The new meme has been memed, why are players angry this time?

Players want nothing fancy, just fairness

The day before yesterday, Binance launched the "Rebirth Support" plan and distributed the first batch of "Rebirth Support" airdrops yesterday, undoubtedly giving meme players on BSC another good topic to discuss.

However, a "forking" event sparked controversy among players.

The first "Rebirth" coin that gathered players' consensus and launched, had a contract address ending in "4444." As seen from the following candlestick chart, after a successful launch, the "Rebirth" coin with a contract ending in "4444" began to rise, reaching a peak market cap that once exceeded $15 million.

Approximately 8 hours later, another "Rebirth" coin, with a contract address starting with "4444," also successfully launched and quickly rose in the next 2 hours, reaching a peak market cap that once exceeded $12 million.

During the rapid rise of the new "Rebirth" coin, the OG "Rebirth" coin suffered a heavy blow, dropping by more than 50% at one point. At this time, a tweet from KOL Li Ping supporting the new "Rebirth" coin made him the target of players' criticism:

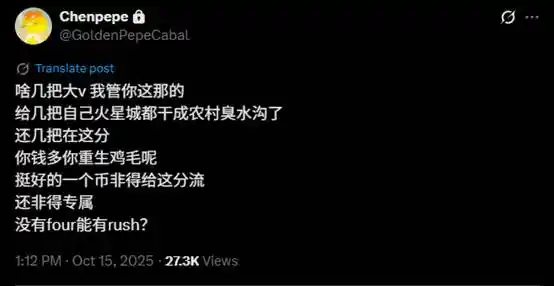

Soon after, another prominent supporter of the OG "Rebirth" coin, KOL Chenpepe, criticized this "forking" behavior:

Previously, "forking" situations have occurred in the crypto world, such as the cases of lowercase and uppercase Neiro, CZ's dog "Broccoli," and so on. However, this time, looking back at yesterday's scenario, Binance was still at the center of public opinion under a massive player "siege," and the BSC meme market was not as hot as before. Furthermore, the OG "Rebirth" coin had already reached a peak market cap of $15 million based on its spontaneous consensus. In this context, the sudden surge of the new "Rebirth" coin, accompanied by KOL endorsements, made it difficult for players supporting the OG "Rebirth" coin to believe that the new coin's uptrend was a result of a spontaneous consensus migration, rather than a conspiracy.

If these two coins had launched successfully at the same time and migrated to external trading to compete, players would not have such strong emotions. In the eyes of many players, if a highly influential KOL has a positive outlook on a topic and, in a situation where their financial capacity alone surpasses that of many ordinary players, joins in to develop the market cap further, what's the harm? Even if initially both coins had identical themes and tickers, competing on the same starting line would still be relatively fair.

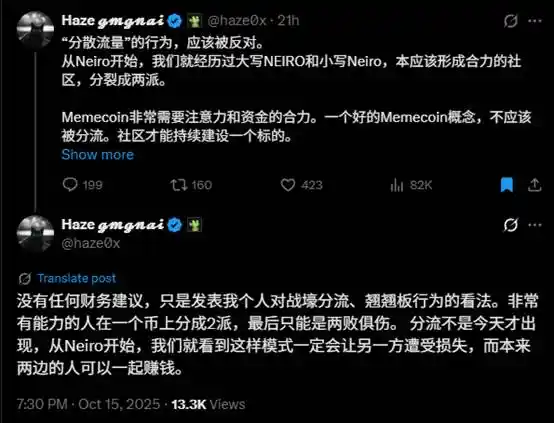

Last night, the founder of gmgn.ai, @haze0x, also expressed his opinion, stating that the act of "forking" should be opposed:

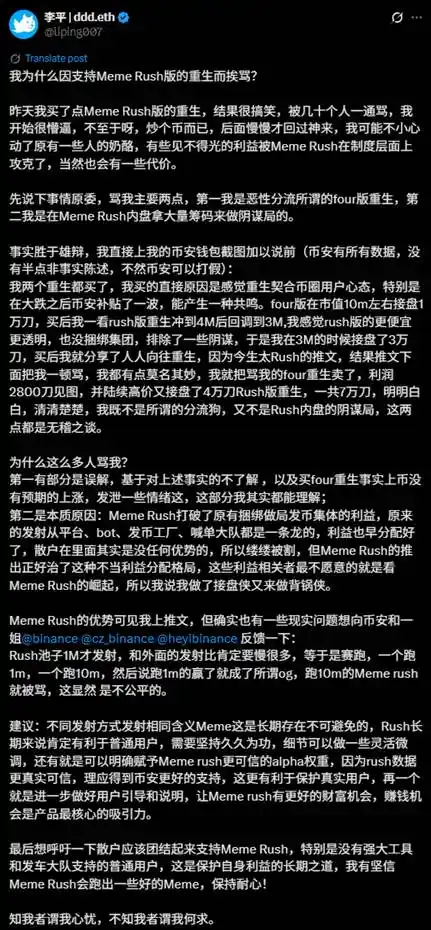

The controversial KOL Li Ping responded this morning, stating that he initially bought both coins but later shifted his support to the new "rebirth" coin, once again expressing support for the new "rebirth" coin:

Currently, the market capitalization of the new "rebirth" coin and the OG "rebirth" coin is both around $3.7 million, putting them back on the same starting line.

With CZ's tweet supporting Chinese tickers and the news of Binance possibly testing Chinese ticker contracts, Chinese ticker tokens in the BSC meme market have started to heat up. The turmoil between "rebirth" coins is unlikely to be resolved quickly but is expected to continue with the potential arrival of the second wave of Chinese market trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The PENGU USDT Sell Alert: Is This a Turning Point for Stablecoin Approaches?

- PENGU/USDT's 2025 collapse triggered a $128M liquidity shortfall, exposing algorithmic stablecoin fragility and accelerating market shift to regulated alternatives. - USDC's market cap surged to $77.6B by 2025, while MiCA-compliant euro-stablecoins gained $680M in cross-border adoption amid regulatory clarity. - DeFi protocols adopted oracle validation and reserve-backed models post-PENGU, reducing exploit losses by 90% since 2020 through institutional-grade security upgrades. - Regulators now prioritize

Emerging Prospects in EdTech and AI-Powered Learning Systems: Ways Educational Institutions Are Transforming Programs and Enhancing Student Achievement

- AI is transforming education by reshaping curricula, enhancing student engagement, and optimizing institutional efficiency. - Universities like Florida and ASU integrate AI literacy across disciplines, offering microcredentials and fostering innovation. - AI tools like Georgia Tech’s Jill Watson and Sydney’s Smart Sparrow boost performance and engagement through personalized learning. - AI streamlines administrative tasks but faces challenges like ethical misuse and skill gaps, requiring structured train

Anthropological Perspectives on Technology and Their Impact on Education and Workforce Preparedness for the Future

- Interdisciplinary STEM/STEAM education integrates technology tools like AI and VR to bridge theory and real-world skills, driven by $163B global edtech growth. - U.S. faces 411,500 STEM teacher shortages and 28% female workforce representation gaps, prompting equity-focused programs like Girls Who Code. - STEM occupations earn $103K median wages (vs. $48K non-STEM), with 10.4% job growth projected through 2033, driving investor opportunities in edtech and workforce alignment. - Strategic investments in t

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov