Ethereum Leads as Solana’s Developer Growth Challenges the Blockchain Hierarchy

A recent analysis of blockchain developer activity has revealed a strong influx of new talent across major ecosystems, with Ethereum maintaining its dominance. The report, based on data from Electric Capital, highlights shifting developer trends and growing debates over how blockchain contributions are tracked.

In brief

- Ethereum tops all blockchains with 31,869 active developers, maintaining dominance despite slower growth.

- Solana attracts over 17,000 developers, showing rapid expansion and challenging Ethereum’s long-held lead.

- Bitcoin ranks third with 11,036 developers, reflecting steady but slower ecosystem engagement.

- Debate rises over developer counts as experts question data accuracy and inclusion of automated projects.

Ethereum Retains Largest Developer Base, Followed by Solana and Bitcoin

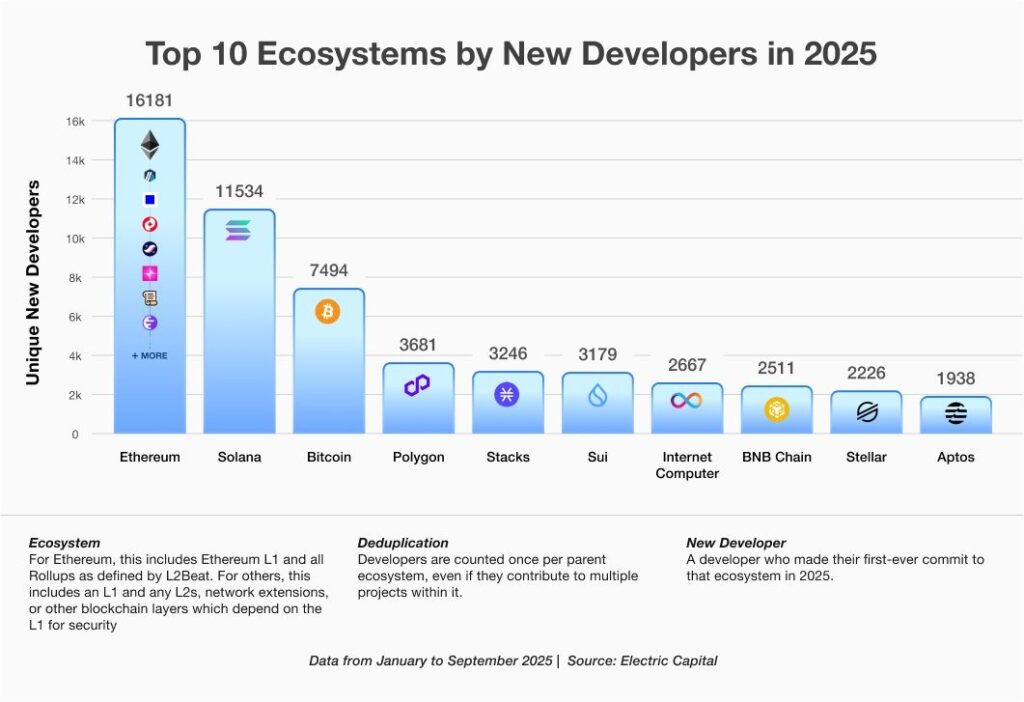

Between January and September, more than 16,000 new developers began contributing to the Ethereum ecosystem , according to data from the Ethereum Foundation. Solana followed with over 11,500 new developers, though a representative from the Solana Foundation suggested the data may be outdated. Bitcoin ranked third, attracting nearly 7,500 new developers in the same period.

A closer look at the data shows that:

- Ethereum leads with 31,869 active developers , making it the largest developer base across all blockchain ecosystems.

- Solana ranks second with 17,708 developers, showing continued strong developer interest.

- Bitcoin holds third place with 11,036 active developers contributing to its ecosystem.

- The Ethereum figure includes contributors to both layer-1 and layer-2 networks, such as Arbitrum, Optimism, and Unichain, without double-counting developers active across multiple projects.

It is worth noting that developers active across multiple Ethereum-based projects were not double-counted.

Ethereum Growth Slows as Solana Gains Momentum

Although Ethereum leads in total developer numbers, its growth has been modest—rising 5.8% over the past year and 6.3% over the past two years. By contrast, Solana has shown stronger momentum. Electric Capital’s tracker reports a 29.1% increase in full-time developers over the past year and a 61.7% rise over the past two years.

Despite these figures, Jacob Creech, Solana Foundation’s head of developer relations, claims that the data undercounts Solana developers by around 7,800. He urged developers to register their GitHub repositories to help improve Solana’s internal tracking.

Several community members have questioned how Electric Capital grouped developer data. Some chains operating on the Ethereum Virtual Machine (EVM) were merged, while others were excluded.

Tomasz K. Stańczak, founder of Nethermind, argued that EVM-based networks such as Polygon and BNB Chain should be considered together since they share compatible tooling and developer skill sets.

Skepticism Grows Over Reported Developer Numbers

Some industry observers remain skeptical of the reported developer numbers. Jarrod Watts, head of Australia for the layer-2 project Abstract, said the figures may be inflated by repositories generated by automated coding tools and temporary hackathon projects.

Watts suggested that short-term or low-quality code—such as hackathon projects and inactive repositories—may inflate the developer figures. He added that genuine new developer participation appears limited this year.

A social media user known as memevsculture noted a gap between the reported number of developers and the visible number of active decentralized applications , suggesting that developer counts may not fully reflect meaningful activity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.

Renewable Energy Training as a Key Investment to Meet Future Workforce Needs

- Farmingdale State College's Wind Turbine Technology program aligns with surging demand for skilled labor in decarbonizing economies, driven by U.S. renewable energy targets. - Industry partnerships with Orsted, GE Renewable Energy, and $500K in offshore wind funding validate the program's role in addressing workforce shortages in expanding wind sectors. - Hands-on training with GWO certifications and VR simulations prepares graduates for high-demand, high-salary roles ($56K-$67K annually), reducing corpo