Largest Wealth Transfer in History Incoming As Unprecedented Quantities of Capital Heading To Gen Z, Millennials and Gen X: Morgan Stanley Strategist

Morgan Stanley’s equity strategist says an “unprecedented” amount of wealth is about to change hands as baby boomers reach their sunset years.

In a Morgan Stanley podcast, Michelle Weaver says that as the generation born between 1946 and 1964 ages, they will pass on wealth worth “tens or even hundreds of trillions of US dollars” to Gen Z, millennials, and Gen X.

Citing a survey conducted by the bank’s AlphaWise unit, Weaver says about 50% of the beneficiaries of history’s largest wealth transfer will receive amounts below six figures.

“About half reported amounts under $100,000 dollars. For about a third, that amount rose to under $500,000. And then meanwhile, 10 per cent reported an inheritance of half a million dollars or more.”

According to Weaver, higher-income households are likely to benefit more than lower-income households from the wealth transfer.

“Only 17 percent of lower income consumers report receiving or expecting an inheritance, but that number jumps to 43 percent among higher income households highlighting a clear wealth divide.”

On how the current and future beneficiaries of the wealth transfer expect to use their inheritance, Weaver says,

“The majority, about 60 percent, say they have or will put their inheritance towards savings, retirement, or investments. About a third say they’ll use it for housing or paying down debt. Day-to-day consumption, travel, education and even starting a business or giving to charity also featured in the survey responses – but to a lesser extent.”

About 14% of consumers in the US expect to receive an inheritance while 17% have already received one, according to Weaver.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Animoca Partners with GROW to Connect Crypto and Traditional Finance

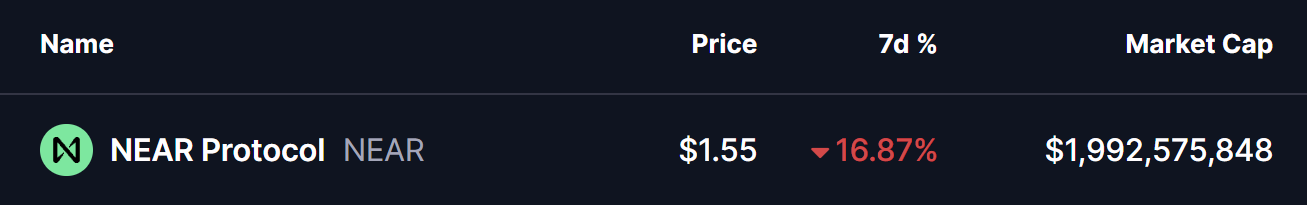

Near Protocol (NEAR) Flashes Potential Bullish Reversal Setup – Will It Bounce Back?

Solana Price Prediction: Grayscale Predicts New Bitcoin ATH, DeepSnitch AI’s Snowball to $900K Fuels the 100x Narrative

Whole Foods to install smart food waste bins from Mill starting in 2027