A 175-year-old French bank issues its first stablecoin under new EU regulations

The development of this stablecoin will depend on the extent to which it is adopted by payment providers and investors, who are seeking a reliable euro-denominated alternative asset in the digital economy.

The development of this stablecoin will depend on the degree of acceptance by payment providers and investors, who are seeking a reliable euro-denominated alternative asset in the digital economy.

Written by: Blockchain Knight

French banking group ODDO BHF has launched the euro-backed stablecoin EUROD, a token that represents a compliant digital version of the euro under the European Union's new Markets in Crypto-Assets Regulation (MiCA) framework.

This move by the 175-year-old bank highlights how traditional banks are gradually expanding into the regulated blockchain finance sector.

ODDO BHF, which manages over 150 billions euros in assets, stated that EUROD will be listed on Madrid-based exchange Bit2Me.

Bit2Me, supported by Telefónica, BBVA, and Unicaja, has completed registration with the Spanish National Securities Market Commission (CNMV) and is among the first exchanges to receive MiCA authorization, allowing it to expand its business across the EU.

ODDO BHF has partnered with infrastructure provider Fireblocks to handle custody and settlement. EUROD is issued on the Polygon network to enable faster and lower-cost transactions. The token is fully backed by euro reserves and is subject to external audits.

Bit2Me CEO Leif Ferreira stated that, as Europe embraces regulated digital assets, this listing "builds a bridge between traditional banking and blockchain infrastructure."

The Markets in Crypto-Assets Regulation (MiCA), which came into effect this year, requires stablecoin issuers to maintain a 1:1 reserve and guarantee redeemability, while enforcing strict governance and transparency standards.

The launch of EUROD will test MiCA's practical effectiveness in harmonizing digital asset regulation across the EU.

European Central Bank (ECB) President Christine Lagarde recently warned that foreign stablecoins lacking "sound equivalent regulatory mechanisms" could trigger reserve runs in the eurozone.

In a letter to the European Parliament, she urged lawmakers to restrict stablecoin issuance rights to EU-authorized entities, citing the collapse of TerraUSD as evidence of the risks posed by unregulated projects.

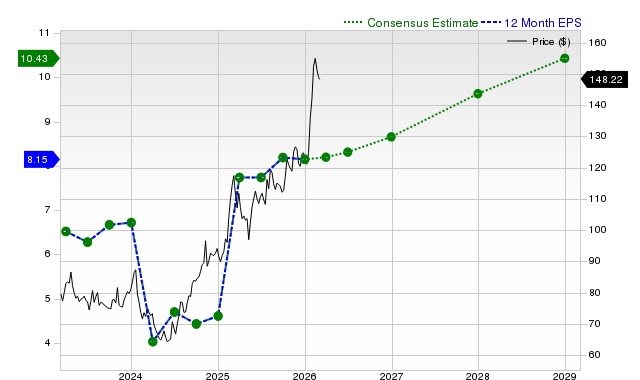

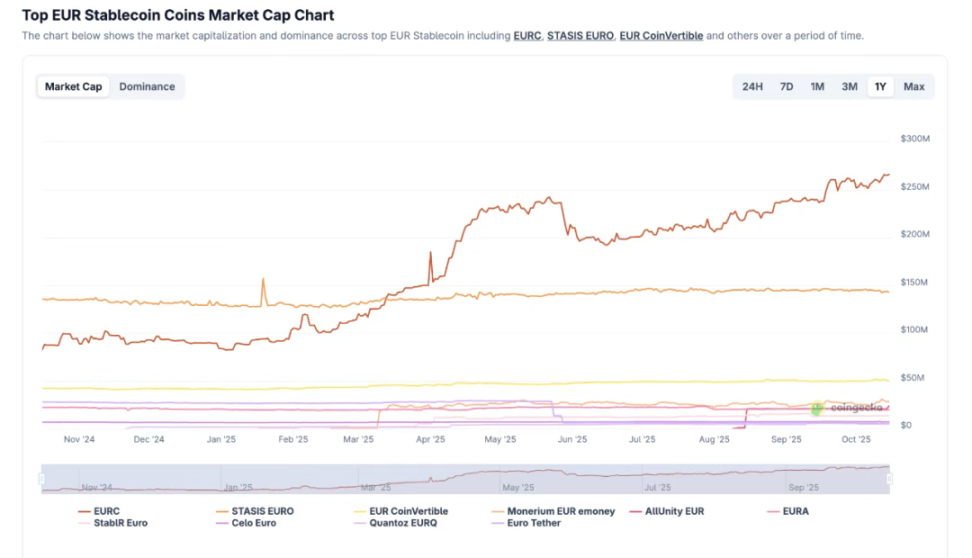

According to CoinGecko data, the market capitalization of euro-pegged stablecoins has doubled this year, with Circle's EURC dominating the market and its market cap climbing to around 270 millions USD.

Under the MiCA framework, demand for bank-issued stablecoins such as EUR CoinVertible by Société Générale remains relatively low.

ECB advisor Jürgen Schaaf believes that Europe must accelerate innovation or risk "erosion of monetary sovereignty."

The European Systemic Risk Board (ESRB) has warned that a multi-issuer model, in which EU and non-EU entities jointly issue the same stablecoin, could introduce systemic risks and requires enhanced regulation.

Despite these warnings, the regulatory clarity brought by MiCA has spurred market competition:

Société Générale's FORGE division has launched the euro stablecoin EURCV; Deutsche Börse has partnered with Circle to include EURC and USDC in its trading system.

Nine European banks, including ING, CaixaBank, and Danske Bank, have formed the Dutch Alliance, planning to issue a MiCA-compliant euro stablecoin in 2026. Citigroup later joined the alliance, with the related stablecoin expected to launch in the second half of 2026.

Meanwhile, ten G7 banks, including Citigroup and Deutsche Bank, are exploring the issuance of multi-currency stablecoins to modernize settlement processes and enhance global liquidity.

Compared to the more than 160 billions USD in dollar-pegged stablecoins, the total market capitalization of euro-backed stablecoins remains small, at less than 574 millions USD.

Regulators believe that, if managed transparently, euro-denominated digital assets will help strengthen financial sovereignty.

For ODDO BHF, EUROD is a strategic move to attract institutional clients through compliance and credibility.

The development of this stablecoin will depend on the degree of acceptance by payment providers and investors, who are seeking a reliable euro-denominated alternative asset in the digital economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street sees early drop as Iran war drives bond selloff

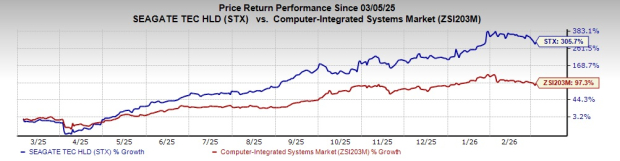

How Does Mozaic 4+ Equip Seagate to Meet Surging AI Data Needs?

AeroVironment (AVAV) Q3 Results Approaching: Experts Share Perspectives on Crucial Performance Metrics

Is Gilead Sciences, Inc. (GILD) a Good Investment at the Moment?