all the other networks, amounting to $223 million.

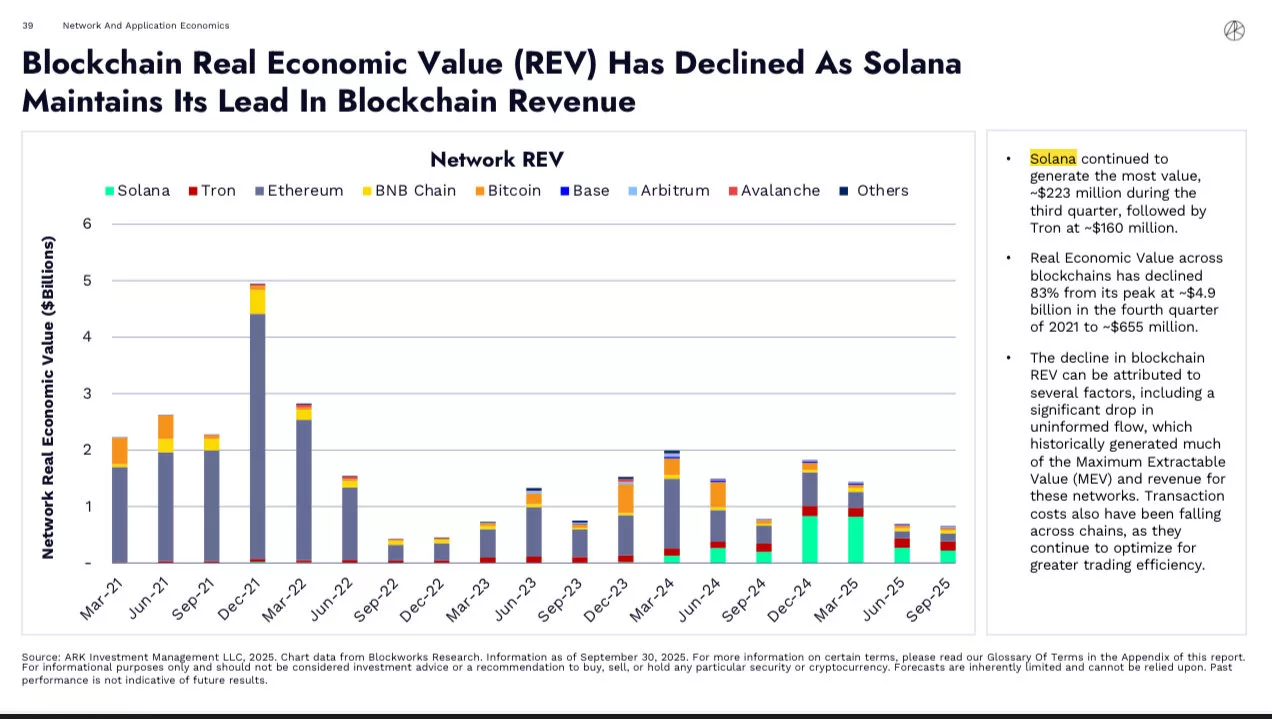

- Solana led all blockchains in Q3 2025, generating $223 million in real economic value, followed by Tron at $160 million, even as total blockchain REV plunged 83% from its 2021 peak.

- ARK Invest attributed the decline in overall REV to reduced uninformed capital flows and falling transaction costs.

According to ARK Invest’s third-quarter DeFI report, Solana continued to generate the most economic value, amounting to around $223 million, leading the charge on all networks listed that create value. The report highlights the Solana ecosystem’s growth and ability to generate more revenue compared to other networks.

The quarterly report covered key metrics in decentralized finance, including on-chain activity, stablecoins, and decentralized exchanges. In total, Solana ( SOL ) generated about $223 million in value, surpassing all other networks.

Coming in at second place is Tron ( TRX ) network, which has generated around $160 million in value.

ARK Invest’s report revealed that Solana leads the charge on real economic value | Source: ARK Invest

ARK Invest’s report revealed that Solana leads the charge on real economic value | Source: ARK Invest

Based on the report, the overall real economic value or REV across networks on-chain has gone down as much as 83% compared to its highest peak at $4.9 billion, which occurred back in the fourth quarter of 2021. In the third quarter of 2025, the overall value has plummeted to $655 million.

ARK Invest concluded that there are several factors that have fueled the downturn of REV among blockchains. The first factor is the significant drop in uninformed flow, which is historically known for generating most of the Maximum Extraction Value and revenue for these networks.

Another reason for the decline in REV is the drop in transaction costs across multiple chains, as they continue to lower costs to attract more users on-chain by optimizing for greater trade efficiency.

According to data from DeFi Llama, Solana’s REV in the past 24 hours has reached $1.1 million. Meanwhile, the chain’s total value locked has amounted to $11.36 billion, rising by 0.74% in the past day. So far, the largest share of fees comes from Gauntlet $12.71 million, while the largest TVL comes from Jupiter.

ARK Invest’s Solana investments

In the past, ARK Invest has invested large amounts of its funds into Solana-related ventures. On Sept. 19, ARK Invest bought about $162 million worth of shares in Solmate or BREA after taking part in the company $300 million funding round. The company now holds about 6.5 million BREA shares.

Back in July 2025, ARK Invest moved its validator operations for its Digital Asset Revolutions Fund to SOL Strategies, a Toronto-based firm specializing in Solana.

Meanwhile, in April 2025, ARK Invest made its first direct Solana investment through the SOLQ ETF, a Canadian-based SOL staking ETF. The purchase made ARKW and ARKF the first-ever U.S.-listed ETFs to add Solana to their portfolios.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Taurus’s Twofold Function Accelerates the Integration of Blockchain into Mainstream Finance

- Taurus SA joins Canton Network as a Super Validator, expanding custody services to support $6T+ tokenized assets via the Canton Token Standard. - As a core infrastructure partner, Taurus enhances Canton's security and governance while enabling 24/7 markets and privacy-compliant operations for institutions. - The partnership with Deutsche Bank , Santander , and State Street underscores Taurus's role in bridging traditional finance and blockchain innovation through interoperable, compliant infrastructure.

Web3 Transformation: Efficiency and Regulation Take Precedence Over Privacy Concepts

- Web3 infrastructure prioritizes performance and compliance over theoretical privacy models like garbled circuits and FHE. - Hanyang University's 108 Gb/s PAM-8 receiver advances data center efficiency with 1.95 pJ/bit energy optimization. - Wemade's KRW stablecoin alliance rebuilds trust through regulated infrastructure, avoiding direct stablecoin issuance. - Coinbase's $1.5B Q2 revenue highlights crypto market volatility, emphasizing institutional infrastructure diversification. - Alphabet's $1B+ cloud

Hyperliquid News Today: MUTM Soars by $19M While MegaETH Plummets: Real Performance Outshines Hype in the Evolving Crypto Landscape

- Mutuum Finance (MUTM) raised $19M in Phase 6 presale, with 250% price growth since 2025 launch and 90% allocation completed. - KuCoin secured AUSTRAC and MiCA licenses, expanding compliance reach across 29 EEA countries while acquiring payment firms to strengthen institutional credibility. - Bitcoin surged past $90K amid Fed rate cut speculation, contrasting MegaETH's $1B token sale collapse due to technical failures, highlighting execution risks in volatile markets. - Crypto exchanges pledged $3.19M for

Bitcoin News Update: Triple Bearish Divergence in Bitcoin Suggests ETF Rally May Be Unstable

- Bitcoin trades near $86.6K, down 31.3% from October peak amid $3.5B November ETF outflows and $2B liquidations. - Technical analysis flags "triple bearish divergence" as price hits higher highs while momentum indicators weaken. - Spot Bitcoin ETFs see $238M inflows but face $90K resistance; Ethereum ETFs gain $175M yet ETH remains below $3,000. - Key support at $85K risks accelerating sell-off to $80K, with 50–60% retracement targeting $34,409–$44,100 if bearish pattern completes.