US is Seizing $12 Billion in Bitcoin, But What Will They Do With It?

The US Treasury’s effort to seize $12 billion in Bitcoin from Cambodia’s Prince Group marks a turning point in crypto crime enforcement. If successful, these assets could significantly strengthen Trump’s Strategic Reserve—unless victims reclaim their stolen funds.

The US is moving to seize around $12 billion in Bitcoin from Prince Group, a Cambodian-based pig butchering operation. It’s also applying massive sanctions to the Huione Group for facilitating money laundering.

If Treasury can acquire and gain ownership of these assets, it could substantially boost Trump’s Strategic Reserve. However, many defrauded Americans may attempt to reclaim their stolen money.

More Bitcoin For The US Government

Pig butchering scams were already a huge problem before 2025’s unprecedented crypto crime wave, but escalating fraud is making all these problems much larger.

One recent incident shows the scale of these incidents, as the Treasury is moving to seize $12 billion in Bitcoin from a long-running scheme:

The Treasury also released a statement on this pig butchering operation, although it does not directly address the effort to seize these bitcoins.

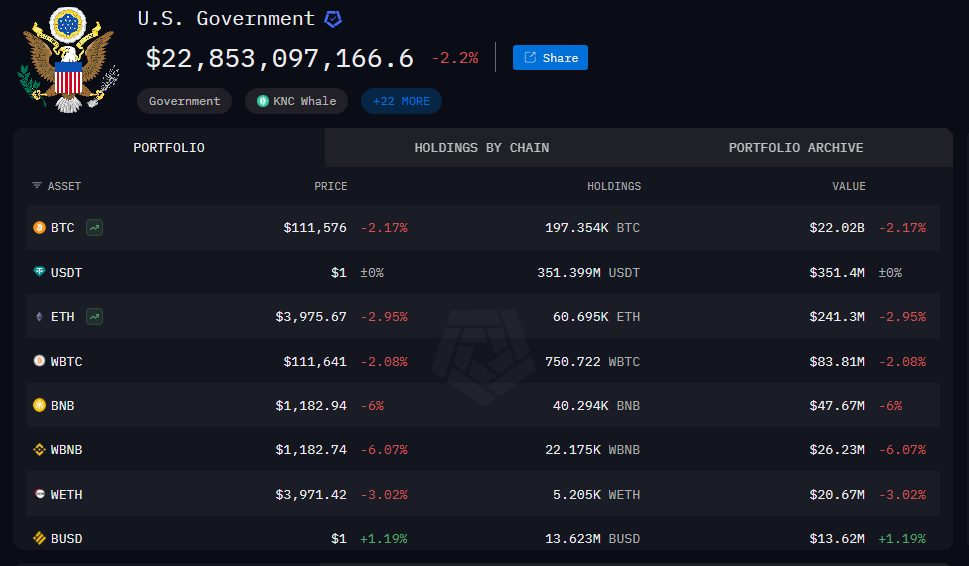

US Government Bitcoin Portfolio Till Now. Source:

US Government Bitcoin Portfolio Till Now. Source:

It claimed that a multinational investigation targeted the Prince Group, a Cambodian-based crime ring. By 2024, this group apparently stole at least $10 billion from US citizens.

Additionally, the Treasury finalized its efforts to sever the Huione Group from the US financial system, due to its history of facilitating money laundering.

Private crypto firms have levied restrictions upon the Cambodian financial conglomerate, but the US government is making a major escalation here.

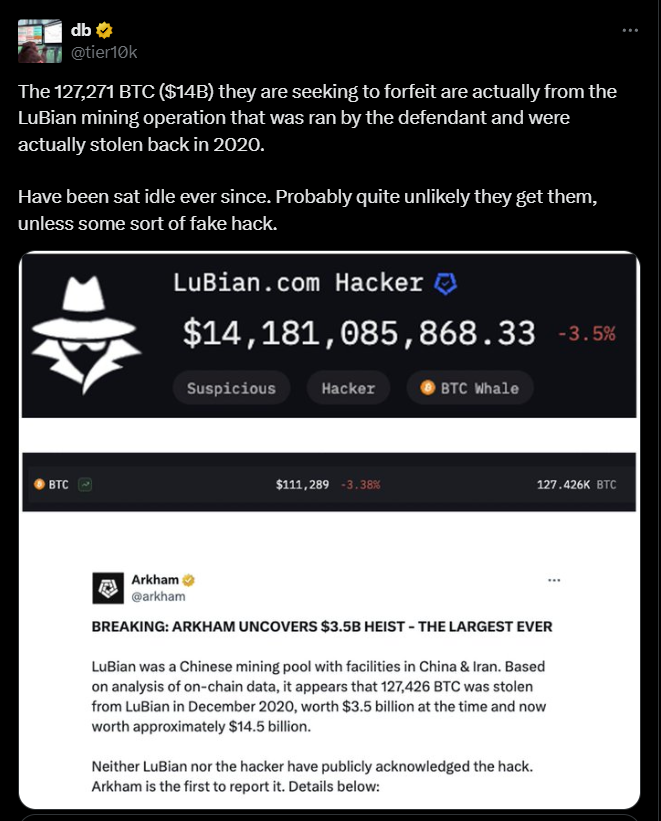

Some reports suggest these funds could actually be linked to the biggest crypto hack till date involving LuBian mining pool.

Source:

Source:

Strategic Reserve Implications?

The Prince Group’s operations were truly frightening, including human trafficking, torture, sexual exploitation, and more. Treasury’s report details all these unseemly aspects, which may be too lurid for our coverage.

However, as far as the crypto community is concerned, there’s one crucial point to realize. If the Treasury can successfully seize this Bitcoin, it could be a huge windfall for Trump’s planned Strategic Reserve.

Specifically, the administration has run into a major problem: it custodies huge quantities of seized bitcoins, but it doesn’t have legal ownership. It can’t exactly put these assets into a Strategic Reserve if it’s legally obligated to return them to the actual fraud victims.

There may be an opportunity here, depending on a few things. If the Treasury can acquire these assets, $12 billion is a huge windfall. If even a tiny fraction of initial theft victims fail to pursue reimbursement, this Bitcoin may be up for grabs.

In short, there are many factors in the air right now. The US may fail to seize these bitcoins, or a huge chunk may simply return to their initial owners. If, however, it can retain a few billion dollars’ worth, this could make a Bitcoin Reserve truly formidable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid’s Growing Influence in Crypto Trading: Enhancing Investor Access and Entry Methods in an Evolving Market

- Hyperliquid dominates 2025 crypto market with 73% DEX perpetual trading share via fee cuts, stablecoin integration, and institutional partnerships. - USDH stablecoin (backed by USD/Treasury) and HyperEVM infrastructure position it as "AWS of liquidity" for on-chain finance developers. - 78% user growth and 1.75M HYPE token unlock resilience highlight its scalability, though stablecoin regulations and market volatility pose risks.

PENGU Token Price Rally: Examining Brief Upward Trends and Institutional Indicators Towards the End of 2025

- PENGU token surged past $0.0100 in late 2025, driven by Bitcoin's rebound and institutional inflows totaling $430,000. - Technical indicators show conflicting signals: overbought RSI (73.76) vs. positive MACD/OBV, with critical support at $0.009. - $66.6M team wallet outflows contrast with institutional accumulation, raising sustainability concerns despite short-term bullish momentum. - Macroeconomic factors like Fed policy and Bitcoin correlation amplify PENGU's volatility, complicating long-term price

LUNA Rises 1.13% Amid Progress on U.S. Lawmaker’s Stock Trading Ban

- LUNA rose 1.13% in 24 hours amid U.S. political pressure to ban congressional stock trading, despite an 82.66% annual decline. - Rep. Anna Paulina Luna advanced the bipartisan Restore Trust in Congress Act, which would prohibit lawmakers and families from trading individual stocks. - The bill faces bipartisan opposition over financial flexibility concerns but has 100+ supporters, including conservatives and progressives, seeking to close ethics loopholes. - Critics argue the 2012 STOCK Act lacks sufficie

BCH Rises 9.13% Over 24 Hours as Overall Market Trends Upward

- Bitcoin Cash (BCH) surged 9.13% in 24 hours, with 10.08% monthly and 37.01% annual gains, signaling sustained bullish momentum. - Analysts attribute the rise to BCH's utility in cross-border payments, low fees, and institutional interest as a Bitcoin layer-2 solution. - No immediate catalysts (regulatory shifts, partnerships) were identified, suggesting market sentiment and macro trends drive the rally. - Experts highlight BCH's structural strengths and active development, positioning it to outperform br