Uniswap launches L2 (Unichain), what does it mean for Ethereum?

As is well known, the emergence of L2 solutions allows smaller, independent blockchains to leverage the deep liquidity available on the Ethereum chain. Moreover, for DeFi...

"Unichain will offer the speed and cost savings already achieved by L2, better cross-chain liquidity access, and greater decentralization."

Written by: Ebunker

As is well known, the emergence of L2 solutions has enabled smaller independent blockchains to leverage the deep liquidity on the Ethereum chain. For DeFi, L2 also provides a way to optimize user experience—this is the direction currently being pursued by Uniswap, the DEX with the highest trading volume.

Uniswap Launches Native L2

On October 10, Uniswap announced plans to build an L2 on Ethereum. This solution, named Unichain, is built using Optimism’s OP Stack and aims to address the current limitations faced by DeFi—cost, speed, and interoperability—unlocking new markets and use cases through faster, cheaper transactions and improved cross-chain liquidity.

Uniswap Labs CEO Hayden Adams believes, "After years of building and scaling DeFi products, we have seen where blockchains need improvement and what is required to continue advancing the Ethereum roadmap. Unichain will offer the speed and cost savings already achieved by L2, better cross-chain liquidity access, and greater decentralization."

Features and Advantages of Unichain

Among the many L2 solutions, Unichain seeks to improve competitiveness in three key areas: cost, speed, and interoperability.

According to official estimates, after the launch of Unichain, transaction costs will be 95% cheaper than Ethereum, and costs will decrease further over time. While low transaction costs are not new for Ethereum L2s, Uniswap claims it will achieve this low cost while maintaining decentralization, something most other L2s have yet to accomplish.

Uniswap states that it will achieve this goal through an upcoming decentralized validation network, allowing full nodes to help validate blocks by staking UNI, which further decentralizes the blockchain. UNI stakers will act as a second layer of security on the Unichain platform, strengthening the network’s security and making it less vulnerable to attacks and manipulation. The addition of new validators also increases network resilience, ensuring the network can support greater transaction demand without compromising security.

At the same time, Unichain will provide users with near-instant transactions, with a block time of 1 second, eventually shortened to 0.2–0.25 seconds. In comparison, Ethereum’s block time is 12 seconds, while most L2s have a block time of 2 seconds. This speed not only improves user experience but also plays a crucial role in enhancing market efficiency.

Unichain’s shorter block times will reduce value loss caused by MEV (Maximal Extractable Value, a form of attack that allows block builders to front-run regular users through priority transactions). With Unichain’s rapid transaction times, opportunities for arbitrage and MEV are reduced, allowing users to get better value from their trades.

Additionally, Unichain significantly shortens transaction times by leveraging a block builder developed in collaboration with Ethereum development team Flashbots. At the core of the block builder is a Trusted Execution Environment (TEE), which can improve the transparency and speed of transaction ordering and prevent transaction failures.

Unichain promises to provide seamless cross-chain swap experiences for Superchain (the multi-chain network of Optimistic rollups) transactions by leveraging Optimism’s native interoperability. This is crucial for the future of DeFi, as users and protocols increasingly demand smooth and convenient access to various blockchains. Currently, Optimistic rollup L2s include Optimism Mainnet, Base, Blast, Celo, etc., all of which are potential candidates for seamless interoperability in the future.

For chains outside of Superchain, Unichain is working to improve communication between different blockchains. Through initiatives like ERC-7683, a cross-chain transaction execution standard developed by Uniswap and Across protocol, the goal is to make transactions between any chains effortless.

Unichain adopts a modular design, meaning new features can be added to make it more decentralized and user-friendly. It is also open source, so other chains can join and use its technology. Uniswap Labs will also continue to contribute to Ethereum’s scaling, ensuring DeFi provides a better experience for everyone.

What Does Vitalik Think About Unichain?

Currently, Vitalik has not commented on Unichain, but many community members are curious about Ethereum co-founder Vitalik Buterin’s attitude toward Unichain’s launch. Some have searched X for clues and finally dug up an old post from Vitalik in September 2022, where he commented on some of Uniswap’s ideas at the time.

Vitalik believed that Uniswap’s value proposition is transaction convenience, so deploying a rollup on a DEX makes no sense. He also stated that if Uniswap is deployed on every rollup, it will develop better.

Of course, this only represents some of Vitalik’s past thoughts. According to his comments on L2 last month, he believes that low transaction fees on L2 are an important milestone for the entire Ethereum ecosystem, as it addresses the main challenge for mainstream adoption.

In fact, Uniswap has been continuously expanding since its launch and has deployments on multiple protocols, including Ethereum, Base, and Binance Smart Chain, but ultimately chose to launch its own native L2—Unichain. Notably, the launch of Ethereum L2 solutions has become a common phenomenon in the crypto space. Most such projects focus on addressing Ethereum’s scalability challenges.

According to L2Beat data, there are currently 105 L2 protocols attempting to solve Ethereum’s scalability problem. Among these L2 protocols, Arbitrum, Base, and Optimism’s OP Mainnet rank in the top three in TVL, with $13 billion, $7.2 billion, and $5.8 billion, respectively.

Meanwhile, Vitalik is also seeking more ways to improve Ethereum’s functionality. He recently shared his new vision for the ecosystem, with a core focus on enhancing Ethereum’s alignment. [Note: Typically, the concept of alignment includes value alignment (e.g., open source, minimizing centralization, supporting public goods), technical alignment (e.g., collaborating with ecosystem-wide standards), and economic alignment (e.g., using ETH as the token where possible).]

In the Ethereum ecosystem, balance is one of the most important governance challenges, integrating decentralization and collaboration. The strength of this ecosystem lies in the wide range of individuals and organizations (client teams, researchers, L2 teams, application developers, local community groups), all working toward their own visions of what Ethereum could become. The main challenge is to ensure that all projects build a single Ethereum ecosystem together, rather than 138 incompatible territories.

How Will Unichain Affect Ethereum?

Since Uniswap generates the highest revenue for Ethereum and is one of the largest user bases on the Ethereum L1 chain, some crypto community commentators believe that Uniswap’s launch of a native L2 chain could impact the Ethereum mainnet. Once Uniswap migrates to its own chain, it will be able to capture transaction fees and MEV revenues. Although the exact business share shifting from Ethereum to the new blockchain remains to be seen, both revenue streams are certainly substantial.

However, this could lead to a decline in related network activity on Ethereum L1, which in turn would affect the rate of ETH burning. As more protocols migrate from Ethereum L1, the narrative of ETH as an "ultrasound money" (an asset that defaults to deflation after EIP-1559 activation) may continue to weaken.

Catalysts for Ethereum Growth: Innovation, Users, Big Tech, dApps

Although the launch of Unichain has raised doubts about the Ethereum narrative, community supporters say that Ethereum still has strong catalysts and that Ethereum as a technology and ecosystem will only grow larger over time.

First, the rise of restaking infrastructure such as Eigenlayer has brought a wealth of innovation to Ethereum technology: data availability layers, on-chain oracles, trustless bridges, and more. The next generation of L2 solutions will push Ethereum’s throughput beyond 100,000 TPS and achieve seamless interoperability with competitive ecosystems beyond EVM.

Second, the participation of top asset management companies (Blackrock) and Web2 tech giants (Sony, Samsung) using Ethereum solutions will only increase over time.

Finally, L2s are actually continuously bringing retail customers to Ethereum, especially when on-chain transaction fees are lower. The same goes for mainstream dApps such as Polymarket or Farcaster, which have finally found product-market fit and are meeting the real-world needs of internet users.

Summary

Although the launch of Unichain may impact Ethereum L1’s transaction fees and to some extent challenge some of Ethereum’s fundamental roles, Uniswap’s move to redirect fees and network activity could trigger a broader migration trend, reshape the competitive landscape of the crypto market, and encourage Ethereum and other blockchains to innovate and remain competitive.

At the same time, as the largest decentralized exchange by trading volume, Unichain will expand the DeFi and Ethereum ecosystem by optimizing transaction speed, reducing costs, and improving user experience, increasing user participation in DeFi, promoting mass adoption, and benefiting multiple blockchains including Ethereum.

Essentially, L2s like Unichain and Ethereum are not in direct competition, but are together creating scenarios more suitable for mass adoption, tapping into Ethereum’s true growth drivers: technological innovation, user growth, broad participation by tech giants, and the explosion of Dapp applications.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Labs CEO challenges Buterin’s vision for blockchain longevity

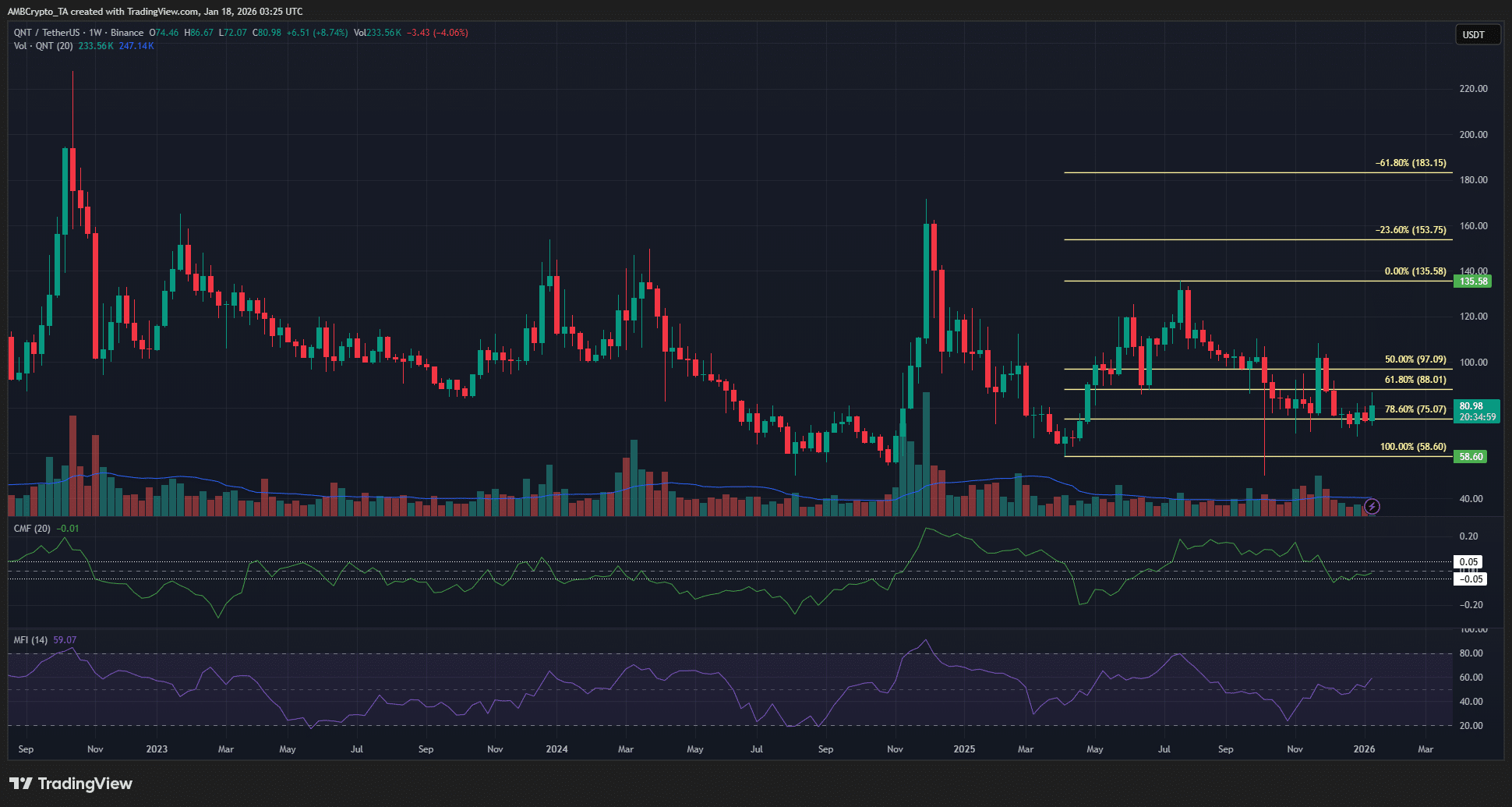

QNT jumps 12% as volume triples — Can Quant bulls defend THIS floor?

GRAM Ecosystem Joins EtherForge to Boost Web3 Gaming Across Chains

Everyone to get their own AI friend in five years, Microsoft executive says