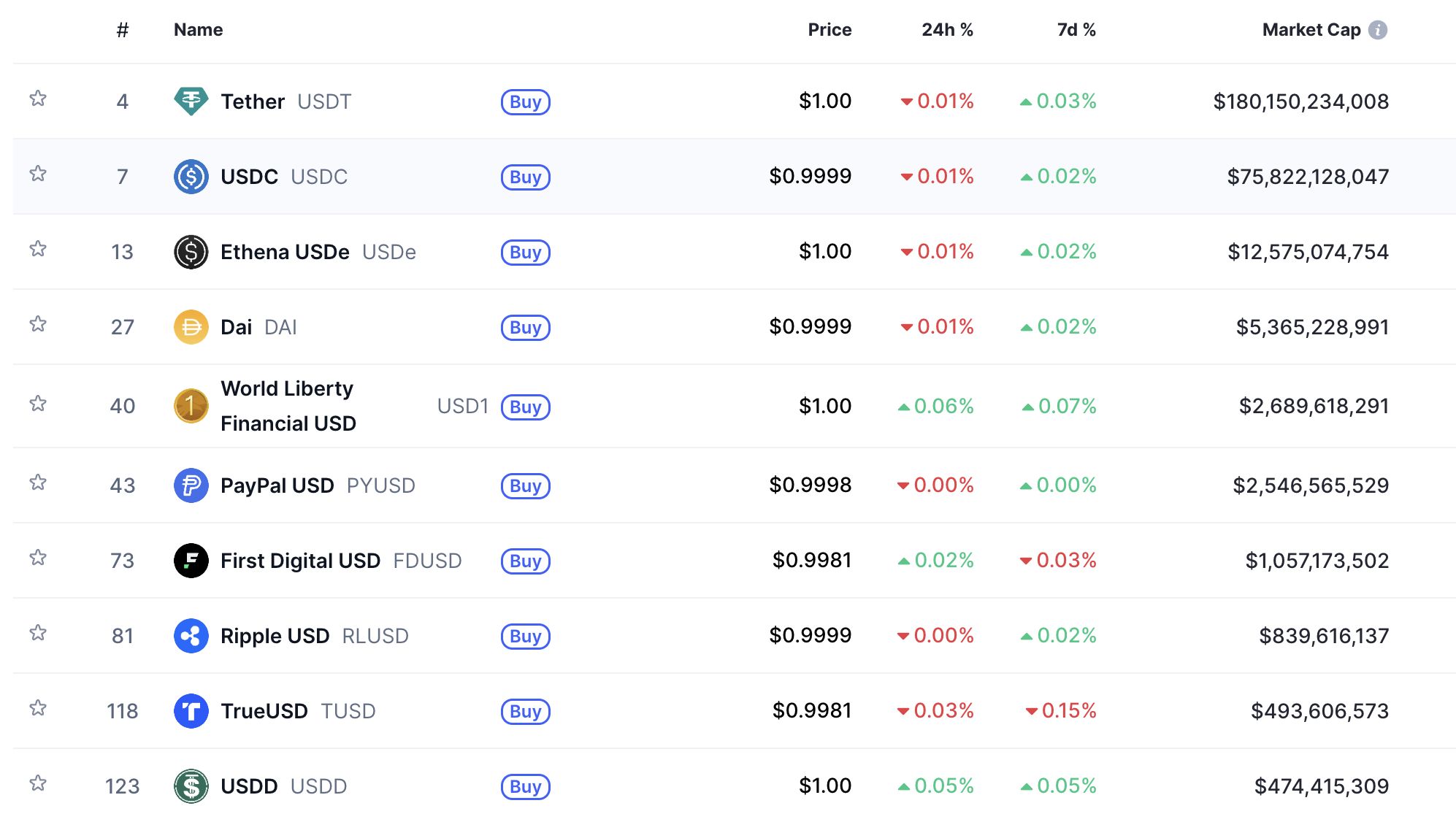

Bernstein predicts that Circle’s USDC supply could nearly triple by the end of 2027, reaching approximately $220 billion, potentially capturing a third of the global stablecoin market. This projection, part of the latest report from Bernstein, notes the expected escalation from the current circulation range of $70-76 billion. The report is based on Circle’s anticipated growth post-IPO and the impact of regulatory frameworks.

Bernstein’s Vision for Circle in 2027

According to Bernstein, the supply of USDC may rise to $220 billion by 2027, driven by its use in payments, institutional adoption, and the scaling of on-chain financial services. This suggests a market share positioning close to one-third. The revised forecast stems from an accelerated growth rate, surpassing previous estimates following the end of the summer.

Furthermore, Wall Street notes maintain their outperform rating for Circle. The New York IPO in June and the ensuing Senate-approved comprehensive stablecoin regulation bill, which includes transparent reserve and monthly reporting requirements, have diminished institutional risk perception. This framework is highlighted as a catalyst that speeds up USDC’s integration with banks and payment networks.

Drivers Behind the Projected Growth

Bernstein analysts attribute the increase in USDC’s market share to its applications beyond exchanges, its role as an alternative for cash management in corporate treasuries, and its use as a collateral/settlement layer in securitized assets. The demand for dollar-based collateral in derivatives markets and custodial services stands out as a volume-sustaining factor, even as fixed yields decline.

Broker notes reiterate that USDC could witness an approximate 260% increase in supply, reaching $220 billion by 2027. Although uncertainties due to market conditions remain, reports suggest an upward bias in the scenario if tokenization and cross-border payments achieve substantial scalability.