Why Ethereum Needs ZK-VM: The Ultimate Path to Scalability

For Ethereum, ZK is not just a technological upgrade but a structural overhaul. It transforms Ethereum from redundant validation to efficient consensus, and from performance bottlenecks to verifiable computation. This could be the key ticket for Ethereum to enter the next cycle.

Author: Ebunker

Among the many approaches to Ethereum scaling, ZK is the most complex and also the most critical direction.

Looking across the entire network, Vitalik and the Ethereum Foundation have placed the biggest bets on ZK. ZK is somewhat like the youngest child in the Ethereum family—receiving the most attention, but also facing the most uncertain future.

A few days ago, the Ethereum Foundation released the Kohaku roadmap, which is a set of basic component plans for privacy wallets. The roadmap once again emphasizes that many core functions will still rely on the implementation of ZK-EVM or ZK-VM.

So, why does Ethereum need ZK-VM so urgently?

The answer is simple: to improve performance, but not at the expense of security.

The Bottleneck of Performance Improvement: Universal Verification and GAS Limit

As we mentioned before, the most immediate way to improve Ethereum's performance is to raise the GAS limit, which means making blocks larger.

But the problem is, increasing the GAS limit comes at a cost; oversized blocks are a heavy burden for nodes.

Currently, Ethereum uses a "universal verification" model, meaning all nodes must fully verify every block. This mechanism is simple and secure, but extremely redundant.

If the GAS limit is significantly increased, the computational load for each node will skyrocket accordingly.

Considering that Ethereum's block interval is only 12 seconds, with time reserved for block propagation and MEV sorting, validators actually have only about 4–8 seconds to verify, leaving almost no room to handle a larger load.

Ethereum After ZK: From "Universal Verification" to "Universal Single Verification"

If Ethereum L1 is fully ZK-ified, the verification model will shift from "universal verification" to "universal single verification". In this model, after a block is assembled, a ZK proof is first generated.

The characteristic of ZK is that proof generation is slow, but verification is extremely fast. Therefore, nodes only need to verify once whether the proof is correct, without repeatedly executing all transactions in the block.

This means Ethereum can significantly raise the GAS limit without greatly increasing the burden on nodes.

A vivid analogy: previously, when you submitted a leave request on DingTalk (sending a transaction), every supervisor (node) had to individually check whether you still had leave balance (universal verification), and the process was only approved after everyone signed off.

After ZK-ification, the system first verifies that you do have leave, then issues a proof (ZK) to all supervisors at once, who only need to trust and quickly approve it (universal single verification).

After ZK-ification, you still submit a leave request (send a transaction), the system finds you have remaining leave, directly tells all supervisors "this person has leave," and the supervisors fully trust the system won't make mistakes (ZK), so approval is much faster (universal single verification).

This is why Ethereum wants to implement ZK-ification.

Cryptographic Challenges and Case Studies

Of course, the engineering workload to achieve all this is enormous, and the cryptographic difficulty is also very high, so Ethereum must work with professional teams.

The Brevis protocol, mentioned by Ethereum Foundation researcher Justin, is one of the leading cases in this field.

Brevis focuses on ZK-VM, and its latest Pico Prism technology is currently one of the fastest solutions for generating ZK proofs under given conditions.

According to test data, with the current Ethereum block size of 45M GAS, Brevis uses 64 RTX 5090 GPUs to complete 99.6% of block proofs within 12 seconds, with 96.8% of blocks able to generate proofs within 10 seconds.

To maintain decentralization, Ethereum requires that the cost of ZK proof devices must not exceed $100,000.

Although higher-end GPUs (such as H200 or B200) can generate proofs even faster, that would greatly raise the entry barrier. Brevis's current design fits right within this limit.

Why is "10-second coverage" also crucial? Because MEV blocks are usually generated within 1–3 seconds, and adding 10 seconds of proof time just fills the 12-second block interval.

Summary: The Logical Path to Ethereum ZK-ification

If Ethereum wants to accelerate L1 performance improvement, it must raise the GAS limit;

To safely raise the GAS limit, it must advance ZK-ification;

And to elegantly achieve ZK-ification (proof generation within 10 seconds, hardware cost under $100,000), it requires the joint efforts of the cryptography community and the crypto ecosystem.

ZK is the most complex but also the most deterministic direction in Ethereum's scaling roadmap.

It is not only about performance, but also the ultimate solution for Ethereum to seek a balance between security and decentralization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

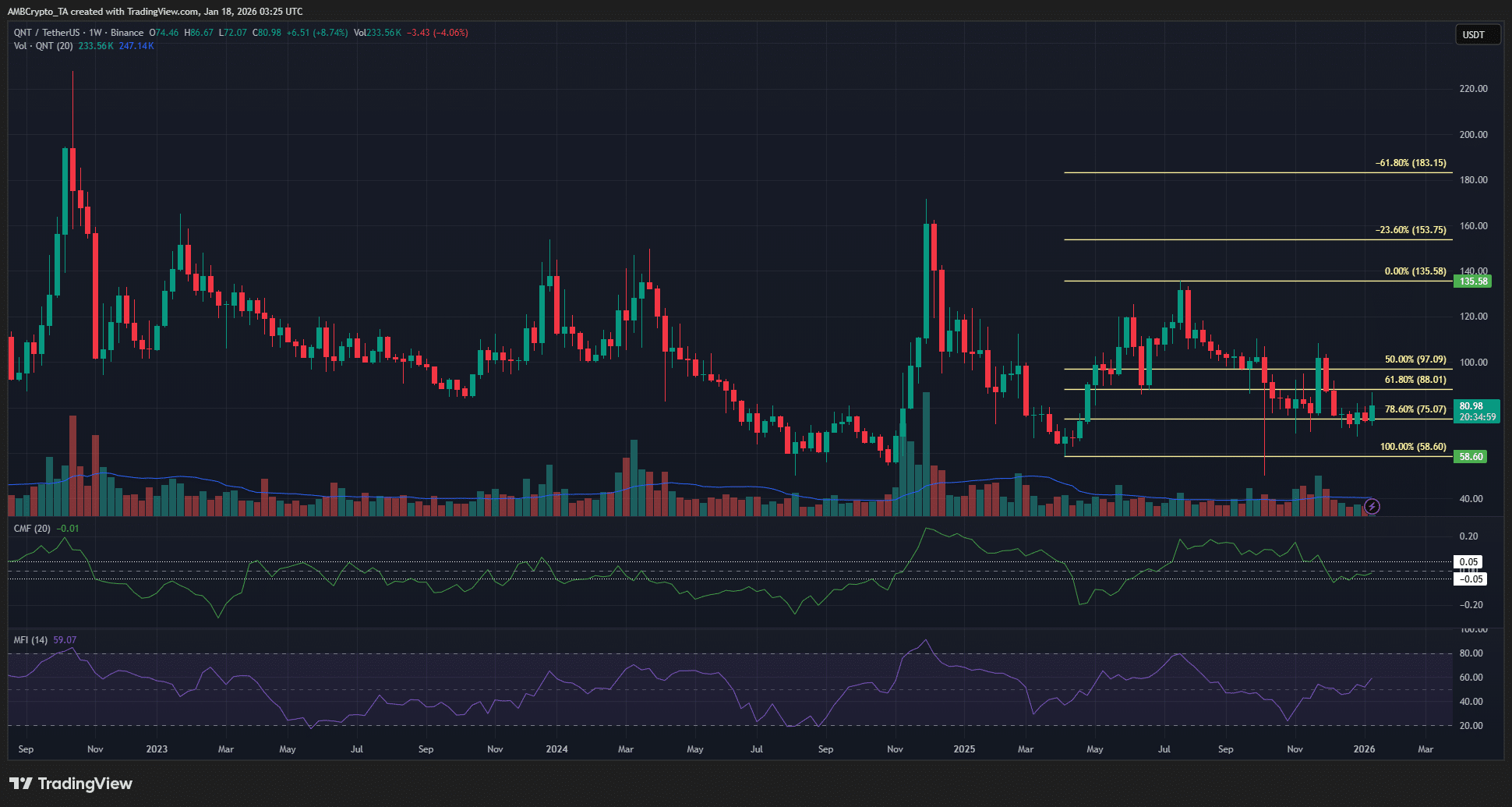

QNT jumps 12% as volume triples — Can Quant bulls defend THIS floor?

GRAM Ecosystem Joins EtherForge to Boost Web3 Gaming Across Chains

Everyone to get their own AI friend in five years, Microsoft executive says

Bitcoin’s Weekend Journey Sparks New Market Trends