Yei Finance (CLO) Price Set for Higher Gains Despite 55% Pullback Risk

The newly launched Clovis (CLO) token from Yei Finance has climbed more than 400% since its debut. Trading activity remains strong on multiple exchanges, though the CLO price has eased slightly after the initial spike.

This short-term cooldown of this DeFi token looks more like profit-taking than a trend reversal. Key on-chain and technical signals across multiple timeframes suggest that sellers may be losing control, setting the stage for another leg higher — if CLO can defend one crucial price level.

Fading Sell Pressure Across Key Indicators

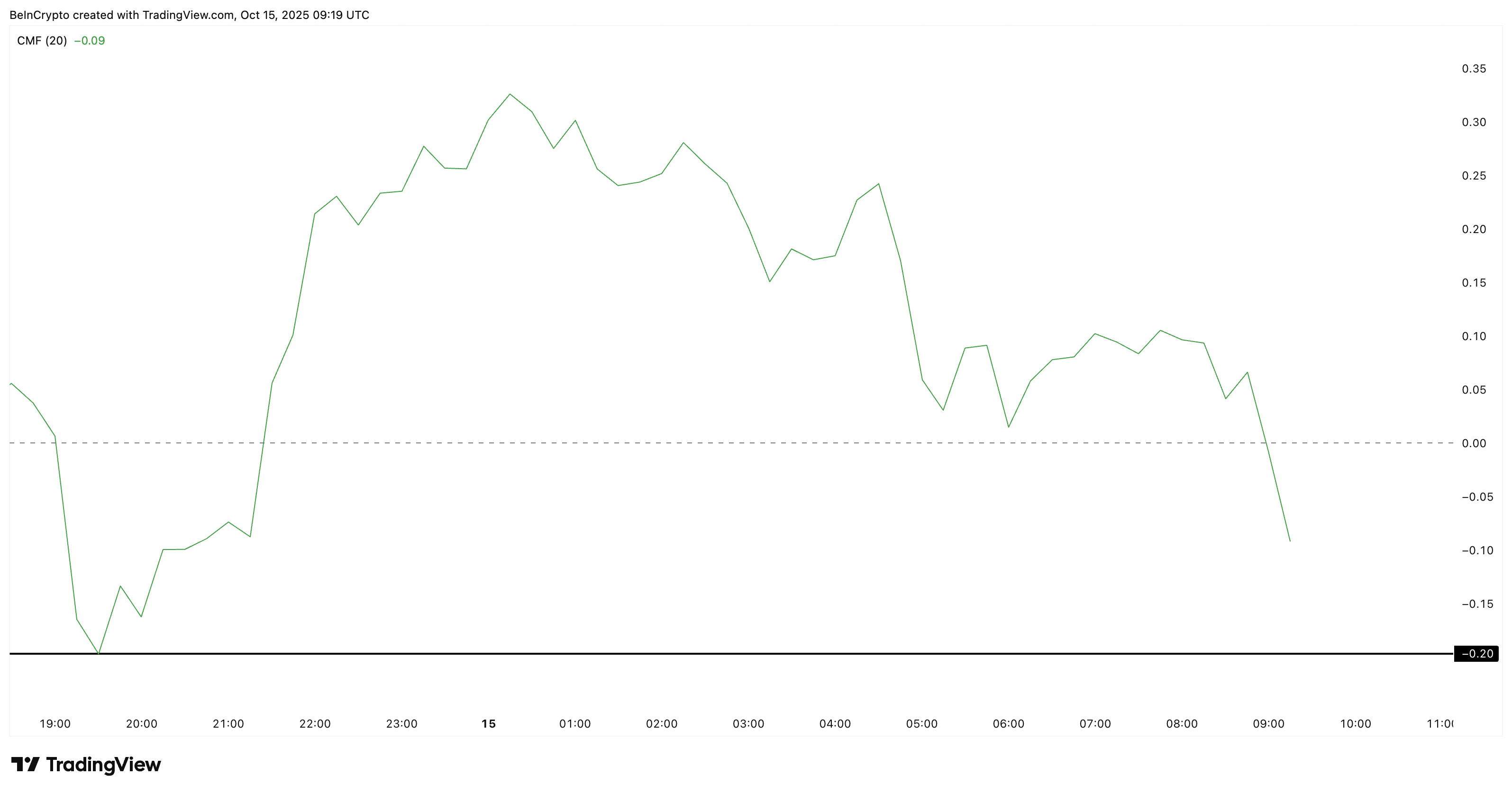

The Chaikin Money Flow (CMF) — an indicator that tracks how much money large wallets move in or out — has dipped below zero, reflecting moderate profit-booking by big holders (supposedly their airdrop stash). It now sits near -0.09, showing that outflows still outweigh inflows but not by much. If CMF stabilizes above –0.20, it would signal that the major selling phase has likely cooled off.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

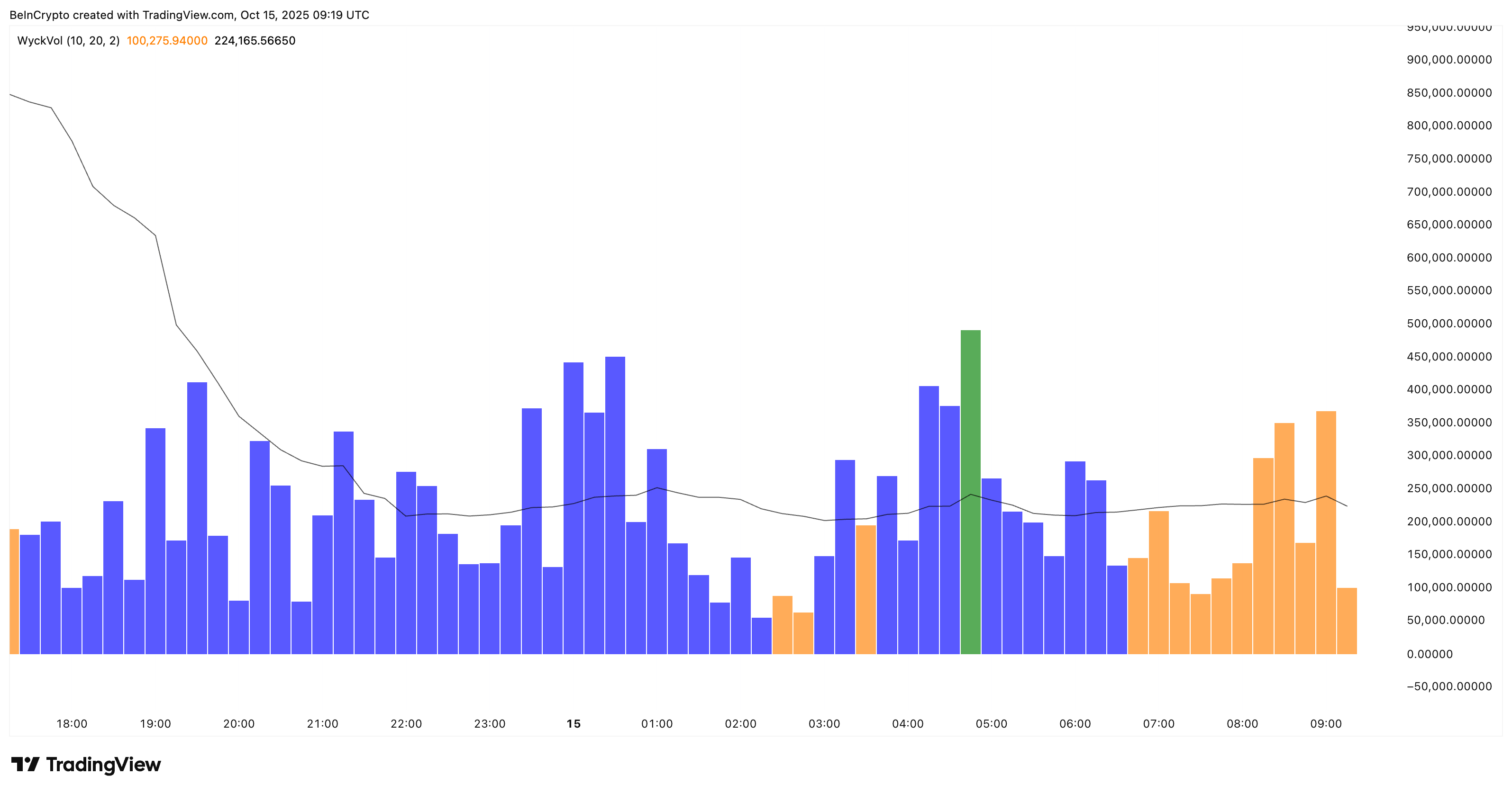

The Wyckoff Volume, which highlights shifts in buying and selling momentum through color-coded bars, turned yellow a few sessions ago, confirming short-term selling dominance. However, those yellow bars have started to shrink, showing that the strength of that selling wave is fading fast.

Meanwhile, the Relative Strength Index (RSI) — a metric that measures the balance between buying and selling — now shows a hidden bullish divergence. While the CLO price formed a higher low, RSI dropped to a lower low, which often hints that downward momentum is weakening.

These readings come from the 15-minute chart, which captures early sentiment shifts before they appear on longer time frames. Together, they suggest that the correction phase is losing steam, though confirmation still depends on how CLO reacts around its next breakout point, highlighted in the next CLO price action bit.

$0.97 Emerges as the CLO Price Breakout Level, But Pullback Risks Loom

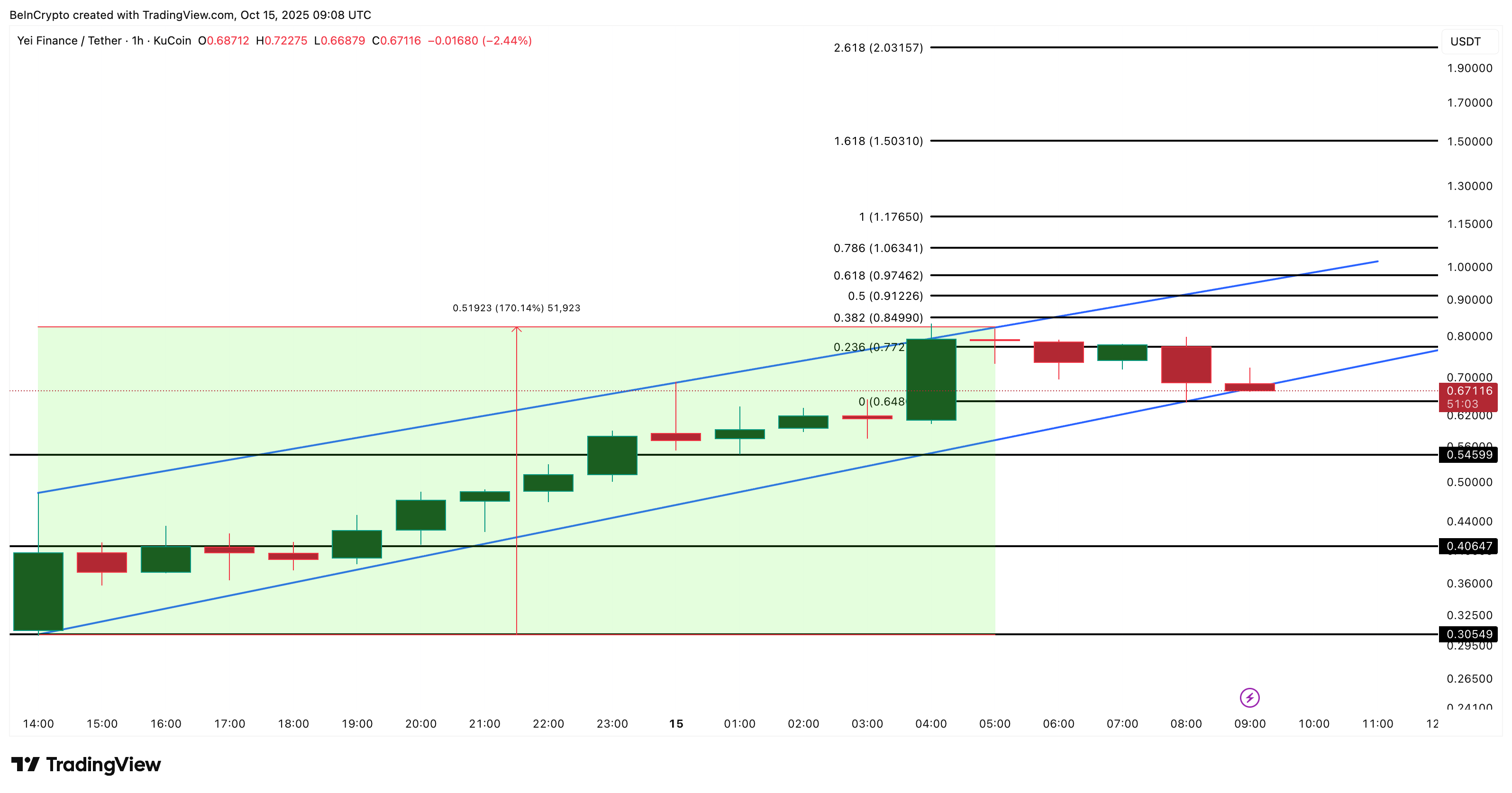

On the one-hour chart, CLO trades inside a rising channel, indicating steady accumulation. The token currently trades near $0.67, but this structure only holds if it stays above its base near $0.64. Losing this level could trigger a short pullback of about 5%, while a drop toward $0.54 would imply a 20% correction, and a deeper slide to $0.30-$0.40 could mark a 40%-55% pullback from current levels.

If CLO instead breaks above $0.97, which also aligns with the 0.618 Fibonacci retracement of its recent swing. Post the breakout, the CLO price might try and aim for the 170% price rise, as identified by the target projection within the channel.

That kind of post-breakout move could move toward $1.06 (58% from current levels), $1.50 (124% higher), and even $2.03 (203% higher). That breakout would also confirm that buyers have regained full control after the early-day pause.

Given the token’s youth and volatility, patterns and price targets could shift fast. Still, if $0.97 breaks and $0,64 holds, Clovis (CLO) could be set for another strong leg up — even with a 40% downside risk in play.

The post Yei Finance (CLO) Price Set for Higher Gains Despite 55% Pullback Risk appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As Apple Collaborates with Google to Enhance Siri with AI, Is Now the Right Time to Invest in AAPL Shares?

Crypto Markets Brace for Turbulent Times as US-EU Tensions Escalate

Ethereum may finally kill “trust me” wallets in 2026, and Vitalik says the fix is already shipping

KLA Corp. Shares Receive Highest Price Target Yet—Is Now the Time to Invest in KLAC?